Perseuss

1. Introduction

This guide takes you through the configuration steps to integrate Perseuss into your Worldline fraud prevention settings. With this system, the merchant's transactions will be sent to Perseuss, that will return a score (which they refer to as the “suspicion rate”) based on the Perseuss community contents and algorithm.

In addition to the blocking rules defined in the FDM settings, the Merchant may choose to block transactions based on the Perseuss score.

This guide is a supplement, and should be read alongside our e-Commerce documentation.

2. Configuration

Clicking the "Fraud Detection" menu item takes you to the Fraud Detection Module configuration screen. At the bottom of this screen you will see a section called "External Fraud Detection" where you can click "Edit" for the payment method for which you want to configure Perseuss.

| Configuring one Payment method does not automatically configure the others. Each Payment Method must be configured individually. |

If you have multiple external fraud providers activated, you will see one tab per provider. Click on "Perseuss" to see the screen below:

There are 3 options to configure:

- "Check transaction with Perseuss": Indicates if the screening is active or not. If the option is inactive, other fraud detection policies may apply (such as the Fraud Detection Module, other third-party fraud detection providers, or even Perseuss with another Payment Method).

- "Apply Perseuss screening": By default, it is activated for all transactions, but you may choose to base its trigger on the FDMA result, either by category or by score.

- "Action according to real-time result": If you wish to automatically block the transaction based on Perseuss' feedback, you may configure it here. Unchecking this option will result in no transactions being blocked, but the Perseuss score will be displayed in the Back-Office.

3. Integration with Hosted Payment Page and DirectLink

The following fields should be sent along with the merchant's transactions in order to be able to benefit from Perseuss Fraud Prevention:

| Field | Max Length | Description |

|---|---|---|

| FACNAME1 | 50 | Last name |

| FACNAME2 | 35 | First name |

| FACSTREET1 | 35 | Invoicing address |

| FACZIP | 10 | Invoicing zip/postal code |

| FACTOWN | 25 | Invoicing city |

| FACCOUNTRY | 35 | Invoicing country |

| TELNO | 30 | Phone number |

| 50 | Email address. If you are requesting 3DSv2.1, please ensure that the format of the email is valid, otherwise the authentication process will fall back to 3DS 1.0 | |

| AIDESTCITYx | 3 | Airport of Destination (where x is a number, in case the travel plan has several destinations. the merchant can then submit AIDESTCITY1, AIDESTCITY2, etc.) |

| AIORCITY1 | 3 | Airport of Origin (only one possible) |

| AIFLDATE1 | 10 | Date of Departure, format YYYY-MM-DD |

| AITIDATE | 10 | Order date, format YYYY-MM-DD |

More information about these fields can be found in your account. Just log in and go to: "Support > Integration & user manuals > Technical guides > Parameter Cookbook".

Please be sure to include these fields in your SHA Calculation. For more info on SHA, please refer to the Hosted Payment Page Integration guides.

4. Results

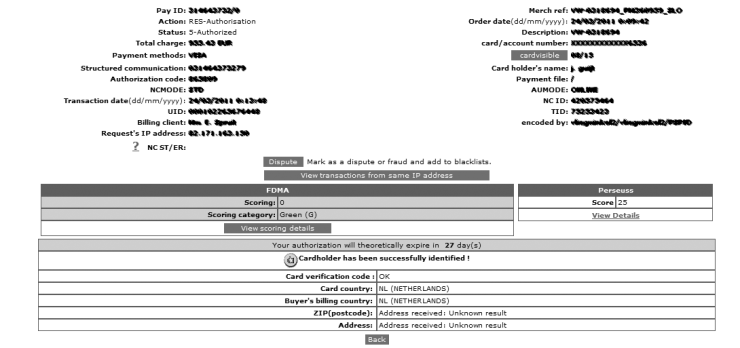

Perseuss returns a score which is between 0 and 100. based on your configuration, the transaction could be blocked if the score is too high.

The score is visible in your Worldline account in the financial history of the merchant's transactions. If you click on the score; you will be redirected to the Perseuss website where you can view the details of the scoring.

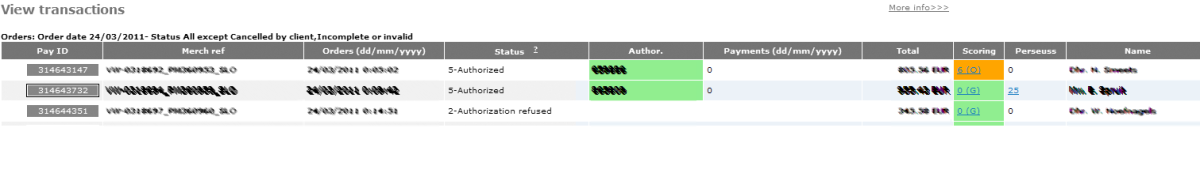

The score is also visible and clickable in the transaction overview.

FAQs

A full green thumbs-up icon means that the transaction was completed with a 3-D Secure authentication method, such as Digipass or a card reader. However, it doesn't necessarily mean the payment itself was processed successfully. Therefore, you should always check the transaction status to know whether you'll receive your money.

Go to Transaction statuses for more information.

Worldline offers a complete suite of flexible products, sophisticated technologies and dedicated expertise to help you manage and optimize your online fraud prevention practices. Our industry-leading fraud detection tools and experts bring over 20 years of industry and regional expertise, and we will work closely with you to develop, implement and manage a holistic fraud solution that includes prevention, detection and management. We also offer comprehensive chargeback management and dispute management solutions.

By working with Worldline, you can pick the solutions that best fit your needs and customize our services to either outsource fraud management functionalities or keep them in-house with our ongoing support.

3-D Secure is a way to authenticate online transactions, similar to enter a PIN code or writing a signature for a transaction on a physical terminal in a shop or restaurant. It was initially developed by VISA under the name "Verified by VISA" and was soon adopted by MasterCard (SecureCode), JCB (J/Secure) and American Express (Safekey®).

There are several forms of 3-D Secure authentication. Depending on the customer's bank and originating country, it can be using a card reader or digipass, entering a PIN-code, or entering a piece of data that only the cardholder can know. 3-D Secure allows merchants selling online to verify that their customers are the genuine cardholder in order to reduce instances of fraud.

Learn more about our fraud prevention solutions.