Perseuss

1. Introduction

This guide takes you through the configuration steps to integrate Perseuss into your Worldline fraud prevention settings. With this system, the merchant's transactions will be sent to Perseuss, that will return a score (which they refer to as the “suspicion rate”) based on the Perseuss community contents and algorithm.

In addition to the blocking rules defined in the FDM settings, the Merchant may choose to block transactions based on the Perseuss score.

This guide is a supplement, and should be read alongside our e-Commerce documentation.

2. Configuration

Clicking the "Fraud Detection" menu item takes you to the Fraud Detection Module configuration screen. At the bottom of this screen you will see a section called "External Fraud Detection" where you can click "Edit" for the payment method for which you want to configure Perseuss.

| Configuring one Payment method does not automatically configure the others. Each Payment Method must be configured individually. |

If you have multiple external fraud providers activated, you will see one tab per provider. Click on "Perseuss" to see the screen below:

There are 3 options to configure:

- "Check transaction with Perseuss": Indicates if the screening is active or not. If the option is inactive, other fraud detection policies may apply (such as the Fraud Detection Module, other third-party fraud detection providers, or even Perseuss with another Payment Method).

- "Apply Perseuss screening": By default, it is activated for all transactions, but you may choose to base its trigger on the FDMA result, either by category or by score.

- "Action according to real-time result": If you wish to automatically block the transaction based on Perseuss' feedback, you may configure it here. Unchecking this option will result in no transactions being blocked, but the Perseuss score will be displayed in the Back-Office.

3. Integration with Gehoste betaalpagina and DirectLink

The following fields should be sent along with the merchant's transactions in order to be able to benefit from Perseuss Fraud Prevention:

| Field | Max Length | Description |

|---|---|---|

| FACNAME1 | 50 | Last name |

| FACNAME2 | 35 | First name |

| FACSTREET1 | 35 | Invoicing address |

| FACZIP | 10 | Invoicing zip/postal code |

| FACTOWN | 25 | Invoicing city |

| FACCOUNTRY | 35 | Invoicing country |

| TELNO | 30 | Phone number |

| 50 | Email address. If you are requesting 3DSv2.1, please ensure that the format of the email is valid, otherwise the authentication process will fall back to 3DS 1.0 | |

| AIDESTCITYx | 3 | Airport of Destination (where x is a number, in case the travel plan has several destinations. the merchant can then submit AIDESTCITY1, AIDESTCITY2, etc.) |

| AIORCITY1 | 3 | Airport of Origin (only one possible) |

| AIFLDATE1 | 10 | Date of Departure, format YYYY-MM-DD |

| AITIDATE | 10 | Order date, format YYYY-MM-DD |

Meer informatie over deze velden vindt u in uw account. Meld u aan en ga naar: "Ondersteuning > Integratie & gebruikershandleidingen > Technische handleidingen > Parameter Cookbook '.

Please be sure to include these fields in your SHA Calculation. For more info on SHA, please refer to the Gehoste betaalpagina Integration guides.

4. Results

Perseuss returns a score which is between 0 and 100. based on your configuration, the transaction could be blocked if the score is too high.

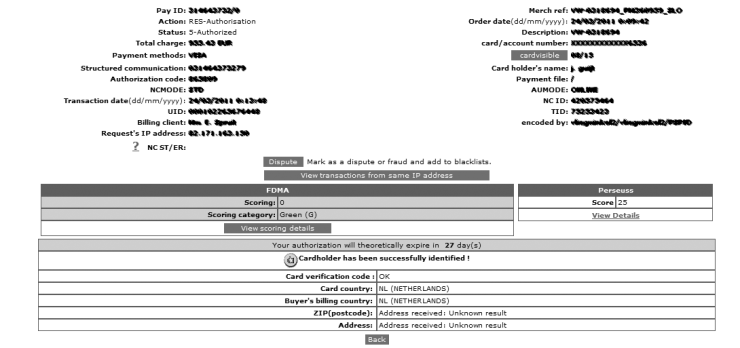

The score is visible in your Worldline account in the financial history of the merchant's transactions. If you click on the score; you will be redirected to the Perseuss website where you can view the details of the scoring.

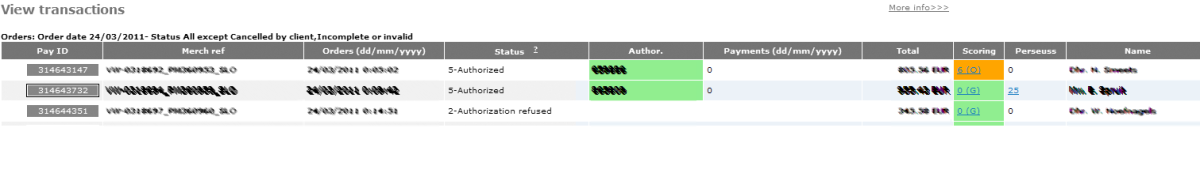

The score is also visible and clickable in the transaction overview.

Veelgestelde vragen

Een volledig groen pictogram met de duim omhoog betekent dat de transactie is voltooid met een 3-D Secure-authenticatiemethode, zoals een digipass of een kaartlezer. Dit betekent echter niet per se dat de betaling zelf succesvol is verwerkt. Daarom moet u altijd de transactiestatus controleren om te weten of u uw geld zult ontvangen.

Ga naar Transactiestatussen voor meer informatie.

Ingenico ePayments biedt een compleet pakket flexibele producten, geavanceerde technologieën en specifieke expertise om u te helpen met het beheren en optimaliseren van uw online fraudepreventiemethoden. Onze toonaangevende fraudedetectietools en experts hebben meer dan 20 jaar ervaring in de branche en in de regio. In nauwe samenwerking met u ontwikkelen, implementeren en beheren we een holistische fraudeoplossing, die preventie, detectie en beheer omvat. We bieden tevens uitgebreide oplossingen voor het beheer van chargebacks en betwiste betalingen.

Als u met Ingenico ePayments werkt, kunt u de oplossingen kiezen die het beste aan uw behoeften voldoen en onze diensten aan uw wensen aanpassen. Zo kunt u bijvoorbeeld uw fraudebeheerfuncties uitbesteden of ze intern oppakken met onze permanente ondersteuning.

3-D Secure is een authenticatiemethode voor online transacties, vergelijkbaar met het invoeren van een pincode of het plaatsen van een handtekening bij een transactie op een fysieke terminal (bijv. in een winkel of restaurant). 3-D Secure is ontwikkeld door VISA onder de naam "Verified by VISA" en werd al snel overgenomen door MasterCard (SecureCode), JCB (J/Secure) en American Express (Safekey®).

There are several forms of 3-D Secure authentication. Depending on the customer's bank and originating country, it can be using a card reader or digipass, entering a PIN-code, or entering a piece of data that only the cardholder can know. 3-D Secure allows merchants selling online to verify that their customers are the genuine cardholder in order to reduce instances of fraud.

Lees meer over onze fraudepreventieoplossingen.