Preguntas más frecuentes

Preguntas más frecuentes

3DS v2

Si utiliza nuestra página de pago Worldline, Worldline se encargará de todos los campos obligatorios.

Si está integrado en DirectLink, lo que significa que tiene su propia página de pago, tenemos un ejemplo de Javascript disponible en la página de soporte para recopilar los datos obligatorios.

Para la recopilación de información opcional, consulte nuestra página de soporte para así saber cómo integrarse con Worldline.

COF en pocas palabras: el cliente inicia una primera transacción con un comerciante con 3D-S (CIT). Desde esta primera experiencia de transacción, el comerciante tiene la posibilidad de realizar transacciones recurrentes (suscripción o con aprobación del cliente -> tokenización) marcadas como transacciones MIT.

Las MIT son una de las excepciones previstas dentro de 3DSv2 si cumplen las siguientes condiciones acumulativas:

- transacciones posteriores de un CIT inicial

- El CIT se realizó con una autenticación obligatoria

- Se establece un enlace de ID dinámico entre el CIT inicial y las MIT posteriores.

Después de la autenticación inicial, se pueden aplicar exenciones/exclusiones:

- Ya sea por las exenciones legales recurrentes que se aplican a las suscripciones con una cantidad fija y una periodicidad (de hecho, se recomienda a los comerciantes que se autentiquen por la cantidad completa y que proporcionen detalles sobre la cantidad de pagos acordados con los titulares de tarjetas)

- O porque otro tipo de transacciones están excluidas del alcance de la SCA... a riesgo exclusivo del comerciante en caso de devolución de cargo (protección limitada a la cantidad autenticada) Y la necesidad de que el emisor acepte ese riesgo:

- COF no programado: el principio de las transacciones posteriores se acuerda con el titular de la tarjeta, pero el importe y/o la periodicidad no son fijos

- Prácticas de la industria: incrementales, ausencia, etc...

Para el período de transición, los esquemas han definido el ID predeterminado que se utilizará para las MIT posteriores creadas antes de la introducción de 3DS v2.

3DSv2 está invitando a los comerciantes a enviar información adicional (obligatorio / recomendado ..). Todo lo que necesitas saber, como comerciante se puede encontrar aquí:

Primero, debe asegurarse de que 3DS esté habilitado en su tienda en línea para todos sus métodos de pago (Visa, MasterCard, American Express, Carte Bancaire, JCB). Asegúrese de que es así. En caso contrario, pida a nuestro equipo de soporte que lo habilite.

Como 3D Secure v2 (3DSv2) tiene como objetivo otorgar el activador de autenticación sólida de clientes (SCA) al banco emisor, el banco emisor debe evaluar mejor el riesgo que implica la transacción. Como consecuencia, la especificación 3DSv2 contiene muchos elementos de datos. Buenas noticias si está utilizando nuestra herramienta de fraude, ya que algunas de ellas ya se utilizan comúnmente en nuestra análisis de fraude. Por supuesto, algunos son nuevos y específicos de 3D Secure v2. En resumen, los elementos de datos se pueden clasificar de la siguiente manera:

- Información obligatoria - datos del navegador:

- Nombre del titular de la tarjeta (CN)

- ¿Integración con las cestas de la compra? Le invitamos a acceder al mercado de cestas de la compra para instalar la última versión del complemento de Worldline o a ponerse en contacto con su proveedor directamente.

- Si utiliza nuestra página de comercio electrónico, Worldline recopila información obligatoria. Puede ir directamente a la información recomendada a continuación.

- Si utiliza su propia página de pago, deberá recopilar la información obligatoria usted mismo tal como se indica a continuación. Le recomendamos que consulte nuestra página de soporte para saber cómo y echar un vistazo al ejemplo de java script.

- Información recomendada - podría usarse usado como parte de la evaluación de prevención de fraude:

- Email (EMAIL)

- Dirección IP (REMOTE_ADDR)

- Número de teléfono (Mpi.WorkPhone.subscriber, Mpi.HomePhone.subscriber ...)

- Dirección de facturación (ECOM_BILLTO_POSTAL_CITY, ECOM_BILLTO_POSTAL_COUNTRYCODE, ECOM_BILLTO_POSTAL_STREET_LINE1 ...)

- Dirección de envío (ECOM_SHIPTO_POSTAL_CITY, ECOM_SHIPTO_POSTAL_COUNTRYCODE, ECOM_SHIPTO_POSTAL_STREET_LINE1 ...)

- Tenga en cuenta que los parámetros recomendados/opcionales deben suministrarse para beneficiarse del flujo sin fricción que puede aumentar su conversión.

- Información opcional - datos ampliados del titular de la tarjeta/cuenta tal como fueron introducidos por EMVCo:

- Mpi.cardholderAccountAgeIndicator

- Mpi.cardholderAccountChange

- Mpi.cardholderAccountPasswordChange

- Mpi.suspiciousAccountActivityDetected

- Mpi.threeDSRequestorChallengeIndicator

- Más información en la lista completa

Nuestras API existentes ya capturan muchos de los elementos de datos, pero estamos agregando muchos elementos de datos nuevos más. La razón es que creemos que todos en el ecosistema de pagos se benefician de una mayor seguridad, con el menor impacto negativo posible en la experiencia del consumidor. Los pagos se basan en la confianza, y proporcionar más datos facilita que las partes confíen entre sí sin necesidad de desafíos adicionales para autenticar al consumidor. Casi todos los elementos de datos recién agregados son opcionales, pero recomendamos que proporcione la mayor cantidad posible de ellos. Esto aumenta la probabilidad de que sus transacciones sigan el flujo sin fricción, mientras se beneficia del cambio de responsabilidad. En caso de que utilice la página de pago alojada de Worldline, capturaremos los datos relacionados con el navegador automáticamente.

El nivel de cambios requeridos variará según el tipo de integración que tenga con Worldline.

Las exclusiones son transacciones que están FUERA del alcance de los reglamentos PSD2 SCA:

- Pedidos por correo/pedidos por teléfono

- Viaje de ida: El PSP del beneficiario (también conocido como adquirente del comerciante) o el PSP del pagador (también conocido como emisor del método de pago del comprador) se encuentra fuera de la zona del EEE.

- Tarjetas prepago anónimas de hasta 150 € (artículo 63)

- MIT - transacciones iniciadas por el comerciante

Las exenciones son transacciones que están DENTRO del alcance de los reglamentos PSD2 SCA:

- Transacciones de bajo valor

- Suscripciones

- Análisis de riesgo

- Lista blanca

Secure v2 es una evolución de los programas 3D Secure v1 existentes: Verified by Visa, Mastercard SecureCode, AmericanExpress SafeKey, Diners/Discover ProtectBuy y JCB J/Secure. Se basa en una especificación redactada por EMVCo. EMVCo existe para facilitar la interoperabilidad mundial y la aceptación de transacciones de pago seguras. Está supervisado por las seis organizaciones miembros de EMVCo, American Express, Discover, JCB, Mastercard, UnionPay y Visa, y cuenta con el respaldo de decenas de bancos, comerciantes, procesadores, proveedores y otros actores de la industria que participan como asociados de EMVCo.

Una de las diferencias principales de la versión 2 es que el emisor puede usar muchos puntos de datos de la transacción para determinar el riesgo de la transacción (análisis basado en el riesgo). En las transacciones de bajo riesgo, los emisores no impugnarán la transacción (por ejemplo, no se enviará un SMS al titular de la tarjeta) aunque autentiquen la transacción (sin fricción). A la inversa, en transacciones de alto riesgo, los emisores requerirán que el titular de la tarjeta se autentique con un SMS o por medios biométrico (desafío).

Por separado, la autenticación sólida de clientes (SCA) requerida desde el 1 de enero 2021 en Europa y desde el 14 de septiembre 2021 en UK como se especifica en la PSD2 dará como resultado un aumento sustancial en el número de transacciones que requieren el uso de autenticación 3D Secure. El uso de 3D Secure v2 debería limitar tanto como sea posible el impacto potencial negativo en la conversión. En resumen, en 3D Secure v2:

- Deberá implementar 3D Secure antes del 1 de enero de 2021 si sus transacciones se ajustan a las pautas de la UE PSD2 SCA (en caso de que aún no sea compatible con 3D Secure)

- Se recomienda (y en algunos casos se requiere) que envíe puntos de datos adicionales para respaldar la evaluación de riesgos realizada por el emisor en caso de 3D Secure v2

- Es posible que deba actualizar su política de privacidad con respecto al RGPD, ya que podría estar compartiendo puntos de datos adicionales con terceros

- Conseguirá una experiencia de usuario mucho mejor para sus consumidores

La expectativa en el mercado es que un porcentaje sustancial de las transacciones que utilizan 3D Secure v2 seguirán el flujo sin fricción, y esto no requiere nada adicional del titular de la tarjeta en comparación con los flujos actuales de pago sin garantía 3D Secure. Esto significa que usted se beneficia de una mayor seguridad y responsabilidad provista por los programas 3D Secure, mientras que la conversión en su proceso de pago no debe verse afectada negativamente.

El valor Añadir tarjeta se refiere al caso en que un proveedor de cartera usa el protocolo 3DS para añadir una tarjeta a su cartera. Esto será implementado por el respectivo proveedor de cartera.

Desde el 1 de enero 2021 en Europa y desde el 14 de septiembre 2021 en UK, las reglas de autenticación sólida de clientes (SCA) entrarán en vigor para todos los pagos digitales en Europa. En este momento, los bancos, los proveedores de servicios de pago y las redes de tarjetas están trabajando en soluciones técnicas que cumplan los requisitos de la PSD2. Para poder aceptar pagos después del 1 de enero, deberá asegurarse de que estas soluciones técnicas funcionen en su tienda en línea.

Para poder aceptar pagos de las redes de tarjetas más importantes del mundo (Visa, Mastercard y Amex) deberá haber implementado la solución de seguridad 3D Secure en su tienda en línea. 3D Secure se utiliza desde 2001 para mejorar la seguridad de las transacciones con tarjetas en línea, pero ahora se ha desarrollado una nueva versión que facilitará los requisitos de la autenticación sólida de clientes de la PSD2.

Recomendamos el uso de 3D Secure, ya que ayuda a prevenir el fraude y también lo protege de cualquier responsabilidad en caso de fraude. A partir del 1 de enero 2021 también será un requisito para aceptar los pagos de las tarjetas principales.

Además del lanzamiento de la plataforma en julio, hemos mejorado los detalles de nuestra descripción general de las transacciones. Las transacciones individuales accesibles ahora contienen información detallada sobre el flujo aplicado (3DS v1 o 3DS v2 heredado). Puede encontrar más información en nuestras notas de la versión 04.133 en Administración desde Soporte > Versiones de plataforma > Versión 04.133

Además, hemos añadido el nuevo parámetro VERSION_3DS a nuestra herramienta de informes electrónica.

Los valores posibles para VERSION_3DS son:

V1 (para 3DS v1)

V2C (para flujo Challenge 3DS v2)

V2F (para flujo Frictionless 3DS v2)

Para añadir este parámetro a las descargas de archivos de transacciones, siga las instrucciones que se muestran en este vídeo:

Nuestra plataforma de prueba está lista para realizar pruebas.

Nuestro simulador propone todos los diferentes escenarios. Se han proporcionado tarjetas de prueba y se encuentran en nuestra página de soporte, así como en el entorno de prueba (Configuración > Información técnica > Información de prueba).

Si quieres empezar a utilizar la versión 2 de 3DS (3DSv2) en producción, contáctenos.

Para facilitar las cosas tanto a los comerciantes como a los consumidores, la PSD2 permite algunas exenciones en la autenticación sólida de clientes. Lo que es importante tener en cuenta es que todas las transacciones que califican para una exención no serán exentas automáticamente. En el caso de transacciones con tarjeta, por ejemplo, es el banco emisor de la tarjeta el que decide si se aprueba o no una exención. Por lo tanto, incluso si una transacción califica para una exención, el cliente podría tener que realizar una autenticación sólida de cliente si el banco emisor de la tarjeta decide exigirla.

La Segunda Directiva de Servicios de Pago de la UE (2015/2366 PSD2) entró en vigor en enero de 2018 con el objetivo de garantizar la protección del consumidor en todos los tipos de pagos, promoviendo un panorama de pagos aún más abierto y competitivo. Como proveedor de servicios de pago, nos enorgullecemos de haber ratificado su conformidad con la PSD2 desde el 29 de mayo de 2018.

Uno de los requisitos clave de la PSD2 se refiere a la autenticación sólida de clientes (SCA) que se exigirá en todas las transacciones electrónicas en la UE a partir de Desde el 1 de enero 2021 en Europa y desde el 14 de septiembre 2021 en UK. La SCA exigirá a los titulares de tarjetas que se autentiquen usando al menos DOS de los tres métodos siguientes:

- Algo que conozcan (PIN, contraseña, etc.)

- Algo que posean (lector de tarjetas, dispositivo móvil, etc.)

- Algo que los distinga (reconocimiento de voz, huella dactilar, etc.)

Esto significa que, en la práctica, sus clientes ya no podrán realizar un pago con tarjeta en línea utilizando únicamente la información de sus tarjetas. En su lugar, deberán, por ejemplo, verificar su identidad en una aplicación bancaria que esté conectada a su teléfono y que requiera una contraseña o huella dactilar para aprobar la compra.

Aquí puede encontrar más información sobre la PSD2: https://www.europeanpaymentscouncil.eu/sites/default/files/infographic/2018-04/EPC_Infographic_PSD2_April%202018.pdf

Esta situación solo es posible si está integrado únicamente a través de DirectLink (página propia del comerciante/FlexCheckOut), como en la página de pago de Worldline alojada, Worldline está recopilando los datos obligatorios.

En primer lugar, Worldline identificará el flujo que se dirigirá a v1 o v2 según los números de tarjeta.

Si la tarjeta es V2, existen los siguientes escenarios posibles:

Datos obligatorios:

- Si se transfieren los datos incorrectos, se bloquea la transacción

- Si faltan algunos datos, Worldline dirigirá su transacción al flujo v1

- Si no se transfieren datos, la transacción NO se bloquea, sino que se desvía al flujo v1

Datos opcionales o recomendados:

- si no se transfieren datos, la transacción NO se bloquea, pero no puede beneficiarse de la exención.

A menos que la autenticación sea un paso obligatorio (es decir, en el caso de un registro de tarjeta o la primera transacción de una serie de transacciones recurrentes), los emisores pueden decidir aprobar o no la autenticación. En este escenario, el emisor será responsable en caso de anulación.

Dado que 3DS v2 introduce autenticación sin fricción, el tiempo para procesar una transacción puede reducirse. Por el contrario, si se solicita una autenticación sólida de clientes, el tiempo de procesamiento puede ser más largo.

Si el emisor está aplicando un nuevo conjunto de reglas PSD2, y 3DS no está activo en la cuenta del comerciante, la transacción será rechazada con un nuevo código de error-rechazo suave (soft decline). Por ello, es muy importante tener 3DS activo para cada marca de su(s) cuenta(s). Si estás integrado con Directlink (servidor a servidor), deberá implementar un mecanismo de rechazo suave (soft decline) end como se describe aquí.

En un caso así, Worldline gestionará automáticamente una reserva en 3-D Secure v1.

No y tampoco está previsto que lo haga.

Con la introducción de la normativa PSD2, todos tus clientes tendrán que pasar un control de autenticación 3-D Secure (salvo algunas exclusiones y exenciones claramente definidas). Para asegurarte de que 3-D Secure se implementa correctamente en tus transacciones siempre que sea necesario, repasa esta lista de comprobación:

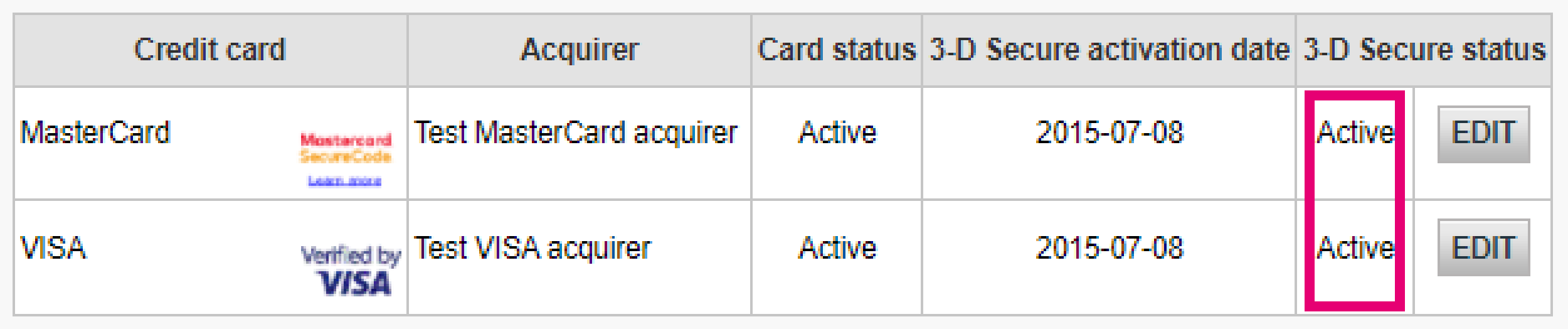

- Confirma que 3-D Secure esté activado para todos los métodos de pago con tarjeta de crédito en el Back Office a través de Avanzado > Detección del fraude > 3D-Secure

La imagen anterior muestra dónde encontrar el estado de activación de 3-D Secure para los métodos de pago en el Back Office

Si alguno de los métodos de pago no se muestra como “Activo” en la columna “Estado de 3-D Secure”, ponte en contacto con nosotros

- Comprueba que la integración implementa correctamente el paso 3-D Secure. Para Página de pago alojada, nos encargamos de esto, pero para DirectLink necesitas implementarlo tú mismo

- Entiende bien cuándo se aplican exclusiones y exenciones en 3-D Secure. Aprende a implementarlo correctamente para Página de pago alojada y DirectLink

- Aprende cuándo omitir 3-D Secure con nuestra función Soft Decline y cómo recuperarlo a través de DirectLink

Si una transacción llega al estado 2, es importante que sepas si está relacionado con una infracción de PSD2. Nuestra plataforma ofrece múltiples fuentes de información para ayudarte. Úsalos para confirmar que la integración tiene en cuenta la normativa PSD2:

- Busca el código de error de la transacción. Los errores más comunes relacionados con PSD2 son:

NCERROR

Causa raíz/Posibles soluciones

40001137

-

- Has pedido que nuestra plataforma lleve a cabo el paso de autorización aunque no se ha producido ninguna comprobación 3-D Secure

- Como el banco del cliente rechazó la transacción, esto queda fuera de tu control

40001139

-

- Rechazo Soft Decline

- Implementa un proceso de recuperación en tiempo real en la lógica empresarial mediante DirectLink

40001134

-

- Tu cliente no ha podido pasar la comprobación de 3-D Secure

- Ponte en contacto con tu cliente para saber por qué no ha podido pasar el control

40001135

-

- El banco emisor de la tarjeta de tu cliente no estaba disponible para activar la comprobación 3-D Secure

- Como el banco de tu cliente no ha implantado la tecnología 3-D Secure, esto queda fuera de tu control. Considera la posibilidad de ofrecer métodos de pago alternativos para los reintentos

Consulta nuestra Códigos de error de transacciones especial para obtener información detallada sobre estos motivos de rechazo

- Has recibido el parámetro CH_AUTHENTICATION_INFO en los comentarios de la transacción para Página de pago alojada y DirectLink. Contiene información sobre los motivos de rechazo de los bancos emisores de la tarjeta de tus clientes

- Consulta nuestra 3-D Secure status guide especial para familiarizarte bien con 3-D Secure. Comprende el significado de todos los estados 3-D Securey aprende a leer el registro de autenticación

Co-badging

Configuration

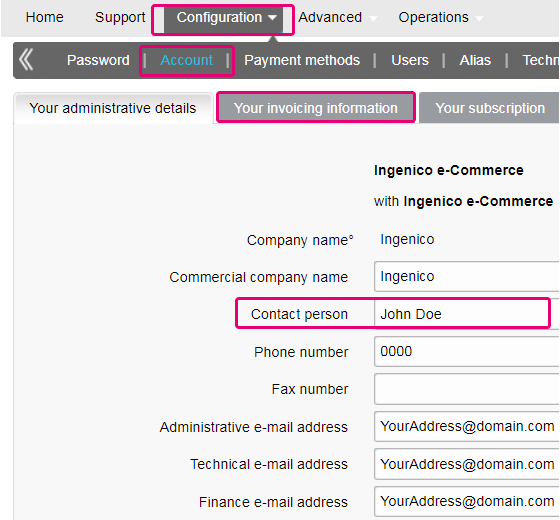

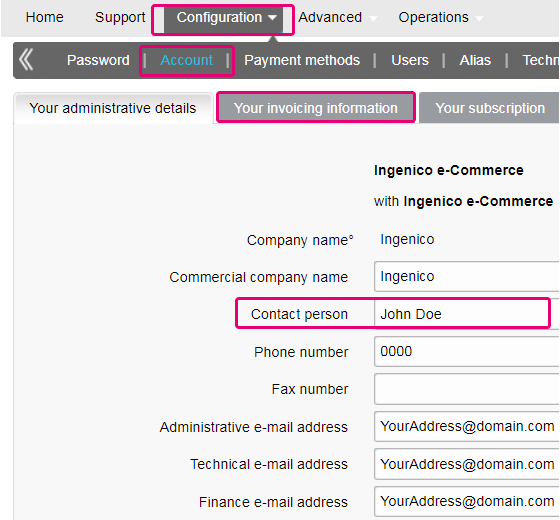

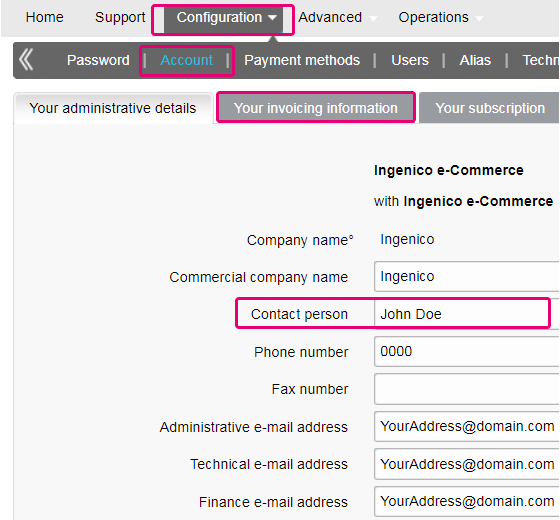

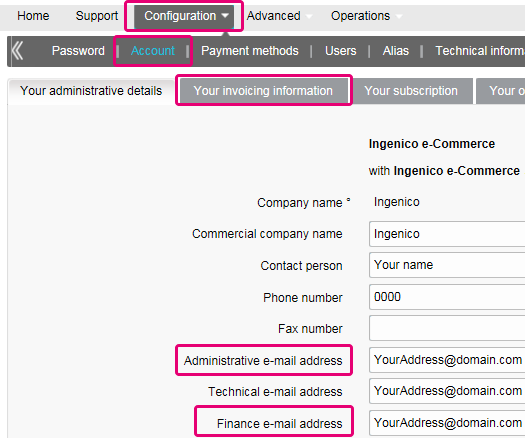

Póngase en contacto con el administrador de su cuenta para iniciar sesión y efectuar la modificación en Configuración – Cuenta – Detalles Administrativos. Si no pueden iniciar sesión, pueden ponerse en contacto con nuestro departamento de atención al cliente.

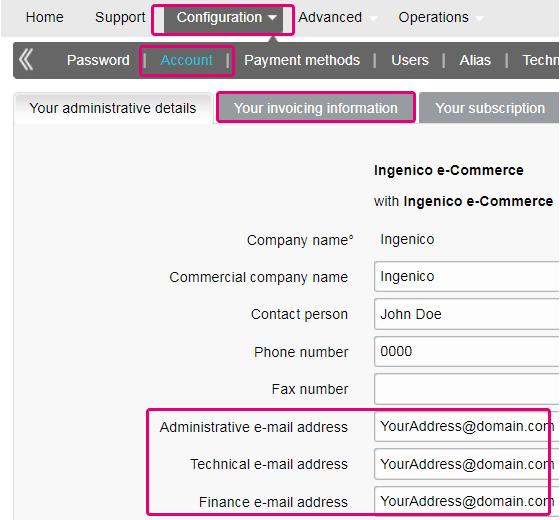

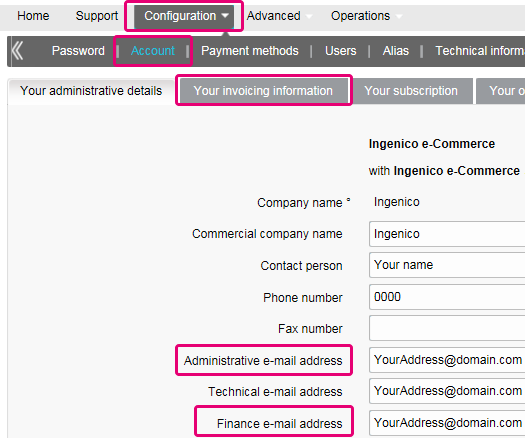

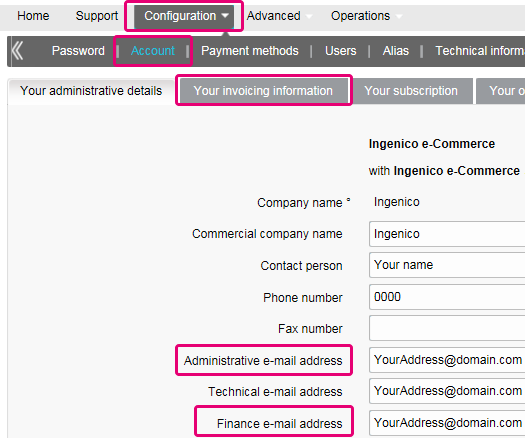

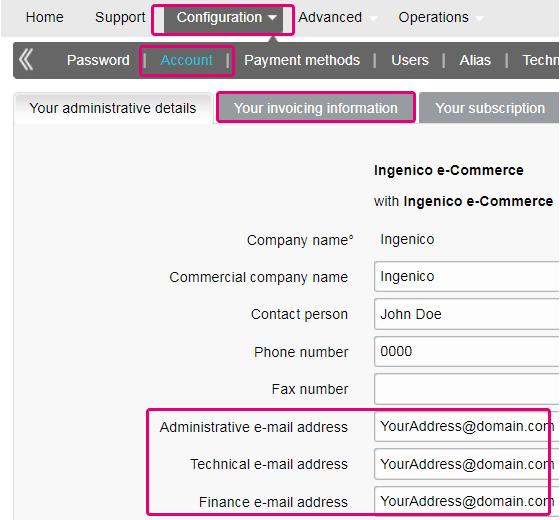

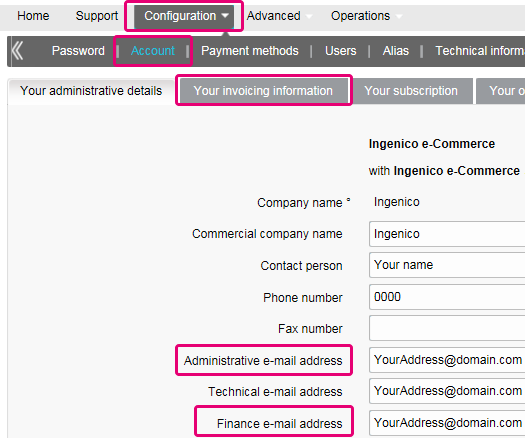

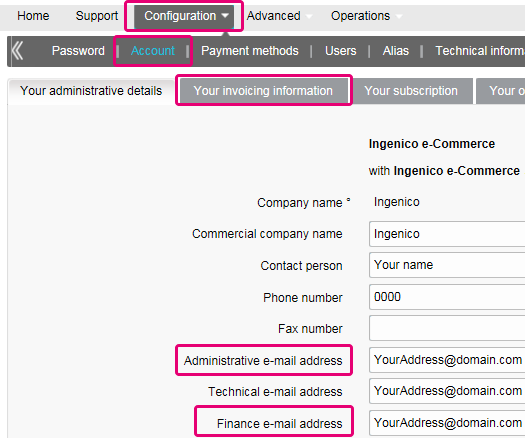

Puede cambiar fácilmente su dirección de correo electrónico en el área de administración. Después de iniciar sesión, acceda a Configuración > Cuenta > Sus detalles administrativos.

Para borrar su cuenta, dado que contiene datos personales, por favor contáctenos.

Nuestro departamento de atención al cliente atenderá su solicitud. Podría darse el caso de que, debido a exigencias legales, se tenga que respetar un período mínimo de retención, con lo que sería imposible borrar su cuenta de inmediato.

Si ha cambiado el CIF, necesitará otro PSPID/cuenta. Póngase en contacto con su administrador de cuentas para crear una cuenta nueva.

El tiempo de activación de un método de pago depende de diversos factores. Le pedimos que tenga en cuenta lo siguiente:

- la entidad adquirente o el banco pueden tardar varios días (o incluso semanas) en completar su afiliación. Por supuesto, si ya tiene una afiliación, la activación sólo nos llevará unos pocos días.

- Algunos métodos de pago requieren cheques adicionales antes de ser activados, por ejemplo, en el caso de 3-D Secure, lo que solicite directamente VISA o MasterCard

Con classic.collect puede activar varios métodos de pago a la vez

En el entorno de prueba puede añadir fácilmente un número ficticio, por ejemplo, 123456789

Para cambiar su número de cuenta bancaria, póngase en contacto con nuestro departamento de atención al cliente. Nuestro equipo atenderá su solicitud.

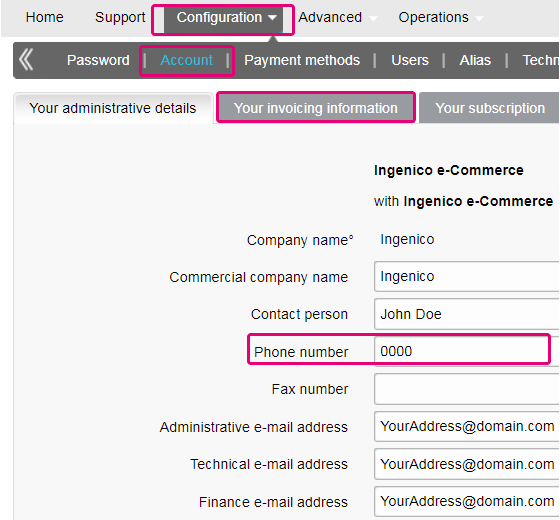

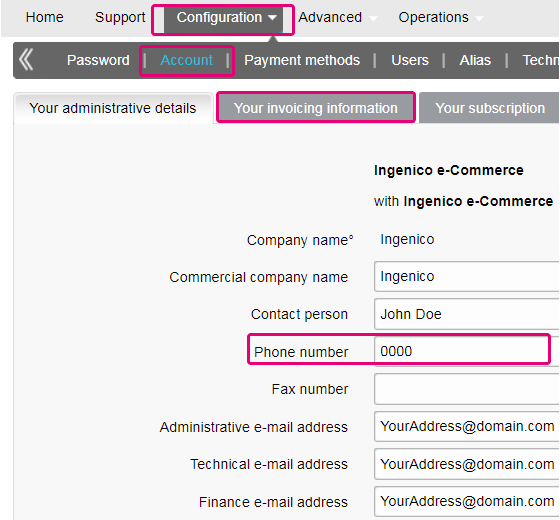

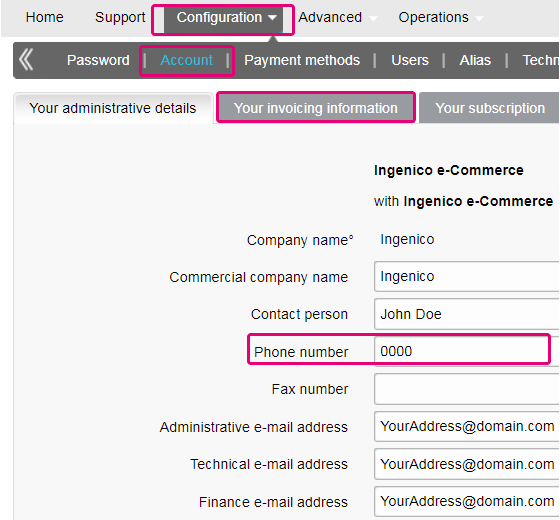

Puede cambiar fácilmente su número de teléfono en el área de administración. Después de iniciar sesión, acceda a Configuración > Cuenta > Sus detalles administrativos.

Para cambiar el nombre de su empresa, en primer lugar nos gustaría saber si el CIF cambia también. En tal caso, póngase en contacto con su administrador de cuentas. Si solo cambia el nombre de la empresa, basta con enviar un correo electrónico o llamar por teléfono a nuestro departamento de atención al cliente.

Si aún tiene una cuenta de prueba, puede cambiar el PSPID (ID del proveedor de servicio de pago) cuando pase a una cuenta de producción.

Si desea cambiar el nombre de PSPID de una cuenta de producción existente, póngase en contacto con su administrador de cuentas de Worldline, que se encargará de abrir una cuenta nueva. Tenga en cuenta que se le cobrará por este servicio.

Puede hacerlo poniéndose en contacto con nuestro departamento de atención al cliente por teléfono o enviando un correo electrónico.

Si desea una cuenta de producción, envíe un correo electrónico a su administrador de cuentas. Si todavía no hay un administrador de cuentas asignado a su cuenta, por favor contáctenos.

Puede enviar un correo electrónico a nuestro departamento de atención al cliente con su PSPID y la nueva dirección. La dirección se actualizará lo antes posible.

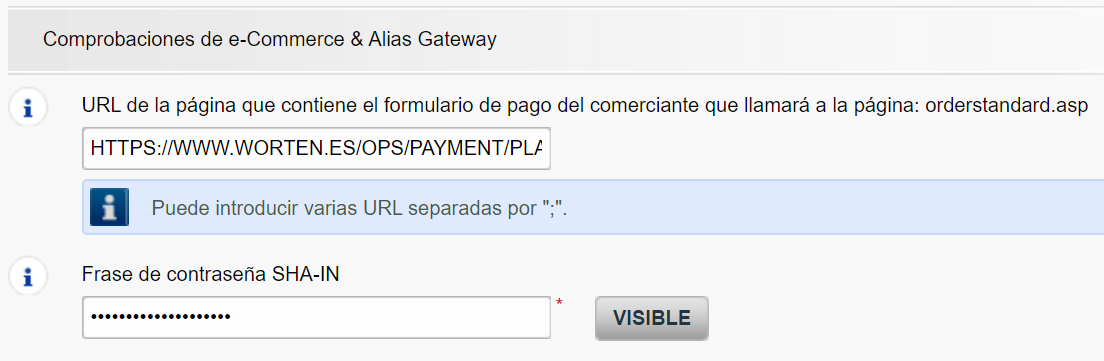

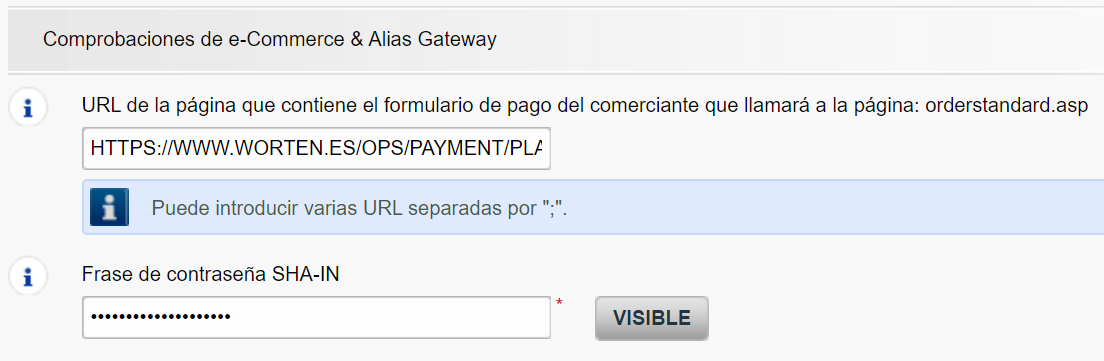

Aunque aconsejamos no hacerlo, ya que esta prestación no será compatible a partir del 25 de agosto de 2020, además de la autenticación de la firma SHA, es posible configurar la llamada comprobación del remitente.

Con esta configuración, nuestro sistema comprueba el origen de la solicitud de la transacción, es decir, de qué URL proviene la solicitud (= el remitente). El objetivo es que las URL no autorizadas (no configuradas en tu cuenta) no puedan llamar a la página de pago.

Para poder configurar esta prestación o para eliminarla, simplemente debes ir a Technical Information > Data and origin verification. En Comprobaciones de e-Commerce & Alias Gateway, puedes introducir una o varias URL que quieras habilitar para llamar a la página de pago: orderstandard.asp/orderstandard_utf8.asp.

Los errores posibles relacionados con la referencia son "pedido desconocido/1/r" y "pedido desconocido/0/r". Acceda a Errores posibles para obtener más información acerca de estos errores.

Importante: aconsejamos encarecidamente que no lo hagas y que simplemente lo dejes en blanco. No obstante, si realmente quieres hacerlo,

-

- Las URL deben empezar siempre con http:// o https://

- Puede introducir la URL completa o simplemente el nombre de dominio; en el último caso se aceptarán todos los subdirectorios y páginas de dicho dominio

- En el caso de disponer de varios dominios, se pueden introducir varias URL, p. ej., http://www.mysite.com;http://www.mysite.net;https://www.secure.mysite.com. Las URL deben ir separadas por punto y coma, sin espacios delante o detrás del punto y coma.

- Si realiza una transacción de prueba desde nuestra página de prueba, recuerde introducir la URL de nuestro sitio como referencia, de lo contrario recibirá un error.

También queremos aprovechar esta oportunidad para recordarte que, aunque el remitente permite que nuestro sistema identifique el origen de un pedido, la autenticación de la firma SHA sigue siendo la forma más fiable de dar seguridad a tus transacciones en el PSPID. Puedes encontrar más información sobre esto en nuestra guía de integración de firmas SHA.

Contract

Puede ponerse en contacto con su administrador de cuentas por teléfono o correo electrónico para solicitar esta opción. Puede que para ello tenga cambiar el tipo de subscripción. En tal caso recibirá un formulario de aumento o reducción de categoría. Después de firmar su formulario de aumento o reducción de categoría, envíelo a nuestro departamento de atención al cliente.

Envíe un correo electrónico a nuestro departamento de atención al cliente indicando su PSPID, la opción solicitada y su precio (si lo conoce). Nuestro equipo administrativo se encargará de activar esa opción.

Puede desactivar la opción (excepto la opción 3-D Secure) enviando un correo electrónico a nuestro departamento de atención al cliente solicitando desactivar dicha opción.

Para activar las domiciliaciones bancarias en su cuenta, envíe su IBAN y BIC o el formulario RIB a nuestro departamento de atención al cliente. Nuestro equipo le enviará un formulario para que lo firme. Después de recibir el formulario firmado, podemos activar fácilmente las domiciliaciones bancarias en su cuenta.

Para cambiar su suscripción, póngase en contacto con el administrador de la cuenta, que le ayudará en su solicitud.

Si todavía no hay un administrador de cuentas asignado a su cuenta, por favor contáctenos.

Envíanos una carta firmada (en pdf) o un correo electrónico con los siguientes datos

- Nombre de la persona que solicita la baja

- Firma del correo electrónico de tu empresa (nombre de la empresa, dirección, etc.)

- Solicitud explícita de baja del contrato con nosotros

- PSPID (nombre de tu cuenta en nuestra plataforma)

Utiliza nuestra plantilla de correo electrónico para facilitar el trámite.

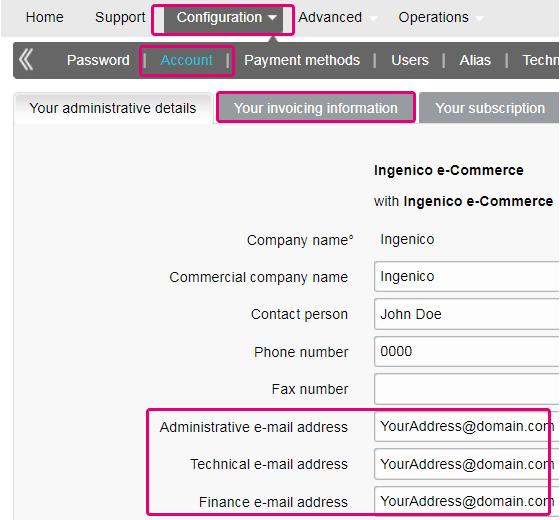

Si envías tu cancelación por correo electrónico, el dominio de la dirección de correo electrónico del remitente debe ser idéntico al que aparece en el (Configuration > Account > Your administrative details > Administrative e-mail address).

Getting started

Sí, admitimos soluciones de carrito de la compra. Haga clic aquí para ver una descripción general de nuestras soluciones de carrito de la compra.

Find a list of supported payment methods here.

En el sitio de soporte puede encontrar todos los manuales de nuestros productos. No dude en consultar estos documentos.

Con la activación de su cuenta, dispondrá automáticamente de nuestra Herramienta de conciliación si dispone de una cuenta en Full Service o beneficia de nuestro servicio de aquerencia Collect. Esta le permite conciliar fácilmente los pagos que reciba en su cuenta bancaria con los pedidos y transacciones de su cuenta de Ingenico ePayments. Para obtener información adicional sobre la Herramienta de conciliación, haga clic aquí.

Worldline ofrece servicios de pago conformes con estándares de seguridad de datos de vanguardia en el sector de pagos: PCI DSS.

PCI DSS incluye un gran conjunto de requisitos de seguridad y controles que se implementan y ejecutan de manera periódica.

Estos controles de seguridad tienen como objetivo mantener un elevado nivel de seguridad constante en la plataforma de pago, lo que brinda una protección óptima de las transacciones y los datos.

Para registrarse en Ingenico ePayments, basta con hacer clic en "Abrir una cuenta de prueba gratis" en el sitio web y rellenar un pequeño formulario.

En cuanto hayamos revisado los datos, le enviaremos un correo electrónico con una contraseña temporal. Después de recibir su contraseña temporal, podrá iniciar sesión con el ID con el que se haya registrado al principio. Para completar su registro y activar completamente la cuenta, siga los pasos que aparecen en la página de inicio de su cuenta.

Glossary

El procesamiento de pagos es un servicio que permite a los sitios web vender por Internet aceptando pagos a través de métodos electrónicos tales como tarjetas de crédito, tarjetas de débito y transferencias bancarias.

El procesamiento de pagos, suministrado por los proveedores de servicios de pago, es la conexión técnica o "pasarela" entre un sitio web y las instituciones financieras o "entidades adquirientes" que rigen distintos métodos de pago. En resumidas cuentas, sin un proveedor de servicios de pago no le pagarán.

Trabajando con Ingenico, se beneficiará de tres formas. En primer lugar, nuestra pasarela de pago está conectada a más de 200 entidades adquirientes locales e internacionales. Por tanto, si desea aceptar pagos a través de Internet, móvil o teléfono, estamos en disposición de ayudarle a encontrar las entidades adquirientes adecuadas para su mercado y ofrecer los métodos de pago preferidos por sus clientes.

En segundo lugar, a través de nuestra filial Tunz.com, también podemos cobrar sus pagos. Podemos ayudarle a activar varios métodos de pago de distintas entidades adquirientes con solo un contrato, para que pueda ofrecer a sus clientes los métodos de pago locales de confianza que conocen.

Y finalmente, además de procesar y cobrar pagos, también ofrecemos soluciones avanzadas de prevención de fraudes para ayudar a las empresas a aceptar pedidos seguros y a bloquear transacciones fraudulentas.

Para obtener más información acerca de las formas en que podemos ayudar a su empresa, consulte nuestra página de soluciones.

Un formulario RIB es el documento original recibido del banco en Francia.

PayPal Seller Protection es una forma de hacer aceptar pagos mediante PayPal de una forma incluso más segura y sin problemas. Protege a su negocio contra pérdidas de devoluciones de cargos y anulaciones de pago, por lo que puede:

- Pasar menos tiempo tratando con reclamaciones de artículos no recibidos

- Protegerse contra pérdidas de dinero por pagos realizados con tarjetas de crédito robadas

- Esta protección mejorada estará disponible de forma gratuita cuando conecte su tienda web Magento a los servicios de proceso de pagos de Worldline ePayments, utilizando la Worldline ePayments Magento Extension más reciente.

Para poder optar a la garantía de Seller Protection, todo lo que tiene que hacer es asegurarse de que sus transacciones PayPal incluyan los siguientes detalles de envío:

- Nombre

- Apellidos

- Dirección

- Ciudad

- Código postal

- Código de país

- Siempre que un comprador realice una reclamación, una devolución de cargo o una anulación de pago, tan solo proporcione a PayPal la prueba de entrega o la prueba de envío y se le emitirán los fondos depositados.

Puede obtener más información sobre nuestro plug-in gratuito de Magento y cómo aceptar PayPal y otros métodos de pago mediante la tienda web de Magento aquí.

Un ID de usuario identifica el usuario específico de una cuenta.

Si la cuenta tiene más de un usuario, inicie sesión rellenando el USERID, el ID de proveedor de servicio de pago (PSPID), si necesario, y la contraseña. Pulse el enlace "Iniciar sesión como usuario" para que se muestren los tres campos.

Si la cuenta solo tiene un usuario, no será necesario un USERID. Iniciará sesión solo con el PSPID y la contraseña, por lo que debe asegurarse de que solo se muestren dos campos en la pantalla de inicio de sesión. Si ve tres campos, haga clic en el enlace "Iniciar sesión como PSPID" en la parte inferior izquierda de la pantalla para iniciar sesión como un comerciante.

Para una integración con DirectLink o por fichero ( Batch) , el parámetro USERID corresponde al usuario de API configurado en su PSPID. Tenga en cuenta que un usuario API no se puede conectar al área de administración.

Una entidad adquirente es una institución financiera que procesa pagos de determinadas tarjetas de crédito y débito. La entidad adquirente es responsable de la parte financiera del procesamiento de la transacción e Worldline es responsable de la parte técnica. Dicho de otro modo, sin una entidad adquiriente, el dinero no se transferirá a su cuenta bancaria.

Por cada método de pago en línea que desee agregar, necesitará un contrato de aceptación con una entidad adquirente. Si desea que le aconsejemos acerca de la entidad adquiriente más adecuada para usted y su región, por favor contáctenos. Si sabe con qué entidades adquirentes desea trabajar, selecciónelas en la lista desplegable al añadir un método de pago en su cuenta.

Como alternativa, puede permitirnos que nos encarguemos por usted. Full Service le permite activar muchos métodos de pago locales, todos a la vez y en varios países distintos con un solo contrato. Si vende en otros países, podría ser la forma ideal de aceptar pagos de toda Europa. Le ahorra tareas de administración que llevan mucho tiempo y, como puede ofrecer más métodos de pago, también podrá aumentar sus ingresos.

Obtenga más información sobre Ingenico Full Service aquí y poniéndose en contacto con nosotros y solicite información sobre contratos.

PSPID significa "Payment Service Provider ID" (identificador del proveedor de servicios de pago). Es el nombre que elige al registrarse para identificar la empresa a la que vincula su cuenta. Necesitará su PSPID y contraseña para iniciar sesión en su cuenta.

Tenga siempre a mano su PSPID cuando se ponga en contacto con nuestro departamento de atención al cliente.

Full Service le permite activar muchos métodos de pago locales a la vez y en varios países con un único contrato. Si vende en otros países, podría ser la forma ideal de aceptar pagos de toda Europa. Le ahorra tareas de administración que llevan mucho tiempo y, como puede ofrecer más métodos de pago, también podrá aumentar sus ingresos.

A través de nuestra filial Ingenico Financial Solutions, podemos cobrar los pagos de sus clientes a través de sus entidades adquirentes locales y enviarlos directamente a su cuenta de comerciante una vez hayan sido autorizados.

En la cuenta de Worldline, sus métodos de pago de Full Service se preconfigurarán con los detalles de afiliación de Worldline FS, de modo que por cada transacción recibida, puedan enviarle el dinero directamente a su cuenta de comerciante.

Como el proceso de pago con Full Service es el mismo que el proceso de pago normal, las transacciones con Full Service funcionarán perfectamente con cualquier carrito de la compra que admita Worldline Página de pago alojada.

Elevate es una solución de inteligencia empresarial para pagos y devoluciones de cargos, creada específicamente para empresas internacionales de comercio electrónico. Elevate traduce los datos de pago en bruto en paneles interactivos y fáciles de leer que le permiten identificar rápidamente y actuar frente a problemas y oportunidades de pago, además de medir el rendimiento respecto a sus homólogos en el sector.

Mediante nuestra solución de inteligencia empresarial personalizable, los comerciantes obtienen información acerca de sus pagos, tasas de autorización, devoluciones de cargos, reembolsos, disputas, comparativas del sector, perspectivas comerciales, etc.

Phishing es un derivado de la palabra "fishing". La sustitución de la 'f' por 'ph' probablemente se base en una abreviatura de la expresión "password harvesting fishing".

Los operadores de phishing utilizan los correos electrónicos, los enlaces de hipertexto y las páginas de Internet para redirigirle a sitios web falsos donde se le pedirá que muestre datos confidenciales como los detalles de su cuenta bancaria o el número de la tarjeta de crédito. Un correo electrónico malicioso normalmente le pide que confirme la contraseña, los detalles bancarios, los números de cuenta, los detalles de la tarjeta de crédito u otros datos similares haciendo clic en un enlace contenido en el mensaje. Este enlace le dirigirá a una página falsa con una dirección que es casi idéntica a la del sitio original.

Prevención:

- Tenga cuidado con los correos electrónicos.

- Es muy fácil falsear la dirección de un remitente: el autor del correo electrónico que reciba no es necesariamente el proveedor de servicio que usted creía que era.

- No responda a los correos electrónicos que le pidan que especifique datos personales. Los proveedores de servicio como Worldline, los bancos, los emisores de tarjetas de crédito, etc., nunca le pedirán que muestre la contraseña, el número de la tarjeta de crédito ni otra información personal por correo electrónico.

- Especifique enlaces de forma manual. No pulse en ningún enlace contenido en mensajes sospechosos: especifique la dirección URL manualmente (por ejemplo, la dirección de su banco, la plataforma de Worldline) o búsquela en sus Favoritos. Los enlaces contenidos en correos electrónicos fraudulentos pueden dirigirle a sitios web falsos. Las diferencias en las direcciones URL normalmente son difíciles de ver. El aspecto del sitio también puede ser engañoso.

- Compruebe el cifrado de las páginas web. Antes de especificar los detalles personales en un sitio web, compruebe que el sitio cifra los datos personales buscando https ("s" para seguro) en la dirección web y un teclado cerrado o un icono de candado en el navegador. Lamentablemente, el icono de teclado (y el candado) puede ser falso en determinados sistemas. Compruebe que se encuentra realmente en el sitio en el que piensa que está haciendo doble clic en el icono de teclado para mostrar el certificado del sitio. Asegúrese de que el nombre del certificado y el nombre de la barra de direcciones coincidan. Si los nombres son distintos, podría estar en un sitio falso.

- Compruebe los extractos bancarios y de la tarjeta de crédito con regularidad.

- Actualice la seguridad de su equipo: Habilite un filtro antiphishing para identificar los sitios fraudulentos antes de visitarlos. Algunos navegadores (p.ej. Internet Explorer) tienen este tipo de filtro. De lo contrario, puede instalarlo como una barra de herramientas. Aplique regularmente las correcciones de seguridad más recientes para el sistema operativo y el software instalado en el equipo. Instale un cortafuegos. Instale un software antivirus y manténgalo actualizado.

¿Qué debe hacer si se convierte en víctima de phishing?

Si cree que ha recibido un correo electrónico de phishing, haga lo siguiente:

- Cambie INMEDIATAMENTE las contraseñas y/o los códigos PIN de la cuenta en línea con la empresa cuya identidad se ha usurpado.

- ENVÍE el mensaje fraudulento a la empresa en cuestión. Normalmente tendrá una dirección de correo electrónico especial para notificar tales ataques. Por ejemplo, si recibe un correo electrónico de phishing relacionado con Worldline e-Commerce Solutions, envíanoslo a través de nuestro formulario de contacto.

- NOTIFIQUE el intento de phishing a las autoridades relevantes (policía local, Internet Fraud Complaint Center (Centro de quejas contra fraude en Internet), Anti-phishing working group (Grupo de trabajo antiphishing).

- CONSERVE todas las PRUEBAS del fraude. En concreto, en el caso de un intento de phishing mediante correo electrónico, no suprima el correo electrónico ya que contiene, oculto en la cabecera, la información necesaria para rastrear el origen del intento.

Worldline ePayments y comunicaciones:

- Los correos electrónicos no comerciales de Worldline e-Commerce Solutions (anteriormente Worldline ePayments) siempre se envían desde el dominio Worldline

- Worldline ePayments nunca le pedirá que muestre sus datos financieros personales ni ninguna otra información personal (contraseña, número de tarjeta de crédito, número de cuenta bancaria, etc.) por correo electrónico.

- Worldline ePayments nunca solicitará a ningún comerciante que realice una operación de pago (tenga en cuenta, sin embargo, que en algunos casos específicos, cuando nos ha contactado por un problema de transacción en curso, podemos solicitarle que realice nuevamente la operación fallida).

- Worldline ePayments nunca mostrará por correo electrónico el número completo de la tarjeta de crédito.

- Los correos electrónicos de Confirmación de pago enviados por la plataforma Worldline ePayments nunca contendrán ningún archivo adjunto.

- En caso de duda o si advierte algo sospechoso, póngase en contacto con nuestro departamento de Atención al cliente

Para obtener más información:

Cuando se procesan transacciones en línea, el manejo de las tasas de intercambio (IC) y las tasas de las tarjetas de crédito (SC) puede ser un desafío: no siempre está claro para qué exactamente los compradores y las marcas de tarjetas las aplican. Además, la tendencia al incremento de esas tasas podría aumentar esa confusión.

Worldline te ayuda a gestionar estas tasas a través de dos modelos. En función de tu modelo de negocio, tanto IC++ como Blended Pricing se adaptará perfectamente a tus necesidades. Nuestro departamento de ventas está a tu disposición para ayudarte a elegir la opción que más te convenga:

- IC++ combina la tasa de intercambio, la tasa del esquema de tarjeta y un porcentaje adicional del valor de la transacción con un precio fijo por transacción. IC++ es un modelo de “passthrough” y por lo tanto está sujeto a las fluctuaciones de los costes.

- Blended Pricing aplica un porcentaje fijo del valor de la transacción. Todas las tasas de intercambio, de red y de evaluación están cubiertas, el modelo Blended Pricing te protege frente a los cambios en los costes (especialmente el aumento de precios de IC & SF) y la combinación de tarjetas.

Las tasas de intercambio cubren los gastos del banco del titular de la tarjeta (el emisor) relacionados con las líneas de crédito y la mitigación del fraude. Tu banco (el comprador) paga esta comisión al emisor. Para cada transacción, el importe total adeudado depende de diversos factores, entre otros:

- La ubicación geográfica de tu empresa y el banco del titular de la tarjeta

- El valor medio de transacción (ATV)

- El método de pago utilizado (tarjeta de débito/crédito)

- El tipo de tarjeta (tarjeta de consumo/comercial)

Ten en cuenta que estas tarifas se aplican en la región del EEE. Para otras regiones, pueden aplicarse tasas diferentes.

Las tasas de intercambio no son negociables, pero tienen un límite máximo para las tarjetas de consumidores europeos* (no para las tarjetas corporativas) para las tarjetas de consumo europeas por la normativa de la UE (al 0,3 % para los pagos con tarjetas de crédito y al 0,2 % para las tarjetas de débito).

Debido al Reglamento de Tasas de Intercambio (IFR) y a otros acontecimientos recientes como el Brexit y la introducción de PSD2, la tendencia general es que ambas tasas son propensas a cambios (es decir, se espera que las tasas del esquema de tarjeta aumenten en el futuro). Para ayudarte a gestionar estas tasas, ofrecemos los modelos Interchange+ y Blended Pricing a través de nuestro modello Full Service.

Aunque esta tasa está definida por las marcas de las tarjetas (es decir, Visa, MasterCard, que también se conocen como “esquemas”), no debe confundirse con la tasa del esquema de tarjeta. Tu comprador paga las tasas del esquema de tarjeta a las marcas de tarjetas para cubrir sus gastos de mantenimiento al proporcionar su red de pago. El importe total está compuesto por las tasas de evaluación, las tasas transfronterizas y las tasas de compensación y liquidación. De manera similar a la tasa de intercambio, el importe total depende del tipo de tarjeta utilizada y de la ubicación geográfica de tu comprador.

Invoicing

Sí, es posible.

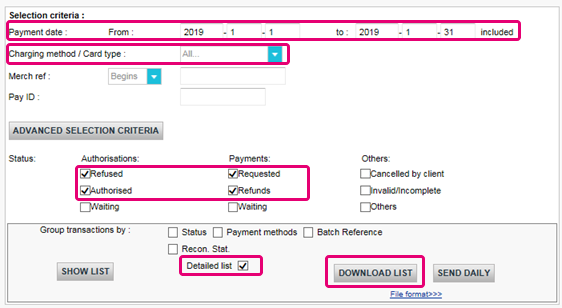

Inicia sesión en Back Office y abre “Configuración > Cuenta > Sus detalles administrativos”.

Introduce una o varias direcciones de email (hasta cinco, separadas por un punto y coma “;”) en “Dirección de correo electrónica financiera”.

El primer email introducido en este campo se añadirá automáticamente a Order2Cash. Si tienes más de una dirección y también quieres añadirlas a Order2Cash, inicia sesión en la plataforma Order2Cash . Allí puedes indicar hasta 5 direcciones de email adicionales para la entrega. Su servicio de atención al cliente te ayudará con mucho gusto en la configuración.

Si el campo “Dirección de correo electrónica financiera” está vacío, enviaremos las facturas a la dirección(es) de email introducida en el campo “Dirección de correo electrónico de administración”.

Puede registrarse a través del correo electrónico de envío de facturas siguiendo estos pasos: abra el correo electrónico de notificación -> Haga clic en el botón "Ver factura" -> Haga clic en el botón "Registrar" donde se ha cargado la ventana del navegador. Su nombre de usuario es la dirección de correo electrónico que recibe la factura. Para cualquier pregunta relativa al registro en Order2Cash, revise las preguntas frecuentes en el sitio web de Order2Cash o póngase en contacto con el servicio de soporte técnico de Order2Cash utilizando su formulario de contacto.

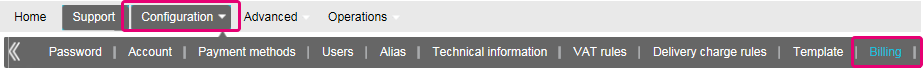

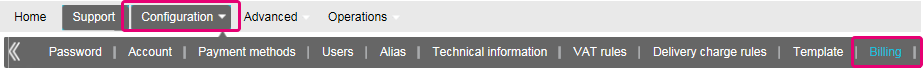

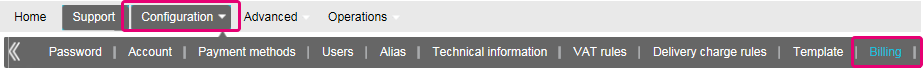

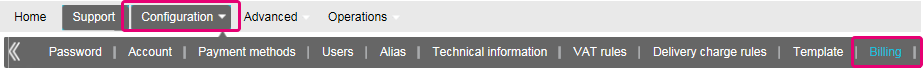

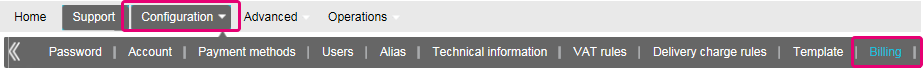

Tus facturas de los últimos 24 meses están disponibles en tu cuenta de Worldline.Inicia sesión en el Back Office y abre “Configuración > Facturación”. Selecciona la factura que deseas descargar.

Puedes acceder a tus facturas anteriores a los últimos 24 meses a través de la plataforma Order2Cash.

Para cambiar su cuenta bancaria en nuestro sistema, envíe el nuevo IBAN/BIC o formulario RIB a nuestro departamento de atención al cliente para crear un nuevo formulario y firmarlo.

Un mandato SEPA es más fácil de organizar y como comerciante debería evitar la molestia que supone pagar nuestras facturas manualmente.

Si desea cambiar su dirección de facturación o la forma de pagar sus facturas, envíenos un correo electrónico con su PSPID a nuestro departamento de atención al cliente.

Nuestro equipo de atención al cliente se encargará de su petición.

Las facturas se envían en formato PDF. Como antes, puede acceder a ellas en formato PDF o CSV en la plataforma. Ahora también están disponibles en la plataforma Order2Cash en los formatos siguientes: xml UBL, xml IFF y xls.

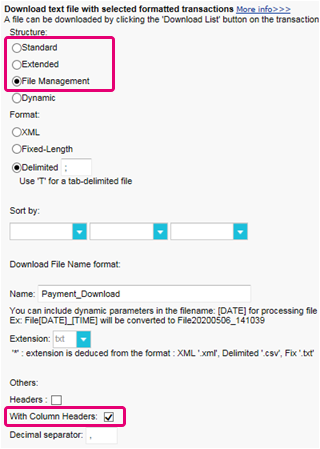

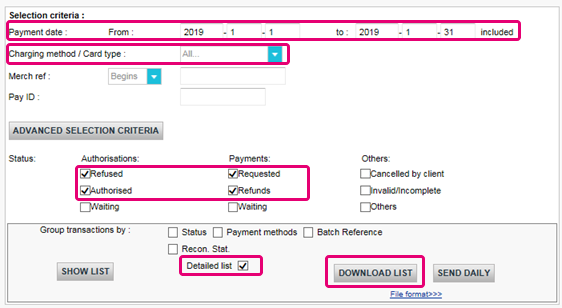

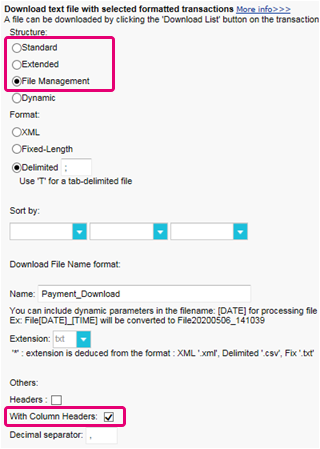

Puede cotejar el importe de las transacciones cargadas de tu factura con la lista de transacciones de Back Office siguiendo estos pasos:

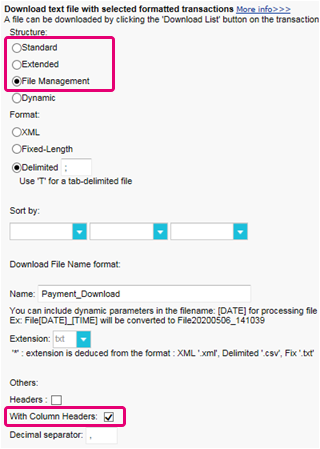

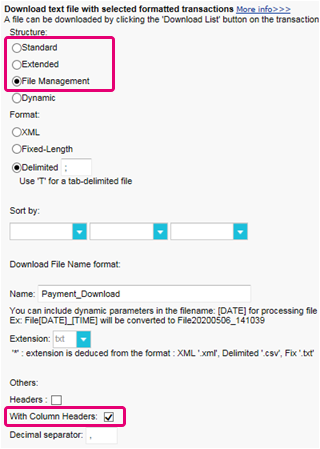

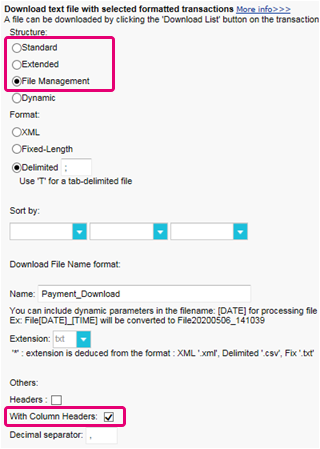

- En el Back Office abre “Configuración > Usuarios > Editar > Informe electrónico para este usuario”.

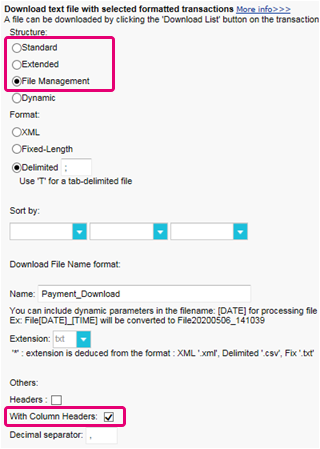

- Comprueba que los siguientes ajustes estén configurados de la siguiente manera:

- Estructura: Selecciona cualquiera de las opciones: Extended / File management / Dynamic

- Selecciona la casilla “Cabeceras”

- Haz clic en ENVIAR

- Abre “Operaciones > Historial financiero”

Una transacción puede haber sido objeto de diferentes operaciones. Puedes realizar varias operaciones de mantenimiento en una sola transacción (es decir, rechazado, autorización y reembolso).

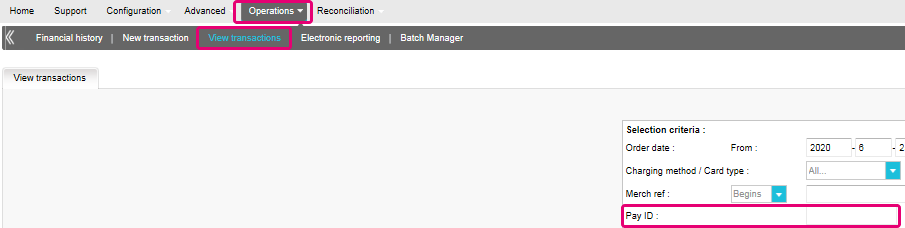

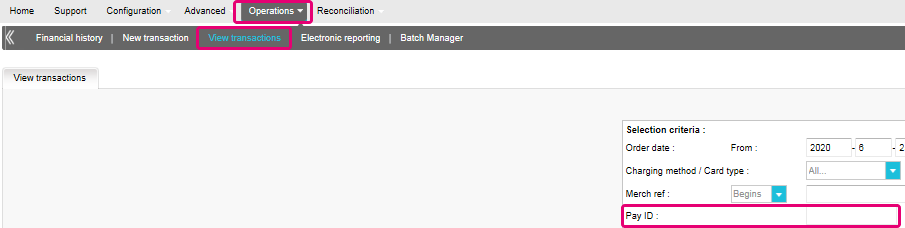

Debido a que el cobro se realiza por operaciones facturables (véase más abajo) y no por transacción, “Ver transacciones” no es la elección correcta (ya que solo mostrará la última operación realizada en una transacción).

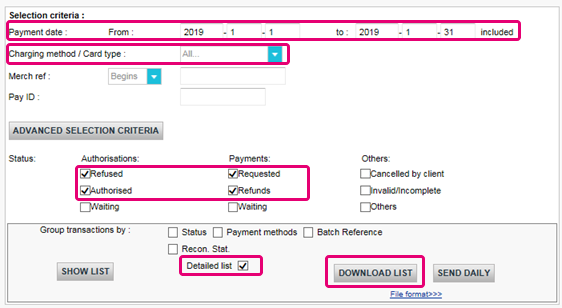

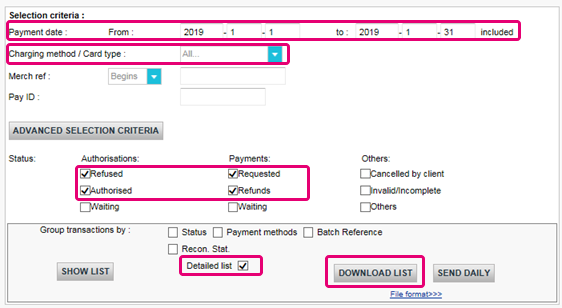

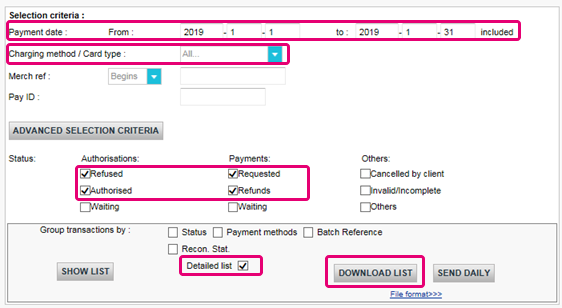

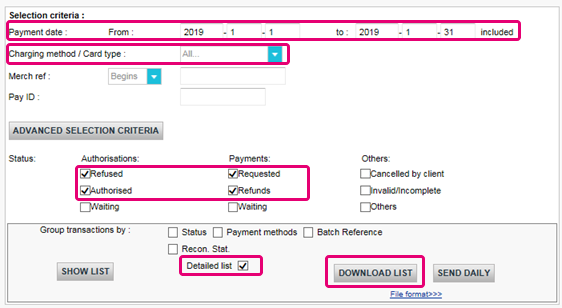

- Rellena los siguientes campos del formulario:

- Fecha de pedido: Introduce el primer y el último día del mes en que se ha emitido la factura

- Método de pago / Tipo de tarjeta: Selecciona "Todo.."

- Estado: Marca “Rechazado”, “Autorizado”, “Reembolsos”, “Solicitado”

- Lista detallada: Si

- Haz clic en DESCARGAR LISTADO

- En la lista resultante, aplica los siguientes filtros para la columna respectiva para mantener las operaciones facturables:

- STATUS: : Filtra para 2, 5, 8 y 9. Estos son los equivalentes a “Rechazado”, “Autorizado”, “Reembolsos”, “Solicitado”

- ACTION: Filtra los valores "DCP", "SAL" y "SAS". Se trata de operaciones de captura de datos sobre transacciones de estado 5 que no cobramos

La cantidad resultante de operaciones por transacción debe coincidir con el importe de tu factura.

Si no coinciden, ponte en contacto con nuestro equipo de atención al cliente. Estarán encantados de resolver la incidencia, ya que los precios específicos de tu contrato y/o suscripción pueden afectar al método de cálculo.

Ten en cuenta que archivamos las transacciones de más de 540 días (= 18 meses). Por lo tanto, asegúrate de cotejarlas antes de que las transacciones se hayan archivado.

Certificación PCI

Es la entidad adquirente del comerciante la que tiene la autoridad de definir el nivel del comerciante en función del número de transacciones anuales. En función del nivel del comerciante (si es de nivel 2, 3 o 4), podría cumplir los requisitos para usar un Cuestionario de autoevaluación (SAQ, según sus siglas inglesas). El tipo de SAQ está muy vinculado al flujo de pago y a si el comerciante captura, procesa, guarda o transmite datos del titular de la tarjeta como el número de tarjeta.

PCI DSS se aplica a todas las entidades que participan en el proceso de la tarjeta de pago, lo que incluye a los comerciantes, los procesadores, las entidades adquirentes, los emisores y proveedores de servicios, así como todas las demás entidades que almacenen, procesen o transmitan datos del titular (CHD, según sus iniciales en inglés) y/o datos de autenticación confidenciales (SAD, según sus iniciales en inglés).

¿Se aplica PCI DSS a la entidad que utiliza un proveedor de servicios tercero (TPSP, según sus siglas en inglés)?

Sí. El uso de un proveedor de servicios tercero (TPSP) no exime la responsabilidad final de la entidad respecto a su propio cumplimiento de PCI DSS, ni exime a la entidad de responsabilidades y obligaciones a la hora de asegurar que los datos de su titular (CHD) y el entorno de datos de la tarjeta (CDE) sean seguros. No obstante, el uso de un proveedor de servicios tercero puede disminuir la exposición a riesgos y reducir el esfuerzo para validar y mantener la conformidad con PCI DSS.

El esfuerzo de un comerciante depende mucho de una serie de factores como, por ejemplo, el nivel del comerciante, el tipo de integración, la infraestructura de apoyo, el uso de proveedores de servicio con certificación PCI DSS, etc.

El SAQ de PCI DSS es una herramienta de validación para comerciantes y proveedores de servicios que no tienen que someterse a una evaluación de seguridad de datos in situ mediante los procedimientos de evaluación de seguridad de PCI DSS. El objetivo del SAQ es ayudar a las organizaciones en el cumplimiento de la autoevaluación con PCI DSS, y puede que, en tanto que comerciante, se le pida compartirlo con su banco adquiriente. Consulte con su entidad adquirente para obtener detalles relativos a sus requisitos de validación de PCI DSS específicos.

La comparación del ámbito de aplicación de SAQ A y SAQ A-EP se describe en la siguiente tabla.

SAQ A

Todas las funciones de datos del titular completamente externalizadas

SAQ A-EP

Canal de pago de comercio electrónico parcialmente externalizado

Se aplica a:

Comerciantes sin presentación de tarjeta (comercio electrónico o correo/pedidos por teléfono)*

Comerciantes de comercio electrónico

Funciones externalizadas

Todas las aceptaciones y todos los procesos de pago están completamente externalizados a proveedores de servicios terceros con validación PCI DSS

Todo procesamiento de los datos del titular está externalizado a un procesador de pagos tercero validado por PCI DSS

Control de datos del titular

El sitio web de comercio electrónico del comerciante no recibe datos del titular y no tiene control directo de la manera en que se capturan, procesan, transmiten o almacenan lo datos del titular

El sitio web de comercio electrónico del comerciante no recibe datos del titular pero controla la forma en que los consumidores, o sus datos de titular, se redireccionan a un procesador de pagos tercero validado por PCI DSS

Páginas de pago

La totalidad de las páginas de pago ofrecidas al navegador del cliente surgen directamente de un proveedor de servicios tercero validado por PCI DSS

Todos los elementos de las páginas de pago que se ofrecen al navegador del cliente provienen del sitio web del comerciante o de un proveedor de servicios que cumple con PCI DSS

Conformidad de terceros

El comerciante ha confirmado que todos los terceros que gestionan la aceptación, el almacenamiento y/o la transmisión de los datos del titular cumplen con PCI DSS

El comerciante ha confirmado que todos los terceros que gestionan el almacenamiento, el procesamiento y/o la transmisión de los datos del titular cumplen con PCI DSS

Sistemas del comerciante

El comerciante no almacena, procesa o transmite electrónicamente ningún dato del titular de la tarjeta en sus sistemas o locales, sino que confía totalmente en un tercero para que gestione todas estas funciones

Conservación de datos

El comerciante solo conserva informes o recibos en papel con los datos del titular, y dichos documentos no se reciben electrónicamente

Si desea más información, el comerciante siempre puede ponerse en contacto con el banco adquiriente.

Toda la información relacionada con PCI se puede encontrar en el Sitio web del Consejo de estándares de seguridad PCI.

El único método totalmente compatible con PCI es el método POST. Así se garantiza que ningún dato sensible de sus clientes quede expuesto.

También puede ayudarle a gestionar las obligaciones del Reglamento general de protección de datos ya que mantiene los datos personales bajo su control.

Nuestra plataforma bloqueará todas las solicitudes enviadas con un método no conforme.

Por favor, póngase en contacto con su departamento de TI para asegurarse de que su sistema solo envía solicitudes POST.

Shopper

En caso de que se haya olvidado de indicar la referencia de pago al transferir el pago a nuestra cuenta, le aconsejamos que se ponga en contacto directamente con el comerciante. El comerciante puede asesorarle mejor en la localización del pago y en asegurarse de que el pago acabe en el lugar correcto.

Esto significa que el banco o la organización financiera en la que se emitió la tarjeta requiere que compruebe su Id. para evitar que otra persona utilice su tarjeta de crédito, por ejemplo en caso de pérdida o robo.

Si tiene alguna dificultad durante este proceso de verificación o tiene alguna duda adicional, le aconsejamos que se ponga en contacto con su banco o con la compañía que emitió la tarjeta de crédito. Dado que es su banco quien requiere la verificación de su identidad, las entidades de Worldline no están involucradas en este proceso.

Si ha realizado el pago pero no ha recibido el pedido en un plazo de tiempo razonable, el primer paso consiste en ponerse en contacto con el comerciante.

Si no puede recibir una respuesta satisfactoria por su parte, en determinados casos podría solicitar a su banco el reembolso del pago.

Tenga en cuenta que esto podría generar costes para usted y para el comerciante.

Otra opción sería ponerse en contacto con una organización de atención al consumidor para reclamar sus derechos.

Tenga en cuenta que Worldline ePayments no puede facilitarle ninguna información relativa a la transacción – esto solo puede hacerlo el comerciante correspondiente.

Para obtener información sobre el estado de su pedido, tiene que ponerse en contacto con el sitio web en el que realizó el pedido. Las entidades de Worldline no conservan ningún detalle sobre el pedido, por tanto no podemos facilitarle esta información.

Las consultas relativas a los pedidos y pagos a las cuentas bancarias adecuadas se deben dirigir a la empresa a la que se haya hecho la compra.

Worldline ePayments no acepta ni rechaza pagos, nos limitamos a transmitir la información al banco o a la empresa de la tarjeta de crédito que utiliza el sitio web en el que ha realizado un pedido. Si la transacción no se realiza correctamente, ello obedece a que el banco o la empresa de la tarjeta de crédito han rechazado la transacción.

Posibles motivos por los que se ha rechazado el pago:

- el sitio web no acepta su tipo de tarjeta de crédito

- la tarjeta ha caducado

- no dispone de más crédito en su tarjeta

Posibles acciones que puede llevar a cabo:

- elegir otro método de pago

- volver a introducir su información

- ponerse en contacto con el sitio web para obtener más información, asegurándose de facilitarles los datos del pedido

Tenga en cuenta que al realizar un pago a un sitio web no se transfiere ningún dinero a través de Worldline ePayments. Simplemente nos aseguramos de que los datos de la transacción lleguen a los bancos y a las empresas de las tarjetas de crédito de forma segura.

Después de haber introducido los datos del pago, normalmente se obtiene un mensaje de confirmación de pedido en pantalla o por correo electrónico.

Si no ha recibido ninguna confirmación, debería ponerse en contacto con la tienda web donde realizó el pedido para averiguar si la transacción se ha realizado correctamente.

Tenga en cuenta que las entidades de Worldline no están autorizadas a facilitar esta información a los clientes.

Para cancelar el pedido u obtener un reembolso, tiene que ponerse en contacto con el sitio web en el que realizó el pedido. Las entidades de Worldline no pueden cancelar su pedido ni reembolsarle el pago, esto solo puede hacerlo la empresa a la que realizó el pedido.

Transactions

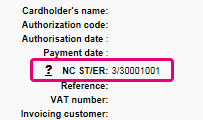

NCERROR y NCSTATUS son estados complementarios que proporcionarán información adicional en caso de que falle la transacción.

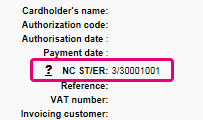

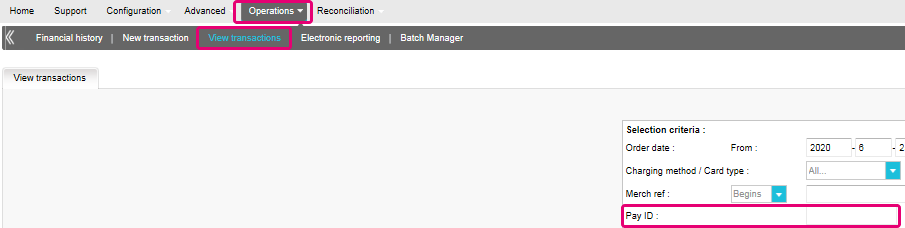

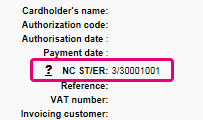

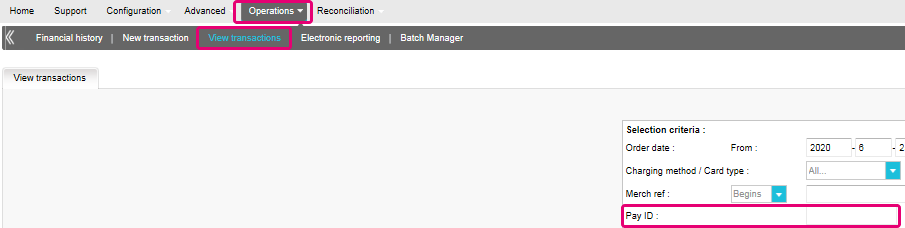

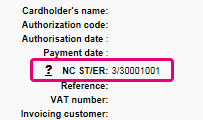

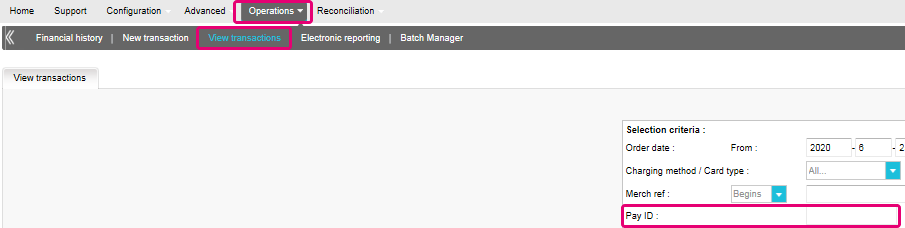

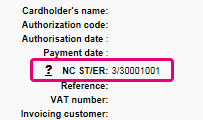

NCERROR es un código de 8 dígitos. Encontrarás una lista completa de todos los posibles errores en tu Back Office: Operations > View Transactions. Busca la transacción correspondiente y haz clic en “?”, como se muestra en el resumen:

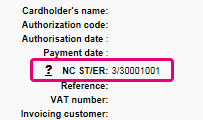

En el caso de transacciones eTerminal , mostramos los campos en el resumen de la transacción como se muestra arriba en “NC ST/ER” (ST = NCSTATUS / ER = NCERROR). También incluimos ambos campos en nuestra información de transacciones para todos los demás modos de integración. Aprende aquí cómo obtener la lista para el canal que utilizas:

3-D Secure es un método de autenticación de transacciones en línea, similar a introducir un código PIN o escribir una firma para una transacción en una terminal física de una tienda o un restaurante. Lo desarrolló inicialmente VISA con el nombre "Verified by VISA" y pronto lo adoptaron MasterCard (SecureCode), JCB (J/Secure) y American Express (Safekey®).

Existen varias formas de autenticación de 3-D Secure. En función del banco del cliente y del país de origen, puede utilizarse usando un lector de tarjetas o digipass, introduciendo un código PIN o introduciendo unos datos que sólo el titular conoce. 3-D Secure permite a los comerciantes que venden en línea verificar que sus clientes son los titulares legítimos de la tarjeta para reducir los casos de fraude.

Más información sobre nuestras soluciones de prevención contra el fraude.

Más información sobre nuestras soluciones de prevención contra el fraude.

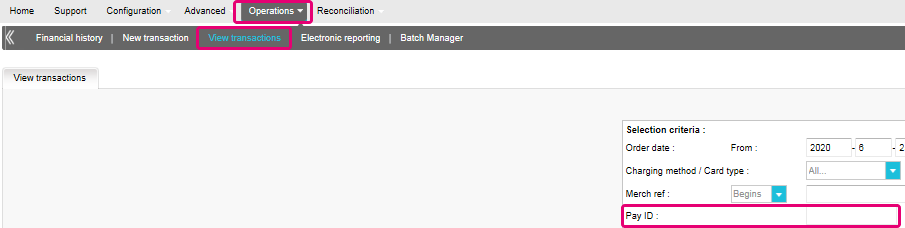

Si desea comprobar los detalles específicos de un pedido o una transacción, o realizar el mantenimiento en las transacciones, debe utilizar "Ver transacciones".

El "historial financiero" es lo más cómodo para comprobar periódicamente los fondos entrantes y salientes por (lotes de) transacciones, y realizar la conciliación.

Si desea obtener más información, vaya a Ver transacciones frente a Historial financiero

Solo puede realizar reembolsos en transacciones cuyo estado es "9 - Pago solicitado". Se puede realizar una cancelación o eliminación tras aproximadamente 24 horas de haber recibido un estado definitivo ( 5-Autorizado o 9 – Pago solicitado ) .

Para conocer la hora límite de la entidad adquirente, le recomendamos que consulte con el departamento de atención al cliente.

Un icono de pulgar hacia arriba totalmente verde significa que la transacción se ha realizado con un método de autenticación 3-D Secure, por ejemplo Digipass o un lector de tarjeta. Sin embargo, no significa necesariamente que el pago propiamente dicho se haya realizado satisfactoriamente. Por tanto, siempre debe comprobar el estado de la transacción para saber si recibirá su dinero.

Vaya a Estados de transacciones para obtener más información.

De forma predeterminada, puede enviar bienes o entregar su servicio después de que una transacción haya alcanzado el estado "5 - Autorizado" o "9 - Pago solicitado". No obstante, aunque el estado 5 es un estado satisfactorio, es únicamente una reserva temporal de un importe de dinero en la tarjeta del cliente. Una transacción en estado 5 sigue necesitando ser confirmada (manual o automáticamente), para pasar el estado 9, que es el estado satisfactorio final de la mayoría de los métodos de pago.

Vaya a Estados de transacciones para obtener más información.

Worldline ofrece una suite completa de productos flexibles, tecnologías sofisticadas y experiencia dedicada para ayudarle a administrar y optimizar sus prácticas de prevención de fraudes en línea. Nuestras herramientas de detección de fraudes son líderes en la industria y nuestros expertos cuentan con más de 20 años de experiencia en el sector y en la región. Colaboraremos estrechamente con usted para desarrollar, implementar y administrar una solución holística contra el fraude que incluye prevención, detección y administración. También ofrecemos soluciones globales de administración de devoluciones de cargo y gestión de conflictos.

Trabajando con Worldline puede elegir las soluciones que mejor se adapten a sus necesidades y personalizar nuestros servicios para externalizar las funcionalidades de administración de fraudes o mantenerlas internamente con nuestro apoyo constante.

Puede reembolsar un pago fácilmente con el botón "Reembolso" en la descripción del pedido de una transacción (mediante Ver transacciones). Si su cuenta lo admite, también puede realizar reembolsos con una solicitud de DirectLink o con una carga de archivo de Fichero de Lote (para varias transacciones).

Tenga en cuenta que la opción Reembolsos debe estar activada en su cuenta.

Vaya a Mantenimiento de transacciones para obtener más información.

En el menú de su cuenta de Worldline, puede fácilmente buscar las transacciones seleccionando "Operaciones" y haciendo clic en "Ver transacciones" o "Historial financiero", dependiendo del tipo de resultados de transacción que busque.

Vaya a Consulte sus transacciones para obtener más información.

Troubleshooting

Si no puede iniciar sesión en la cuenta mediante el ID de proveedor de servicio de pago (PSPID) y la contraseña, puede deberse a uno de los siguientes motivos:

- Podría estar utilizando su PSPID de prueba y/o contraseña en el entorno de producción, o el PSPID de producción y/o la contraseña en el entorno de prueba. Puede comprobar el entorno en la parte superior de la pantalla de inicio de sesión, donde verá "Identificación de producción" o "Identificación de PRUEBA". Para cambiar de entorno, utilice el enlace que se encuentra debajo de los campos de inicio de sesión.

- Podría estar iniciando sesión como comerciante en la pantalla de usuario o como usuario en la pantalla del comerciante. Si está iniciando sesión como comerciante, verá dos campos: PSPID y Contraseña. Si está iniciando sesión como un usuario, verá tres campos: USERID, PSPID (opcional) y Contraseña. Para cambiar a la pantalla de inicio de sesión, pulse el botón "Iniciar sesión como usuario" o "Iniciar sesión como PSPID" en la parte inferior izquierda de la pantalla.

- Quizá haya escrito la contraseña en mayúsculas o minúsculas. Las contraseñas distinguen entre mayúsculas y minúsculas. Intente escribir la contraseña en un editor de texto como, por ejemplo, Word o el Bloc de notas, para comprobar la ortografía y el uso de mayúsculas y minúsculas y, a continuación, copie y pegue el resultado en el campo de contraseña.

- Al enviar los detalles de inicio de sesión, si la página de inicio de sesión vuelve a aparecer y la información que ha especificado no aparece, significa que el navegador no acepta las cookies de la sesión. Para habilitar las cookies de la sesión, vaya a la configuración del navegador. Si no está seguro de cómo hacerlo para su sistema operativo y versión de navegador, consulte con un especialista en TI.

Si olvidó la contraseña, haga clic en el botón "¿Ha perdido su contraseña?" en la parte inferior de la pantalla.

Existen tres motivos por los que no puede reembolsarse una transacción. Debe tener en cuenta lo siguiente (con la condición de que la opción Reembolso esté activada en su cuenta):

- La transacción está en un estado "incompleto", por ejemplo, en estado pendiente o erróneo (91, 92, etc.) que no permiten la operación de reembolso.

- Si la transacción está autorizada (estado 5), en cuyo momento no se ha realizado todavía el pago, tiene que cancelar la autorización en lugar de solicitar el reembolso.

- El método de pago usado no admite la funcionalidad de reembolso, caso de determinadas tarjetas de débito, métodos de banca web y métodos de pago "fuera de línea", como la transferencia bancaria.

Por favor envíe a nuestro departamento de Atención al Cliente el contrato firmado. Para activar su cuenta, debe activarse al menos un método de pago. Si desea obtener más información sobre los métodos de pago, comuníquese con su administrador de cuentas.

Para garantizar que sigues cumpliendo el estándar Payment Card Industry Data Security Standard (PCI DSS) y que estás a salvo de posibles infracciones de seguridad, te invitamos a que migres a Magento 2 o a otra plataforma de eCommerce.

Sabemos que este paso puede resultar complejo. Por eso, nuestros expertos de integración de Magento estarán encantados de ayudarte sin coste alguno. Ponte en contacto con nosotros para obtener más información sobre esta oferta.

Solicite a otro usuario administrador de su PSPID que le desactive la autenticación de dos factores o póngase en contacto con nuestro equipo de atención al cliente para obtener ayuda adicional.

A veces ocurre que la entidad adquiriente desactiva un número de afiliación. Le recomendamos que se ponga en contacto con su entidad adquiriente.

El mensaje "Se ha producido un error, vuelva a intentarlo más tarde. Si es el dueño o el integrador de este sitio web, inicie una sesión en el área de administración de Worldline para ver los detalles del error." es un mensaje de error genérico que aparece si se produce un problema técnico específico al solicitar la página de pago. No mostramos el error real en la página de pago, principalmente por motivos de seguridad, pero también para no confundir a los clientes.

En su cuenta de Worldline, en "Configuración" > "Registros de errores", puede buscar fácilmente los errores que se han producido cuando aparece el mensaje de error genérico. El significado real de estos errores se describe en la página Posibles errores.

Si la autorización no funciona, debe ponerse en contacto con su banco y preguntar por qué se ha rechazado.

Puede restablecer su contraseña con el botón "¿Ha perdido su contraseña?" en la parte inferior de la pantalla de inicio de sesión.

Si utiliza nuestra página de pago Worldline, Worldline se encargará de todos los campos obligatorios.

Si está integrado en DirectLink, lo que significa que tiene su propia página de pago, tenemos un ejemplo de Javascript disponible en la página de soporte para recopilar los datos obligatorios.

Para la recopilación de información opcional, consulte nuestra página de soporte para así saber cómo integrarse con Worldline.

COF en pocas palabras: el cliente inicia una primera transacción con un comerciante con 3D-S (CIT). Desde esta primera experiencia de transacción, el comerciante tiene la posibilidad de realizar transacciones recurrentes (suscripción o con aprobación del cliente -> tokenización) marcadas como transacciones MIT.

Las MIT son una de las excepciones previstas dentro de 3DSv2 si cumplen las siguientes condiciones acumulativas:

- transacciones posteriores de un CIT inicial

- El CIT se realizó con una autenticación obligatoria

- Se establece un enlace de ID dinámico entre el CIT inicial y las MIT posteriores.

Después de la autenticación inicial, se pueden aplicar exenciones/exclusiones:

- Ya sea por las exenciones legales recurrentes que se aplican a las suscripciones con una cantidad fija y una periodicidad (de hecho, se recomienda a los comerciantes que se autentiquen por la cantidad completa y que proporcionen detalles sobre la cantidad de pagos acordados con los titulares de tarjetas)

- O porque otro tipo de transacciones están excluidas del alcance de la SCA... a riesgo exclusivo del comerciante en caso de devolución de cargo (protección limitada a la cantidad autenticada) Y la necesidad de que el emisor acepte ese riesgo:

- COF no programado: el principio de las transacciones posteriores se acuerda con el titular de la tarjeta, pero el importe y/o la periodicidad no son fijos

- Prácticas de la industria: incrementales, ausencia, etc...

Para el período de transición, los esquemas han definido el ID predeterminado que se utilizará para las MIT posteriores creadas antes de la introducción de 3DS v2.

3DSv2 está invitando a los comerciantes a enviar información adicional (obligatorio / recomendado ..). Todo lo que necesitas saber, como comerciante se puede encontrar aquí:

Primero, debe asegurarse de que 3DS esté habilitado en su tienda en línea para todos sus métodos de pago (Visa, MasterCard, American Express, Carte Bancaire, JCB). Asegúrese de que es así. En caso contrario, pida a nuestro equipo de soporte que lo habilite.

Como 3D Secure v2 (3DSv2) tiene como objetivo otorgar el activador de autenticación sólida de clientes (SCA) al banco emisor, el banco emisor debe evaluar mejor el riesgo que implica la transacción. Como consecuencia, la especificación 3DSv2 contiene muchos elementos de datos. Buenas noticias si está utilizando nuestra herramienta de fraude, ya que algunas de ellas ya se utilizan comúnmente en nuestra análisis de fraude. Por supuesto, algunos son nuevos y específicos de 3D Secure v2. En resumen, los elementos de datos se pueden clasificar de la siguiente manera:

- Información obligatoria - datos del navegador:

- Nombre del titular de la tarjeta (CN)

- ¿Integración con las cestas de la compra? Le invitamos a acceder al mercado de cestas de la compra para instalar la última versión del complemento de Worldline o a ponerse en contacto con su proveedor directamente.

- Si utiliza nuestra página de comercio electrónico, Worldline recopila información obligatoria. Puede ir directamente a la información recomendada a continuación.

- Si utiliza su propia página de pago, deberá recopilar la información obligatoria usted mismo tal como se indica a continuación. Le recomendamos que consulte nuestra página de soporte para saber cómo y echar un vistazo al ejemplo de java script.

- Información recomendada - podría usarse usado como parte de la evaluación de prevención de fraude:

- Email (EMAIL)

- Dirección IP (REMOTE_ADDR)

- Número de teléfono (Mpi.WorkPhone.subscriber, Mpi.HomePhone.subscriber ...)

- Dirección de facturación (ECOM_BILLTO_POSTAL_CITY, ECOM_BILLTO_POSTAL_COUNTRYCODE, ECOM_BILLTO_POSTAL_STREET_LINE1 ...)

- Dirección de envío (ECOM_SHIPTO_POSTAL_CITY, ECOM_SHIPTO_POSTAL_COUNTRYCODE, ECOM_SHIPTO_POSTAL_STREET_LINE1 ...)

- Tenga en cuenta que los parámetros recomendados/opcionales deben suministrarse para beneficiarse del flujo sin fricción que puede aumentar su conversión.

- Información opcional - datos ampliados del titular de la tarjeta/cuenta tal como fueron introducidos por EMVCo:

- Mpi.cardholderAccountAgeIndicator

- Mpi.cardholderAccountChange

- Mpi.cardholderAccountPasswordChange

- Mpi.suspiciousAccountActivityDetected

- Mpi.threeDSRequestorChallengeIndicator

- Más información en la lista completa

Nuestras API existentes ya capturan muchos de los elementos de datos, pero estamos agregando muchos elementos de datos nuevos más. La razón es que creemos que todos en el ecosistema de pagos se benefician de una mayor seguridad, con el menor impacto negativo posible en la experiencia del consumidor. Los pagos se basan en la confianza, y proporcionar más datos facilita que las partes confíen entre sí sin necesidad de desafíos adicionales para autenticar al consumidor. Casi todos los elementos de datos recién agregados son opcionales, pero recomendamos que proporcione la mayor cantidad posible de ellos. Esto aumenta la probabilidad de que sus transacciones sigan el flujo sin fricción, mientras se beneficia del cambio de responsabilidad. En caso de que utilice la página de pago alojada de Worldline, capturaremos los datos relacionados con el navegador automáticamente.

El nivel de cambios requeridos variará según el tipo de integración que tenga con Worldline.

- Pedidos por correo/pedidos por teléfono

- Viaje de ida: El PSP del beneficiario (también conocido como adquirente del comerciante) o el PSP del pagador (también conocido como emisor del método de pago del comprador) se encuentra fuera de la zona del EEE.

- Tarjetas prepago anónimas de hasta 150 € (artículo 63)

- MIT - transacciones iniciadas por el comerciante

Las exenciones son transacciones que están DENTRO del alcance de los reglamentos PSD2 SCA:

- Transacciones de bajo valor

- Suscripciones

- Análisis de riesgo

- Lista blanca

Secure v2 es una evolución de los programas 3D Secure v1 existentes: Verified by Visa, Mastercard SecureCode, AmericanExpress SafeKey, Diners/Discover ProtectBuy y JCB J/Secure. Se basa en una especificación redactada por EMVCo. EMVCo existe para facilitar la interoperabilidad mundial y la aceptación de transacciones de pago seguras. Está supervisado por las seis organizaciones miembros de EMVCo, American Express, Discover, JCB, Mastercard, UnionPay y Visa, y cuenta con el respaldo de decenas de bancos, comerciantes, procesadores, proveedores y otros actores de la industria que participan como asociados de EMVCo.

Una de las diferencias principales de la versión 2 es que el emisor puede usar muchos puntos de datos de la transacción para determinar el riesgo de la transacción (análisis basado en el riesgo). En las transacciones de bajo riesgo, los emisores no impugnarán la transacción (por ejemplo, no se enviará un SMS al titular de la tarjeta) aunque autentiquen la transacción (sin fricción). A la inversa, en transacciones de alto riesgo, los emisores requerirán que el titular de la tarjeta se autentique con un SMS o por medios biométrico (desafío).

Por separado, la autenticación sólida de clientes (SCA) requerida desde el 1 de enero 2021 en Europa y desde el 14 de septiembre 2021 en UK como se especifica en la PSD2 dará como resultado un aumento sustancial en el número de transacciones que requieren el uso de autenticación 3D Secure. El uso de 3D Secure v2 debería limitar tanto como sea posible el impacto potencial negativo en la conversión. En resumen, en 3D Secure v2:

- Deberá implementar 3D Secure antes del 1 de enero de 2021 si sus transacciones se ajustan a las pautas de la UE PSD2 SCA (en caso de que aún no sea compatible con 3D Secure)

- Se recomienda (y en algunos casos se requiere) que envíe puntos de datos adicionales para respaldar la evaluación de riesgos realizada por el emisor en caso de 3D Secure v2

- Es posible que deba actualizar su política de privacidad con respecto al RGPD, ya que podría estar compartiendo puntos de datos adicionales con terceros

- Conseguirá una experiencia de usuario mucho mejor para sus consumidores

La expectativa en el mercado es que un porcentaje sustancial de las transacciones que utilizan 3D Secure v2 seguirán el flujo sin fricción, y esto no requiere nada adicional del titular de la tarjeta en comparación con los flujos actuales de pago sin garantía 3D Secure. Esto significa que usted se beneficia de una mayor seguridad y responsabilidad provista por los programas 3D Secure, mientras que la conversión en su proceso de pago no debe verse afectada negativamente.

Desde el 1 de enero 2021 en Europa y desde el 14 de septiembre 2021 en UK, las reglas de autenticación sólida de clientes (SCA) entrarán en vigor para todos los pagos digitales en Europa. En este momento, los bancos, los proveedores de servicios de pago y las redes de tarjetas están trabajando en soluciones técnicas que cumplan los requisitos de la PSD2. Para poder aceptar pagos después del 1 de enero, deberá asegurarse de que estas soluciones técnicas funcionen en su tienda en línea.

Para poder aceptar pagos de las redes de tarjetas más importantes del mundo (Visa, Mastercard y Amex) deberá haber implementado la solución de seguridad 3D Secure en su tienda en línea. 3D Secure se utiliza desde 2001 para mejorar la seguridad de las transacciones con tarjetas en línea, pero ahora se ha desarrollado una nueva versión que facilitará los requisitos de la autenticación sólida de clientes de la PSD2.

Recomendamos el uso de 3D Secure, ya que ayuda a prevenir el fraude y también lo protege de cualquier responsabilidad en caso de fraude. A partir del 1 de enero 2021 también será un requisito para aceptar los pagos de las tarjetas principales.

V1 (para 3DS v1)

V2C (para flujo Challenge 3DS v2)

V2F (para flujo Frictionless 3DS v2)

Para añadir este parámetro a las descargas de archivos de transacciones, siga las instrucciones que se muestran en este vídeo:

Nuestra plataforma de prueba está lista para realizar pruebas.

Nuestro simulador propone todos los diferentes escenarios. Se han proporcionado tarjetas de prueba y se encuentran en nuestra página de soporte, así como en el entorno de prueba (Configuración > Información técnica > Información de prueba).

Si quieres empezar a utilizar la versión 2 de 3DS (3DSv2) en producción, contáctenos.

Para facilitar las cosas tanto a los comerciantes como a los consumidores, la PSD2 permite algunas exenciones en la autenticación sólida de clientes. Lo que es importante tener en cuenta es que todas las transacciones que califican para una exención no serán exentas automáticamente. En el caso de transacciones con tarjeta, por ejemplo, es el banco emisor de la tarjeta el que decide si se aprueba o no una exención. Por lo tanto, incluso si una transacción califica para una exención, el cliente podría tener que realizar una autenticación sólida de cliente si el banco emisor de la tarjeta decide exigirla.