Omni channel

1. Introduction

| This guide must be read alongside our DirectLink guide. |

Hereafter we guide you through the features of the online part of the Worldline Omni-channel offer.

The following key elements to benefit from the online Omni-channel offer are covered:

- How to become an Omni-channel merchant?

- How to benefit from Omni-channel features such as the single back office (e-Portal), online refunding of in-store transactions and the tokenization?

- How to make transactions in an Omni-channel context?

- What are the new fields to handle via the various integration modes?

2. Activation: how to be Omni-channel

Please contact your sales representative to request activation of your Omni-channel features.

During the activation phase, you will define and submit to Worldline a hierarchical list of users and entities by which the transactions will be generated. Hereunder we've summarized how you can describe the different webshops and users.

For more details, please contact your sales representative for guidance on the activation process.

3. Access to the back-office e-Portal

One of the key benefits of the Omni-channel offer is a common back office to review and manage your transactions and your configuration. This web-based portal is called e-Portal.

Using e-Portal, you can perform refunds on your transactions, whether they were done online or in-store.

The Ogone online payments section is directly available in e-Portal, using your e-Portal credentials.

You can access e-Portal here: https://eportal.services.ingenico.com

For more details on how to use e-Portal, please refer to relevant e-Portal User Guide.

4. Group of Groups

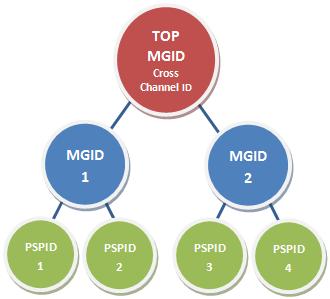

Prior to the Omni-channel offer, you were able to define users (lowest level PSPID) and to order them into groups, by placing common users under one Merchant Group or MGID.

A concept has been added, where several groups can be grouped under a top MGID. During the activation process, you will provide a list of users list representing your shop structure and their users. Here is an example:

The maximum number of layers (levels) is 3 (e.g., country - region - store).

For more details, please contact your sales representative or refer to the relevant e-Portal User Guide.

5. User management

In order to simplify the user management, its configuration has been centralized within e-Portal. Please refer to e-Portal User Guide - User Management module for more details.

Note that API users on the Ogone platform must still be managed via the user management section in the "Online" tab of e-Portal.

6. API General information

XDL is a new API that allows Omni-channel merchants to access all of the features of Ogone DirectLink (new orders, maintenance and query) with the same interface as DirectLink, but with Omni-channel features included.

This means that the merchant will be able to act on his transactions, whether they come from Card Present (CP) or Card Not Present (CNP) world. Payment terminals at POS are CP, and payment online at a web shop is CNP.

This includes use cases like refund CP and/or CNP payment, deferred payment, etc. Please refer to your sales representative for more information about our proposed Omni-channel use cases.

6.1 Concept

In the context of Omni-channel we have a few new concepts to introduce:

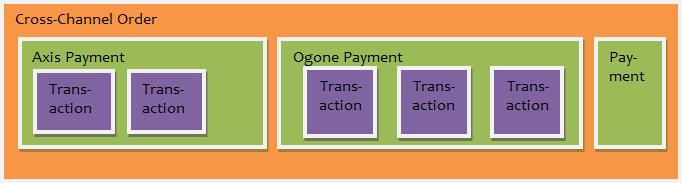

| Concept | Description | Platform |

|---|---|---|

| Omni-channel Order |

A set of transactions that belong together from the point of view of the merchant. All of the transactions in the Omni-channel order have the same ORDERID. The order is identified by the combination of merchant and his sales reference. |

n/a |

| Payment |

Treatment of a payment. Starts with the authorization or the direct sale. Consists of multiple transactions. |

Ogone: Order, identified by PAYID |

| Transaction |

Lowest level of interaction. There are several types of transactions like capture, refund, credit, cancellation etc. |

Ogone: Payment History, identified by PAYID + PAYIDSUB |

6.2 URLs

| Test | Production | |

|---|---|---|

| New order | https://ogone.test.v-psp.com/dl/neworder |

https://secure.ogone.com/dl/neworder |

| Maintenance | https://ogone.test.v-psp.com/dl/maintenance |

https://secure.ogone.com/dl/maintenance |

| Query | https://ogone.test.v-psp.com/dl/query |

https://secure.ogone.com/dl/query |

6.3 Integration with Omni-channel

6.3.1 Parameters

With the new Omni-channel features, additional items or artefacts have been made available. Here is a summary of each new item added for each solution.

| Parameter | Description |

|---|---|

| OPERATORID |

While calling XDL, the merchant can, for the sake of reporting and auditing, indicate which human user of his enterprise requested the action. Optional |

| ORDERID |

The merchant’s reference to the sale between the merchant and the merchant’s customer in the context of Omni-channel. The merchant has to guarantee the uniqueness of this field within the merchant’s realm. Mandatory |

| REQUESTID |

In order to identify different requests / payments for the same ORDERID / SalesReference, the merchant must send a unique request identifier for each individual request. In case a first call fails, and there is no response from our server, all subsequent retries must use the same REQUESTID. Mandatory |

| TRANSACTIONID |

Transaction identifier. In order to transfer the Omni-channel transaction to act upon (for instance during maintenance). Each operation on the Worldline platform by an Omni-channel merchant will return both the PAYID and the TRANSACTIONID. The Omni-channel merchant is advised to store the TRANSACTIONID in his records. If the Omni-channel merchant sends TRANSACTIONID and PAYID (and/or PAYIDSUB) parameters together in one request, the consistency between both is verified, and if they do not refer to the same transaction, the request is rejected with an error. Mandatory for maintenance on Card Present transactions. In all other cases it is advised to use TRANSACTIONID, but optional as the merchant can also use the PAYID + PAYIDSUB instead. Mandatory |

| XCORDERAMOUNT |

The Omni-channel Order has an order amount attribute that the merchant can use to report on the planned value of the order. This information will be used in KPI reports regarding upselling. The parameter is expressed in the same currency as the first transaction in the order (x 100, so there are no decimals). The amount of the order does not influence transaction handling in any way. Optional |

| XCORDERSTATUS |

Omni-channel orders can be marked as Open or Closed. The closed status indicates that the normal sales process has been executed. This information can be used in the click-and-collect case, whereas open orders will be available for collecting. Optional |

| CRMTOKEN and XCDIGEST (Tokenization fields) |

|

6.3.2 Operation codes

A few new operations were added to the DirectLink specification, for the purpose of supporting the deferred use case.

| Operation code* | Parameters |

|---|---|

|

PAL Maintenance operation that requests the system to issue a second, third, etc. payment, starting from an original payment transaction identified by TRANSACTIONID, with the same payment method details. The amount to be paid is mandatory, as well as the ORDERID. |

Mandatory PSPID=ECOMRDSPSPID11 Recommended REQUESTID=UMDoperation001 Optional REFKIND=MGID URL TEST: https://ogone.test.v-psp.com/dl/Maintenance |

|

PES Same as PAL, but only gets an authorisation. This operation does not capture the payment. This is an alternative to RES (request for authorisation). |

Mandatory PSPID=ECOMRDSPSPID11 Recommended REQUESTID=PESoperation001 Optional URL TEST: |

|

UMD Maintenance operation that allows updating the metadata fields of an Omni-channel Order without a financial transaction. |

Mandatory PSPID=ECOMRDSPSPID11 Recommended REQUESTID=UMDoperation001 Optional REFID=ECOMRDS.MGP00 URL TEST: |

|

CRD Pure credit operation that works the same as a refund (RFD) but without verification of the amount. Double credit check: If for the same order two concurrent credits are attempted, the second attempt will be blocked. In that way "double-credit fraud", which is a risk when working with multiple channels, is avoided. This system is supported for all ePayments API’s, with Axis terminals and with e-Terminal (MOTO). |

Mandatory PSPID=QAINTC01PSPID01 Optional REFID=QAINTC01PSPID01 URL TEST: |

| RES |

Mandatory PSPID=PSPIDRESTY02 Optional REFID=MG_RESTY_01 URL TEST: |

| REN |

Mandatory PSPID=ECOMRDSPSPID11 Optional REFID=ECOMRDS.MGP00 REFKIND=MGID URL TEST: |

| SAL |

Mandatory PSPID=ECOMRDSPSPID11 Recommended REQUESTID=SALOperation01 Optional REFKIND=MGID URL TEST: |

| SAS |

Mandatory PSPID=ECOMRDSPSPID11 Recommended REFKIND=MGID Optional REQUESTID=SASOperation01 URL TEST: |

| DEL |

Mandatory PSPID=ECOMRDSPSPID11 Recommended REQUESTID=DELOperation001 Optional REFKIND=MGID amount=1000 URL TEST: |

| DES |

Mandatory PSPID=ECOMRDSPSPID11 Recommended REQUESTID=DESOperation001 Optional REFKIND=MGID URL TEST: |

|

RFD

|

Mandatory PSPID=ECOMRDSPSPID11 Optional REFID=ECOMRDS.MGP00 URL TEST: |

| RFS |

Mandatory PSPID=ECOMRDSPSPID11 Optional REFID=ECOMRDS.MGP00 URL TEST: |

| QUERY |

Mandatory PSPID=ECOMRDSPSPID11 Optional REFID=ECOMRDS.MGP00 URL TEST: |

6.3.3 Metadata

XDL features a generic metadata system for transaction and order metadata. This will allow the merchant to bring additional information elements about the transaction and the order. This information does not influence the transaction processing, but will be used in the Unified Journal reporting. The fields are ANNEXNAMEx and ANNEXVALUEx. X is the sequence number and the fields should always come in pairs having the same sequence number. After processing, the sequence number is not relevant anymore, and you should not expect the metadata to be returned in the same sequence order.

You can send metadata with any of the transactions. The metadata already in the system is updated with the new values. Metadata that is not updated in a subsequent request will remain in the system. In order to clear a value, the name and value pair have to be sent, with the value set to nothing, like in &ANNEXNAME2=ORDER-USERDATA1&ANNEXVALUE2=

Although the merchant can send any type of metadata, only some annex names are recognized by Omni-channel for the purpose of KPI reporting:

- ORDER-USERDATA1

ANNEXNAME1=ORDER-USERDATA1

ANNEXVALUE1=DEFERRED

6.3.4 Output

The output returned to the merchant can always be tuned to the merchant's expectations by changing the options in the Ogone back office. This section explains the availability of new output parameters. Whether they are returned to you depends on your settings.

PAYID and TRANSACTIONID

Upon each request from the merchant, the platform will respond with the reference of the executed transaction, commonly known as PAYID and PAYIDSUB.

When the merchant has been configured for Omni-channel, the platform will return the TRANSACTIONID together with the PAYID (if configured accordingly in the list of dynamic parameters).

More details about the TRANSACTIONID can be found earlier in this document, under Parameters.

CRMTOKEN and XCDIGEST (Offline token)

For each transaction request by the merchant that involves card details, the platform will return the CRM tokens that are available for Omni-channel merchants. The returned tokens are specific to the merchant and can only be used to track the cardholder, both online and in-store.

These two card identifiers are:

- CRM Token: a “mask” for the card number, keeping the format of a card number

- Offline token: a non-format preserving identifier for the card used for the payment, at the merchant level.

| Field | Format |

|---|---|

| CRMTOKEN |

Numeric – 16 digits Example: 0246777044912837 |

| XCDIGEST (=Offline token) |

Hexa - 64 digits Example: 05E9… |

Which type of token to choose is entirely up to the merchant, based on the requirements and/or possibilities of his own system.

In case of the XCDIGEST/Offline token, the merchant's system must be able to process long digests.

Note: if the CRM token/Offline token couldn’t be generated, the transaction will still go through but no token will be returned. Contact our Support team.

Add Omni-channel fields to transaction feedback

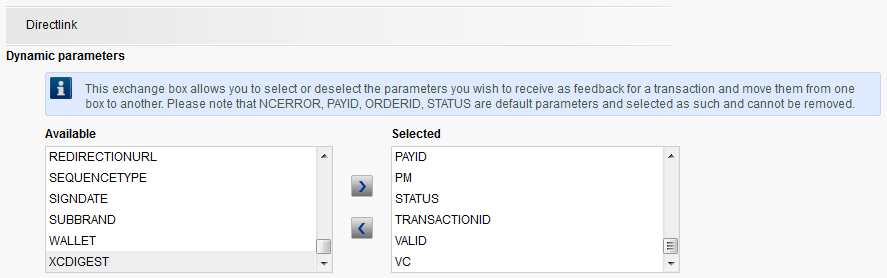

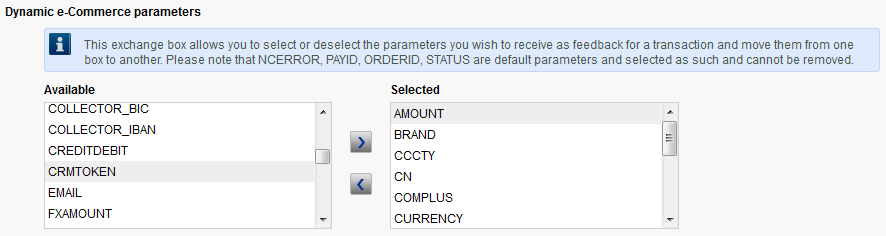

Log on to e-Portal and go to the Online payments tab > Configuration > Technical information > Transaction feedback:

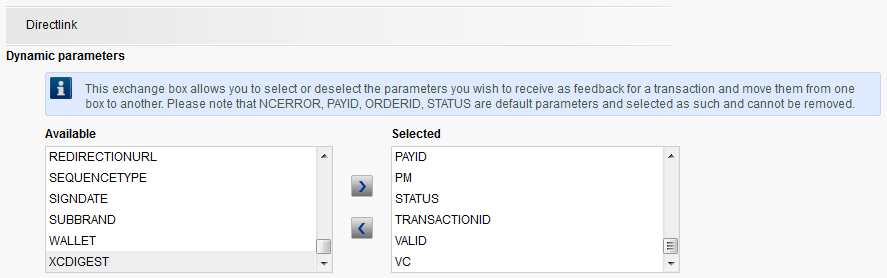

- Under DirectLink: Dynamic parameters, select the relevant fields (CRMTOKEN, XCDIGEST, TRANSACTIONID, ORDERID, PAYID) in the "Available" dropdown list, and set as “Selected”.

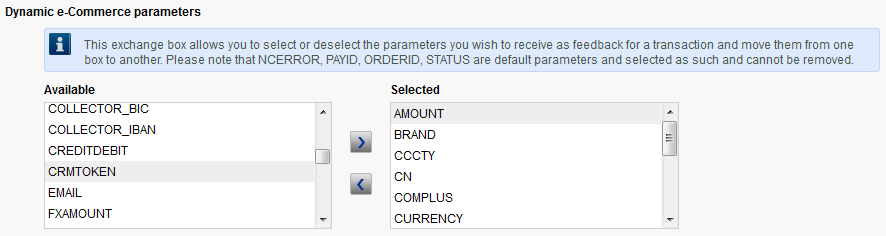

- Under e-Commerce: Dynamic e-Commerce parameters, select the relevant fields (CRMTOKEN, XCDIGEST, TRANSACTIONID, ORDERID, PAYID) in the "Available" dropdown list, and set as “Selected”.

Add Omni-channel fields to electronic reports

Log on to e-Portal and go to the Online payments tab: Operations > View Transactions (note: you need to select one of your PSPIDs to have the menu item displayed):

- Click on “File format”

- Under "Structure", select "Dynamic". Confirm this change directly by clicking "Submit" at the bottom of the page, to show the list of available fields.

- Select "Available fields", add [CRMTOKEN], [XCDIGEST] and [TRANSACTIONID] and click "Submit" at the bottom

- "Selected fields" should show [CRMTOKEN], [XCDIGEST] and [TRANSACTIONID]

When this is done, the transaction reports will show these two fields.

Download reports including Omni-channel fields

Log on to e-Portal and go to the Online payments tab: Operations > Financial history (note: you need to select one of your PSPIDs to have the menu item displayed):

- Check the “detailed list” box

- Select all type of transactions needed

- Click “Download list”.

The list will contain in the header CRMTOKEN; XCDIGEST; TRANSACTIONID. The values will be shown with each transaction.

6.3.5 SHA signature

List of additional Omni-channel parameters to be included in SHA-IN and/or SHA-OUT calculation. *XX* is the placeholder for sequence numbers:

ANNEXNAME*XX*ANNEXVALUE*XX*

CRMTOKEN

OPERATORID

REQUESTID

TRANSACTIONID

XCDIGEST

XCORDERAMOUNT

XCORDERSTATUS

Please refer to our documentation about SHA-OUT.

6.4 Refunds

6.4.1 Cross-payment refunds

You can refund up to the full amount that is calculated as the sum of all payments (Card Present and Card Not Present) done for the whole order.

Example: If within one and the same order there was a CNP payment of €10 and a CP payment of €890, after capturing only the €10 (CP) it is still possible to refund the full €900.

6.4.2 Double refunds check

If for the same order two concurrent refunds are attempted, the second attempt will receive an error “Cannot refund - Order is already locked”.

In that way "double-refund fraud", which is a risk when working with multiple channels, is avoided.

This system is supported for all ePayments API’s, with Axis terminals and with e-Terminal (MOTO).

The order is unlocked shortly after the refund action has been completed.

7. Tokenization

A key pillar of the Omni-channel offer is the tokenization service allowing you to replace sensitive data (e.g. a card number) with non-sensitive data (i.e. a token).

Go to the CRM Token and Offline token chapter for detailed integration info.

For more details about the tokenization service, please refer to the Tokenization Overview document.

8. Error codes

In case the requested refund amount is higher than what is available on the balance, the following error info is returned:

- NCERROR="50001129"

- NCERRORPLUS="Overflow in refunds requests/"MaxRefund amount"/"balance amount"

Veelgestelde vragen

Op deze support-website vindt u alle handleidingen van onze producten. Blader er gerust eens doorheen.

Wanneer uw account wordt geactiveerd, krijgt u automatisch de beschikking over onze reconciliatietool als u een Full Service-account heeft of u gebruik maakt van onze Collect-acquiring. Hiermee kunt u de betalingen die u op uw bankrekening ontvangt eenvoudig reconciliëren met de bestellingen/transacties in uw Worldline-account. Klik hier voor meer informatie over de reconciliatietool.

Worldline biedt de juiste, veilige, slimme en naadloze betaaloplossingen, ongeacht het kanaal: in de winkel, online en mobiel. Worldline biedt handelaren een uitgebreid en innovatief pakket diensten en oplossingen, die een eind maken aan de complexiteit van betalingen. Hierdoor kunnen consumenten snel, probleemloos en veilig aankopen doen via diverse verkoopkanalen en betaalmethoden.

Worldline bestaat uit drie divisies: Worldline Smart Terminals, Worldline Payment Services en IWorldline . Via ons uitgebreide assortiment smart terminals, betaaldiensten en mobiele oplossingen kunnen handelaren zowel in de winkel als online betalingen accepteren.

Via het menu van uw Worldline-account kunt u uw transacties eenvoudig opzoeken. Kies 'Transacties’ en klik vervolgens op ‘Beheer transacties' of 'Financiële historiek’/’Dagtotalen’, afhankelijk van het type transactieresultaten dat u zoekt.

Ga naar Uw transacties raadplegen voor meer informatie.

Standaard kunt u goederen verzenden of uw dienst leveren zodra een transactie de status '9 - Betaling aangevraagd' heeft gekregen. Hoewel status 5-Geautoriseerd een geslaagde status is, is het echter slechts een tijdelijke reservering van een geldbedrag op de kaart van de klant. Een transactie met status 5 moet nog worden bevestigd (handmatig of automatisch) om naar status 9 te gaan. Deze laatste is voor de meeste betaalmethoden de uiteindelijke geslaagde status.

Ga naar Transactiestatussen voor meer informatie.

U kunt een betaling eenvoudig terugstorten met de knop 'Terugbetaling’ in het orderoverzicht van een transactie (via ’Beheer transacties’). Als dit door uw account wordt ondersteund, kunt u ook terugbetalingen doen met een DirectLink-aanvraag of met een Batch-bestandsupload (voor meerdere transacties).

Hiervoor moet in uw account de optie Refunds (Terugbetalingen) zijn ingeschakeld.

Ga voor meer informatie naar transacties beheren.

Een volledig groen pictogram met de duim omhoog betekent dat de transactie is voltooid met een 3-D Secure-authenticatiemethode, zoals een digipass of een kaartlezer. Dit betekent echter niet per se dat de betaling zelf succesvol is verwerkt. Daarom moet u altijd de transactiestatus controleren om te weten of u uw geld zult ontvangen.

Ga naar Transactiestatussen voor meer informatie.

Ingenico ePayments biedt een compleet pakket flexibele producten, geavanceerde technologieën en specifieke expertise om u te helpen met het beheren en optimaliseren van uw online fraudepreventiemethoden. Onze toonaangevende fraudedetectietools en experts hebben meer dan 20 jaar ervaring in de branche en in de regio. In nauwe samenwerking met u ontwikkelen, implementeren en beheren we een holistische fraudeoplossing, die preventie, detectie en beheer omvat. We bieden tevens uitgebreide oplossingen voor het beheer van chargebacks en betwiste betalingen.

Als u met Ingenico ePayments werkt, kunt u de oplossingen kiezen die het beste aan uw behoeften voldoen en onze diensten aan uw wensen aanpassen. Zo kunt u bijvoorbeeld uw fraudebeheerfuncties uitbesteden of ze intern oppakken met onze permanente ondersteuning.

Als u specifieke details van een bestelling/transactie wilt controleren of onderhoud wilt uitvoeren op transacties, moet u ‘Beheer transacties’ gebruiken. ‘Financiële historiek’/’Dagtotalen’ is de handigste manier om binnenkomende en uitgaande bedragen te controleren.

Ga voor meer informatie naar Beheer transacties vs. Financiële historiek/Dagtotalen.

U kunt alleen terugbetalingen uitvoeren op transacties die al minstens 24 uur in status 9 staan. U kunt een annulering uitvoeren binnen ongeveer 24 uur nadat de eindstatus bereikt is (status 9 of 5).

Als u de cut-off time van uw acquirer wilt weten, adviseren we u om rechtstreeks contact op te nemen met onze klantendienst.