Utilizzo selettivo di 3-D Secure

1. Introduzione

Per garantire la conformità a PSD2, consigliamo di non utilizzare più queste funzioni.

L’uso selettivo della funzionalità 3-D Secure faceva parte di 3DSv1, ora gradualmente deprecata. In origine, abbiamo introdotto questa funzione per offrire la possibilità di gestire eccezioni ed esenzioni da 3-D Secure, garantendo alti tassi di conversione per le transazioni a rischio minimo.

Con l’introduzione di PSD2, è disponibile la nuova versione 2 di 3-D Secure, che ha sostituito la funzione 3-D Secure originale. Questa nuova versione definisce le proprie esenzioni ed esclusioni da 3-D Secure. L’uso selettivo della funzionalità 3-D Secure non è conforme a tali definizioni.

Per garantire la conformità a PSD2 e per gestire allo stesso tempo queste esenzioni/esclusioni, consigliamo vivamente un approccio diverso. Per ulteriori informazioni, dai un’occhiata ai nostri capitoli dedicati a 3-D Secure per Pagina di pagamento ospitata/DirectLink.

3-D Secure (conosciuto anche come 3D secure authentication o 3DS) è un protocollo di prevenzione delle frodi che rende possibile l’identificazione del titolare della di credito tramite la richiesta di autenticazione online. Purtroppo, 3DS potrebbe non solo complicare il processo di pagamento per i tuoi clienti, ma potrebbe anche impedire il completamento positivo delle transazioni valide e oneste al pagamento.

Per fortuna, puoi utilizzare Utilizzo selettivo di 3-D Secure per:

- Effettuare la combinazione con altri moduli antifrode di Worldline.

- Trovare l’equilibrio perfetto tra la protezione dalle frodi e il mantenimento di un’esperienza di pagamento semplice per i tuoi clienti.

- Disattivare 3-D Secure per le transazioni con importi ridotti.

Per utilizzare questo servizio, avrai bisogno di un abbonamento Fraud Expert Scoring o Fraud Expert Checklist attivo. Se non disponi di un abbonamento, contatta un rappresentante Worldline.

2. Prima di iniziare

Lo strumento Selective use of 3-D Secure dovrà essere utilizzato insieme a uno dei seguenti moduli di rilevamento delle frodi:

- CAP1 – Fraud Detection Module Advanced Checklist (FDMAc)

- CAP2 – Fraud Detection Module Advanced Scoring (FDMAs)

Questa guida illustra come disattivare 3-D Secure (3DS) per le transazioni considerate a basso rischio da FDMAs o FDMAc.

Per iniziare, assicurati che l’abbonamento FDMAc o FDMAs sia stato attivato. Puoi farlo andando a Configuration > Account > Your options nell’account.

Se non è stato attivato, contatta il nostro team di supporto.

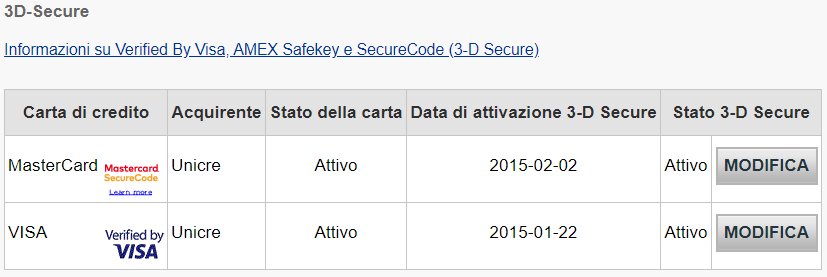

3. Gestione delle impostazioni 3DS

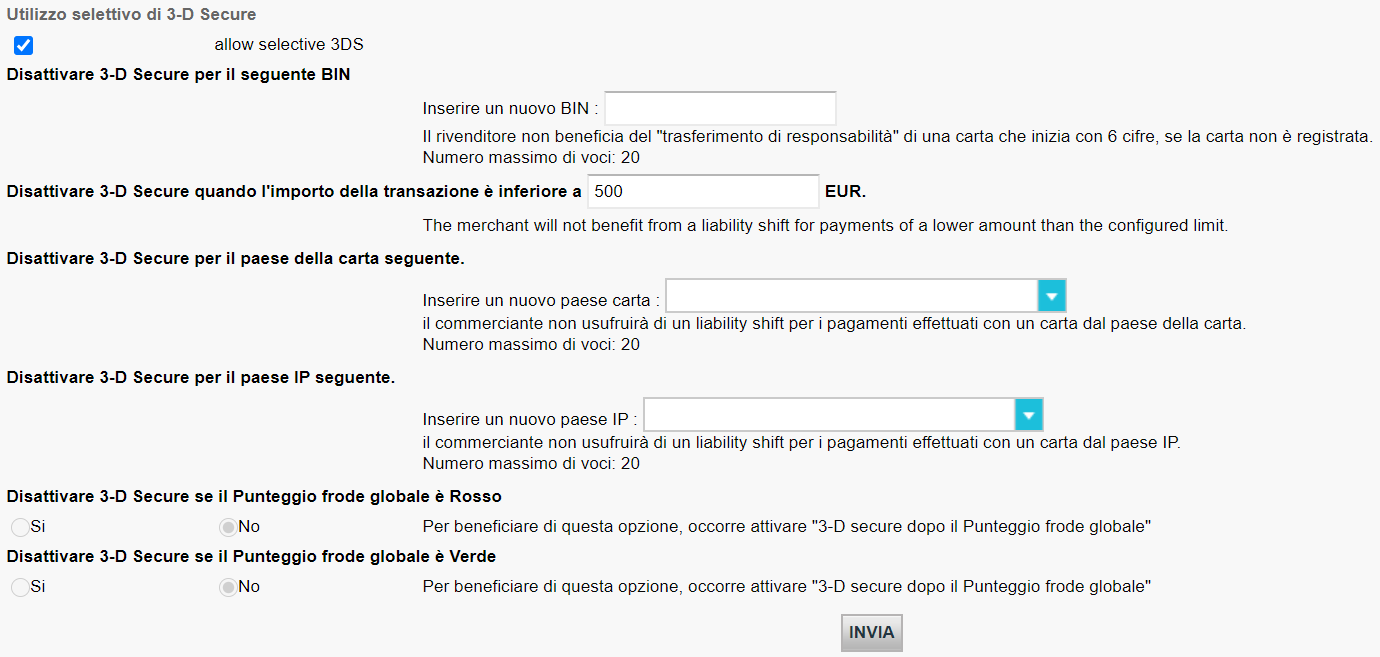

Una volta attivato l’abbonamento contro le frodi, possiamo configurare le impostazioni 3DS.

Vai a Advanced > Fraud Detection. 3DS deve essere configurato individualmente per ciascun metodo di pagamento. In 3-D Secure, seleziona un metodo di pagamento facendo clic su EDIT. Queste impostazioni sovrascriveranno le preferenze 3D-Secure configurate per CAP1 o CAP2 (ovvero, una regola Force Review verrà ignorata)

La tabella seguente fornisce una guida sulle possibili impostazioni configurabili

| Descrizione delle impostazioni | Spiegazione |

|---|---|

| Disattivare 3-D Secure per il seguente BIN | Inserire le prime sei cifre di una carta di credito |

| Disattivare 3-D Secure quando l'importo della transazione è inferiore a X EUR. | Se la transazione non supera un importo specifico, 3DS non si attiva |

| Disattivare 3-D Secure per il paese della carta seguente. | Disponibile solo per Visa/MasterCard/American Express/Diners |

| Disattivare 3-D Secure per il paese IP seguente. | |

| Disattivare 3-D Secure se il Punteggio frode globale è Rosso | Disponibile solo se si utilizza Checklist o Scoring e Fraud Expert |

| Disattivare 3-D Secure se il Punteggio frode globale è Verde | Disponibile solo se si utilizza Checklist o Scoring e Fraud Expert |

Aggiungi elementi inserendo un valore specifico nei campi di immissione o selezionando un elemento dal menu a tendina. Rimuovi gli elementi spuntando Delete. Conferma le tue azioni facendo clic su SUBMIT.

Nota: utilizzando queste impostazioni, potresti non beneficiare della garanzia di pagamento condizionale in caso di storni di addebito. Per ulteriori informazioni, contatta l’acquirente.

Se hai configurato più di una sola impostazione, 3DS viene disattivato se viene soddisfatta anche solo un condizione. Se desideri lavorare con più condizioni, contatta i nostri esperti di frodi.

Domande frequenti

3DS v2

Nel l'UE dal 1° gennaio 2021 e nel Regno Unito dal 14 settembre 2021 le regole dell’autenticazione forte del cliente (SCA) diverranno effettive per tutti i pagamenti digitali in Europa. In questo momento le banche, i fornitori di servizi di pagamento e le reti di carte di pagamento sono tutti al lavoro sulle soluzioni tecniche per conformarsi ai requisiti della PSD2. Per accettare i pagamenti dopo il 1° gennaio 2021, dovrai verificare che queste soluzioni tecniche funzionino per il tuo negozio online.

Per accettare i pagamenti dalle più grandi reti mondiali di carte, Visa, Mastercard e Amex, sarà necessario aver implementato la soluzione di sicurezza 3D Secure nel tuo negozio online. 3D Secure viene utilizzata fin dal 2001 per migliorare la sicurezza delle transazioni online delle carte di pagamento, e ora è stata sviluppata una nuova versione che faciliterà i requisiti dell’autenticazione forte del cliente (SCA) della PSD2.

Worldline consiglia di utilizzare 3-D Secure, perché aiuta a prevenire le truffe e protegge anche dalle responsabilità per eventuali frodi. Dal 1° gennaio 2021 sarà anche un requisito per accettare i pagamenti delle principali carte.

La seconda direttiva UE sui servizi di pagamento (2015/2366 Second Payment Services Directive, PSD2) è entrata in vigore nel gennaio 2018, allo scopo di garantire la protezione dei consumatori su tutti i tipi di pagamento, promuovendo una visione sui pagamenti ancora più aperta e competitiva. Agendo come fornitore di servizi di pagamento, Worldline si reputa di essere certificato conforme alla PSD2 dal 29 maggio 2018.

Uno dei requisiti chiave della PSD2 è legato all’autenticazione forte del cliente (Strong Customer Authentication, SCA) che sarà richiesta per tutte le transazioni elettroniche nel l'UE dal 1° gennaio 2021 e nel Regno Unito dal 14 settembre 2021. La SCA richiederà ai titolari di carte di credito di autenticarsi con almeno DUE dei seguenti tre metodi:

- Qualcosa che conoscono (PIN, password, ...)

- Qualcosa che possiedono (lettore di carte, telefonino, …)

- Qualcosa della loro persona (riconoscimento vocale, impronta digitale, …

In pratica questo significa che i tuoi clienti non potranno più effettuare un pagamento online con carta di pagamento usando solo le informazioni delle loro carte. Al loro posto dovranno, per esempio, verificare la propria identità con la app di una banca collegata al proprio telefono e che richiede una password o un’impronta digitale per approvare l’acquisto.

Maggiori informazioni su PSD2 potranno essere trovate qui: https://www.europeanpaymentscouncil.eu/sites/default/files/infographic/2018-04/EPC_Infographic_PSD2_April%202018.pdf

3DSv2 sta invitando i commercianti a inviare informazioni aggiuntive (obbligatorie / raccomandate..). Tutto quello che devi sapere come commerciante su questo argomento può essere trovato qui:

COF in breve: il cliente avvia una prima transazione con un commerciante con 3D-S (CIT). A partire da questa prima esperienza di transazione, il commerciante ha la possibilità di eseguire transazioni ricorrenti (in abbonamento o con approvazione del cliente -> tokenizzazione), contrassegnate come transazioni MIT.

Le transazioni MIT rappresentano una delle esenzioni previste all’interno della soluzione 3DSv2, a condizione che soddisfino le seguenti condizioni cumulative:

- transazioni successive a una CIT iniziale

- CIT eseguita con un’autenticazione obbligatoria

- Viene stabilito un collegamento ID dinamico tra la CIT iniziale e le transazioni MIT successive

Dopo l’autenticazione iniziale, possono essere applicate esenzioni/esclusioni:

- Sia a causa di esenzioni legali ricorrenti applicabili ad abbonamenti con periodicità e importo di tipo fisso (si consiglia ai commercianti di autenticarsi per l’importo totale + fornire dettagli sul numero di pagamenti concordati con i titolari di carte di credito)

- Sia perché altri tipi di transazioni vengono esclusi dall’ambito SCA... a esclusivo rischio del commerciante in caso di chargeback (protezione limitata all’importo autenticato) E con necessità da parte dell’emittente di accettare l’assunzione di tale rischio:

- COF non programmata: il principio delle transazioni successive viene concordato con il titolare della carta di credito, ma l’importo e/o la periodicità non è di tipo fisso

- Pratiche del settore: incrementale, no show, ecc...

Per il periodo di transizione, gli schemi prevedono un ID predefinito da utilizzare per MIT successive create prima dell’introduzione di 3DS v2.

Non sono disponibili informazioni al riguardo, dato che gli emittenti non hanno ancora fornito dati affidabili. MasterCard sta attualmente conducendo sondaggi in Europa, ma i risultati possono variare notevolmente a seconda della Nazione. Lo stato continuerà a evolversi fino a settembre. A gennaio 2019, solo i 2/3 degli emittenti hanno completato la certificazione EMVCo v2.1. In questo elenco di emittenti, il supporto delle esenzioni ha oscillato tra l’80% (ricorrente) e il 50% (whitelist).

Se usi la nostra pagina Worldline, Worldline si prenderà cura di tutti i campi obbligatori.

Se sei integrato in DirectLink, significa che gestisci la tua pagina di pagamento, e per questo caso abbiamo un esempio di Javascript per raccogliere i dati obbligatori e questo è disponibile nella pagina di supporto.

A meno che l’autenticazione non sia una fase obbligatoria (ad esempio, in caso di registrazione di una carta o di transazione iniziale di una serie di transazioni ricorrenti), gli emittenti possono decidere di saltare l’autenticazione. In tale scenario, l’emittente sarà responsabile in caso di chargeback.

“Aggiungere valore alla carta” fa riferimento al caso in cui un fornitore di portafogli utilizza il protocollo 3DS per aggiungere una carta al proprio portafoglio. Questa opzione sarà implementata dal rispettivo fornitore di portafogli.

La versione 2 di Secure è l’evoluzione dei programmi dell’attuale versione 1 di 3-D Secure: verificata da Visa, Mastercard SecureCode, AmericanExpress SafeKey, Diners/Discover ProtectBuy e JCB J/Secure. Si basa su una specifica stilata da EMVco. La presenza di EMVCo facilita l’interoperabilità a livello mondiale e l’accettazione delle transazioni di pagamento sicure. È supervisionata dai sei membri costituenti l’organizzazione di EMVCo - American Express, Discover, JCB, Mastercard, UnionPay e Visa - ed è supportata da dozzine di banche, commercianti, incaricati, vendor e altri operatori del settore che partecipano come associati di EMVCo.

Nella versione 2 una delle principali differenze è che l’emittente utilizza i molti punti-dati emergenti dalla transazione per determinarne i rischi (analisi basata sul rischio). Nelle transazioni a basso rischio gli emittenti non sarà chiesta conferma della transazione (ad esempio non sarà inviato un SMS al titolare della carta), anche se la transazione (senza attrito) viene autenticata. Al contrario, nelle transazioni ad alto rischio gli emittenti chiederanno al titolare della carta l’autenticazione con un SMS o con mezzi biometrici (richiesta di conferma).

Oltre a questo, l’autenticazione forte del cliente (SCA) richiesta nel l'UE dal 1° gennaio 2021 e nel Regno Unito dal 14 settembre 2021 come specificato nella PSD2 darà luogo a un sostanziale aumento del numero di transazioni che richiedono l’uso dell’autenticazione 3-D Secure. L’utilizzo della versione 2 di 3-D Secure dovrebbe limitare al massimo i possibili effetti negativi sulla conversione. In breve, la versione 2 di 3-D Secure significa che:

- Dovrai implementare 3-D Secure prima del 1 gennaio 2021 se le tue transazioni rientrano nelle direttive SCA PSD2 dell’EU (nel caso in cui 3-D Secure non sia già supportato).

- Ti sarà consigliato (e ad alcuni sarà richiesto) di inviare altri punti-dati per supportare la valutazione del rischio eseguita dall’emittente nel caso della versione 2 di 3-D Secure

- Potrebbe essere necessario aggiornare la tua normativa sulla privacy relativamente al GDPR, perché potresti condividere altri punti-dati con terze parti

- I consumatori avranno una user experience molto migliore

Il mercato si aspetta che una sostanziale percentuale delle transazioni che utilizzano la versione 2 di 3-D Secure seguirà il flusso senza attrito, perché non viene richiesta nessuna aggiunta da parte del titolare della carta rispetto agli attuali flussi di cassa eseguiti senza 3-D Secure. Ciò significa che puoi beneficiare di un maggiore livello di sicurezza e responsabilità fornito dai programmi 3-D Secure, mentre la conversione nel processo di checkout non dovrebbe avere un impatto negativo.

Questo scenario è possibile esclusivamente in caso di integrazione solo tramite DirectLink (pagina del commerciante/FlexCheckOut), dal momento che nella pagina di pagamento ospitata da Worldline, Worldline raccoglie i dati obbligatori.

Innanzitutto, Worldline identificherà il flusso da indirizzare a v1 o v2 in base ai numeri delle carte.

Se la carta è registrata V2, sono possibili i seguenti scenari:

Dati obbligatori:

- Se vengono trasmessi dati errati, la transazione viene bloccata

- In mancanza di alcuni dati, Worldline indirizzerà la transazione al flusso v1

- Se non viene trasmesso alcun dato, la transazione NON viene bloccata ma deviata verso il flusso v1

Dati raccomandati o opzionali:

- se non viene trasmesso alcun dato, la transazione NON viene bloccata, ma non può beneficiare dell’esenzione.

Come questo è definito dalla prontezza dell’acquirente, la disponibilità di 3DSv2 dipende dal singolo acquirente.

La maggior parte degli acquirenti francesi supporterà l’autenticazione forte del cliente (SCA) entro il 14 settembre 2019, ma non le esenzioni. L’introduzione delle esenzioni sarà resa disponibile dai singoli acquirenti tra ottobre 2019 e marzo 2020.

Per rendere la vita più facile ai commercianti e ai consumatori, la PSD2 permette ad alcuni l’esenzione dall’autenticazione forte del cliente (SCA) È importante notare che tutte le transazioni che si qualificano per l’esenzione non saranno esentate automaticamente. Per esempio, nel caso delle transazioni con carte di pagamento è la banca emittente della carta che decide se l’esenzione venga approvata o meno. Quindi, anche se una transazione si qualifica per l’esenzione, il cliente potrebbe dover effettuare anche l’autenticazione forte se la banca emittente della carta sceglie di richiederlo.

Puoi iniziare a testare, Ingenico utilizza nella piattaforma di test, un simulatore per creare tutti i diversi scenari.

Le carte di pagamento di prova sono disponibili e possono essere trovate sul sito di supporto, così come nell'ambiente di prova (Configurzione > Informazione tecniche > Info di test)

Se desiderate iniziare a utilizzare la versione 2 (3DSv2) di 3-D Secure in produzione, vi preghiamo di contattarci

Il tuo certificato PCI è valido per un anno ed è conforme per qualsiasi acquirente.

Attualmente siamo in fase di certificazione per la v2.2 e sarà in produzione nel quarto trimestre del 2020.

Oltre al rilascio della piattaforma a luglio, abbiamo migliorato i dettagli della nostra panoramica sulle transazioni. Ora, le singole transazioni accessibili contengono informazioni dettagliate relative a quale flusso (3Dsv2 o 3DS v1 legacy) è stato applicato. Ulteriori informazioni sono disponibili nelle nostre note per la versione 04.133 nel backoffice tramite Support (Supporto) > Platform Releases (Versioni piattaforma) > Release 04.133 (Versione 04.133)

dei rapporti elettronico.

I valori possibili per VERSION_3DS sono

V1 (per 3DS v1)

V2C (per Flusso 3DS v2 Challenge)

V2F (per Flusso 3DS v2 Frictionless)

Per aggiungere questo parametro ai download dei file delle transazioni, seguire le istruzioni come mostrato in questo video:

Le esclusioni sono transazioni ESTERNE all’applicazione delle normative SCA della PSD2:

- Ordini per posta/ordini telefonici

- Il PSP del beneficiario (ovvero l’acquirente del commerciante) o il PSP del pagatore (ovvero l’emittente del metodo di pagamento dell’acquirente) si trova fuori dalla zona SEE (Spazio Economico Europeo)

- Carte di pagamento prepagate anonime fino a 150 € (articolo 63)

- MIT - Merchant Initiated Transactions

Le esenzioni sono transazioni INTERNE all’applicazione delle normative SCA della PSD2:

- Transazioni di basso valore

- Quote associative

- Analisi del rischio

- Whitelisting

No, questo non è possibile e non è nemmeno pianificato di farlo.

In casi simili, Worldline gestirà automaticamente un fallback a 3-D Secure v1.

L’ABE (Autorità bancaria europea) e le banche nazionali di ogni Nazione interessata hanno concordato un periodo di tolleranza (almeno fino a marzo 2020). Ciò darà a tutti gli attori del settore eCommerce l’opportunità di chiarire tutti i dettagli relativi a questa nuova normativa. Tuttavia, consigliamo vivamente di attivare il 3DS nei propri account il prima possibile.

Il nostro ambiente TEST è pronto, quindi consigliamo di iniziare a provare la tua integrazione il prima possibile.

Fai clic qui se stai utilizzando la pagina eCommerce. Se stai usando la tua pagina, fai clic qui.

Se l'emittente applica il nuovo regolamento PSD2 e 3-d Secure (3DS) non è attivo nell’account del commerciante, la transazione sarà rifiutata con un nuovo codice di errore - soft decline.

Pertanto, si prega di assicurarsi di avere 3DS attivo per ogni marchio negli account.

Se si è integrati con DirectLink (Server to Server), sarà necessario implementare il meccanismo di soft decline nd come descritto qui.

Poiché 3DSv2 introduce un’autenticazione frictionless, il tempo di elaborazione di una transazione potrebbe essere ridotto. Al contrario, se viene richiesta un’autenticazione forte del cliente (SCA), il tempo di elaborazione potrebbe essere maggiore.

Nel l'UE dal 1° gennaio 2021 e nel Regno Unito dal 14 settembre 2021 le regole dell’autenticazione forte del cliente (SCA) diverranno effettive per tutti i pagamenti digitali in Europa. In questo momento le banche, i fornitori di servizi di pagamento e le reti di carte di pagamento sono tutti al lavoro sulle soluzioni tecniche per conformarsi ai requisiti della PSD2. Per accettare i pagamenti dopo il 1° gennaio 2021, dovrai verificare che queste soluzioni tecniche funzionino per il tuo negozio online.

Per accettare i pagamenti dalle più grandi reti mondiali di carte, Visa, Mastercard e Amex, sarà necessario aver implementato la soluzione di sicurezza 3D Secure nel tuo negozio online. 3D Secure viene utilizzata fin dal 2001 per migliorare la sicurezza delle transazioni online delle carte di pagamento, e ora è stata sviluppata una nuova versione che faciliterà i requisiti dell’autenticazione forte del cliente (SCA) della PSD2.

Worldline consiglia di utilizzare 3-D Secure, perché aiuta a prevenire le truffe e protegge anche dalle responsabilità per eventuali frodi. Dal 1° gennaio 2021 sarà anche un requisito per accettare i pagamenti delle principali carte.

La seconda direttiva UE sui servizi di pagamento (2015/2366 Second Payment Services Directive, PSD2) è entrata in vigore nel gennaio 2018, allo scopo di garantire la protezione dei consumatori su tutti i tipi di pagamento, promuovendo una visione sui pagamenti ancora più aperta e competitiva. Agendo come fornitore di servizi di pagamento, Worldline si reputa di essere certificato conforme alla PSD2 dal 29 maggio 2018.

Uno dei requisiti chiave della PSD2 è legato all’autenticazione forte del cliente (Strong Customer Authentication, SCA) che sarà richiesta per tutte le transazioni elettroniche nel l'UE dal 1° gennaio 2021 e nel Regno Unito dal 14 settembre 2021. La SCA richiederà ai titolari di carte di credito di autenticarsi con almeno DUE dei seguenti tre metodi:

- Qualcosa che conoscono (PIN, password, ...)

- Qualcosa che possiedono (lettore di carte, telefonino, …)

- Qualcosa della loro persona (riconoscimento vocale, impronta digitale, …

In pratica questo significa che i tuoi clienti non potranno più effettuare un pagamento online con carta di pagamento usando solo le informazioni delle loro carte. Al loro posto dovranno, per esempio, verificare la propria identità con la app di una banca collegata al proprio telefono e che richiede una password o un’impronta digitale per approvare l’acquisto.

Maggiori informazioni su PSD2 potranno essere trovate qui: https://www.europeanpaymentscouncil.eu/sites/default/files/infographic/2018-04/EPC_Infographic_PSD2_April%202018.pdf

3DSv2 sta invitando i commercianti a inviare informazioni aggiuntive (obbligatorie / raccomandate..). Tutto quello che devi sapere come commerciante su questo argomento può essere trovato qui:

COF in breve: il cliente avvia una prima transazione con un commerciante con 3D-S (CIT). A partire da questa prima esperienza di transazione, il commerciante ha la possibilità di eseguire transazioni ricorrenti (in abbonamento o con approvazione del cliente -> tokenizzazione), contrassegnate come transazioni MIT.

Le transazioni MIT rappresentano una delle esenzioni previste all’interno della soluzione 3DSv2, a condizione che soddisfino le seguenti condizioni cumulative:

- transazioni successive a una CIT iniziale

- CIT eseguita con un’autenticazione obbligatoria

- Viene stabilito un collegamento ID dinamico tra la CIT iniziale e le transazioni MIT successive

Dopo l’autenticazione iniziale, possono essere applicate esenzioni/esclusioni:

- Sia a causa di esenzioni legali ricorrenti applicabili ad abbonamenti con periodicità e importo di tipo fisso (si consiglia ai commercianti di autenticarsi per l’importo totale + fornire dettagli sul numero di pagamenti concordati con i titolari di carte di credito)

- Sia perché altri tipi di transazioni vengono esclusi dall’ambito SCA... a esclusivo rischio del commerciante in caso di chargeback (protezione limitata all’importo autenticato) E con necessità da parte dell’emittente di accettare l’assunzione di tale rischio:

- COF non programmata: il principio delle transazioni successive viene concordato con il titolare della carta di credito, ma l’importo e/o la periodicità non è di tipo fisso

- Pratiche del settore: incrementale, no show, ecc...

Per il periodo di transizione, gli schemi prevedono un ID predefinito da utilizzare per MIT successive create prima dell’introduzione di 3DS v2.

Se usi la nostra pagina Worldline, Worldline si prenderà cura di tutti i campi obbligatori.

Se sei integrato in DirectLink, significa che gestisci la tua pagina di pagamento, e per questo caso abbiamo un esempio di Javascript per raccogliere i dati obbligatori e questo è disponibile nella pagina di supporto.

La versione 2 di Secure è l’evoluzione dei programmi dell’attuale versione 1 di 3-D Secure: verificata da Visa, Mastercard SecureCode, AmericanExpress SafeKey, Diners/Discover ProtectBuy e JCB J/Secure. Si basa su una specifica stilata da EMVco. La presenza di EMVCo facilita l’interoperabilità a livello mondiale e l’accettazione delle transazioni di pagamento sicure. È supervisionata dai sei membri costituenti l’organizzazione di EMVCo - American Express, Discover, JCB, Mastercard, UnionPay e Visa - ed è supportata da dozzine di banche, commercianti, incaricati, vendor e altri operatori del settore che partecipano come associati di EMVCo.

Nella versione 2 una delle principali differenze è che l’emittente utilizza i molti punti-dati emergenti dalla transazione per determinarne i rischi (analisi basata sul rischio). Nelle transazioni a basso rischio gli emittenti non sarà chiesta conferma della transazione (ad esempio non sarà inviato un SMS al titolare della carta), anche se la transazione (senza attrito) viene autenticata. Al contrario, nelle transazioni ad alto rischio gli emittenti chiederanno al titolare della carta l’autenticazione con un SMS o con mezzi biometrici (richiesta di conferma).

Oltre a questo, l’autenticazione forte del cliente (SCA) richiesta nel l'UE dal 1° gennaio 2021 e nel Regno Unito dal 14 settembre 2021 come specificato nella PSD2 darà luogo a un sostanziale aumento del numero di transazioni che richiedono l’uso dell’autenticazione 3-D Secure. L’utilizzo della versione 2 di 3-D Secure dovrebbe limitare al massimo i possibili effetti negativi sulla conversione. In breve, la versione 2 di 3-D Secure significa che:

- Dovrai implementare 3-D Secure prima del 1 gennaio 2021 se le tue transazioni rientrano nelle direttive SCA PSD2 dell’EU (nel caso in cui 3-D Secure non sia già supportato).

- Ti sarà consigliato (e ad alcuni sarà richiesto) di inviare altri punti-dati per supportare la valutazione del rischio eseguita dall’emittente nel caso della versione 2 di 3-D Secure

- Potrebbe essere necessario aggiornare la tua normativa sulla privacy relativamente al GDPR, perché potresti condividere altri punti-dati con terze parti

- I consumatori avranno una user experience molto migliore

Il mercato si aspetta che una sostanziale percentuale delle transazioni che utilizzano la versione 2 di 3-D Secure seguirà il flusso senza attrito, perché non viene richiesta nessuna aggiunta da parte del titolare della carta rispetto agli attuali flussi di cassa eseguiti senza 3-D Secure. Ciò significa che puoi beneficiare di un maggiore livello di sicurezza e responsabilità fornito dai programmi 3-D Secure, mentre la conversione nel processo di checkout non dovrebbe avere un impatto negativo.

Questo scenario è possibile esclusivamente in caso di integrazione solo tramite DirectLink (pagina del commerciante/FlexCheckOut), dal momento che nella pagina di pagamento ospitata da Worldline, Worldline raccoglie i dati obbligatori.

Innanzitutto, Worldline identificherà il flusso da indirizzare a v1 o v2 in base ai numeri delle carte.

Se la carta è registrata V2, sono possibili i seguenti scenari:

Dati obbligatori:

- Se vengono trasmessi dati errati, la transazione viene bloccata

- In mancanza di alcuni dati, Worldline indirizzerà la transazione al flusso v1

- Se non viene trasmesso alcun dato, la transazione NON viene bloccata ma deviata verso il flusso v1

- se non viene trasmesso alcun dato, la transazione NON viene bloccata, ma non può beneficiare dell’esenzione.

La maggior parte degli acquirenti francesi supporterà l’autenticazione forte del cliente (SCA) entro il 14 settembre 2019, ma non le esenzioni. L’introduzione delle esenzioni sarà resa disponibile dai singoli acquirenti tra ottobre 2019 e marzo 2020.

Per rendere la vita più facile ai commercianti e ai consumatori, la PSD2 permette ad alcuni l’esenzione dall’autenticazione forte del cliente (SCA) È importante notare che tutte le transazioni che si qualificano per l’esenzione non saranno esentate automaticamente. Per esempio, nel caso delle transazioni con carte di pagamento è la banca emittente della carta che decide se l’esenzione venga approvata o meno. Quindi, anche se una transazione si qualifica per l’esenzione, il cliente potrebbe dover effettuare anche l’autenticazione forte se la banca emittente della carta sceglie di richiederlo.

Puoi iniziare a testare, Ingenico utilizza nella piattaforma di test, un simulatore per creare tutti i diversi scenari.

Le carte di pagamento di prova sono disponibili e possono essere trovate sul sito di supporto, così come nell'ambiente di prova (Configurzione > Informazione tecniche > Info di test)

Se desiderate iniziare a utilizzare la versione 2 (3DSv2) di 3-D Secure in produzione, vi preghiamo di contattarci

Attualmente siamo in fase di certificazione per la v2.2 e sarà in produzione nel quarto trimestre del 2020.

I valori possibili per VERSION_3DS sono

V1 (per 3DS v1)

V2C (per Flusso 3DS v2 Challenge)

V2F (per Flusso 3DS v2 Frictionless)

Per aggiungere questo parametro ai download dei file delle transazioni, seguire le istruzioni come mostrato in questo video:

- Ordini per posta/ordini telefonici

- Il PSP del beneficiario (ovvero l’acquirente del commerciante) o il PSP del pagatore (ovvero l’emittente del metodo di pagamento dell’acquirente) si trova fuori dalla zona SEE (Spazio Economico Europeo)

- Carte di pagamento prepagate anonime fino a 150 € (articolo 63)

- MIT - Merchant Initiated Transactions

- Transazioni di basso valore

- Quote associative

- Analisi del rischio

- Whitelisting

L’ABE (Autorità bancaria europea) e le banche nazionali di ogni Nazione interessata hanno concordato un periodo di tolleranza (almeno fino a marzo 2020). Ciò darà a tutti gli attori del settore eCommerce l’opportunità di chiarire tutti i dettagli relativi a questa nuova normativa. Tuttavia, consigliamo vivamente di attivare il 3DS nei propri account il prima possibile.

Il nostro ambiente TEST è pronto, quindi consigliamo di iniziare a provare la tua integrazione il prima possibile.

Fai clic qui se stai utilizzando la pagina eCommerce. Se stai usando la tua pagina, fai clic qui.

Se l'emittente applica il nuovo regolamento PSD2 e 3-d Secure (3DS) non è attivo nell’account del commerciante, la transazione sarà rifiutata con un nuovo codice di errore - soft decline.

Pertanto, si prega di assicurarsi di avere 3DS attivo per ogni marchio negli account.

Se si è integrati con DirectLink (Server to Server), sarà necessario implementare il meccanismo di soft decline nd come descritto qui.