Direct Debits

1. Introduction

This guide is to inform you about our Direct Debit payment methods, and how they need to be configured and integrated, with special attention to the SEPA (Single Euro Payments Area) rules and regulations.

Depending on the processing modes you use, you may have to check the following integration documentation for more technical info:

2. Direct Debits DE (Worldline)

2.1 Introduction

Worldline will implement the SEPA changes on the ELV integration, to align with Worldline.

Note: From now on only IBAN is accepted. You are no longer allowed to send Kontonummer with BLZ.

2.2 Configuration

You need to insert your CREDITORID in the "Direct Debits DE" configuration page.

By default the configuration is now switched to SEPA mode.

A flag will be implemented to configure whether or not to show a mandate text on the payment page (in e-commerce mode):

- Flag switched on: Mandate text will be shown on the payment page

- Flag switched off: Mandate text is not shown

To be able to switch on the flag; you need to enter the CREDITORID.

You must obtain the German CREDITORID from the Bundesbank.

A CREDITORID is structured in the same way all over the SEPA zone:

- The first two characters represent the ISO country code for Germany (DE) as the country issuing the Creditor Identifier.

- The third and fourth characters are the check digits which are calculated in compliance with the IBAN check digits (ISO 13616), without taking characters five to seven (Creditor Business Code) into account.

- The fifth, sixth and seventh characters in the sequence signify the Creditor Business Code for which the direct debit creditor may select alphanumeric characters to denote individual business areas or branches specific to his requirements. The use of blanks, special characters and umlauts is not permitted. As a rule, the three characters entered here are the letters “ZZZ”.

- The remaining characters 8 to 18 signify the national identifier for the direct debit creditor and are numbered in consecutive ascending order. Until further notice, the eighth character in the Creditor Identifier will always be “0”.

The format of the German CREDITORID is as follows: 18 alphanumeric characters. A German CREDITORID should be provided for the processing of ELV transactions.

2.3 Integration with Gehoste betaalpagina

The following fields can be sent along for Direct Debits DE (ELV) transactions. They will be displayed to the customer, in the Mandate text on the payment page.

| Field | Description |

|---|---|

| CN | Cardholder name |

| Optional for SEPA (*) transactions (not applicable for Billpay): | |

| MANDATEID | Unique Mandate Reference Max. 35 AN characters, charset: “A-Z a-z 0-9 space /-?:().,'+”) |

| SIGNDATE | The date the mandate is signed |

| MANDATEID | OOFF or RCUR (OOFF is the default one if not provided) |

Note: These fields can be returned in the post-payment feedback (Dynamic e-commerce parameters) and need to be included in the SHA-IN (and optionally SHA-OUT) calculation.

Notes for SEPA (Single Euro Payments Area):

- If you don't provide the CN, this field will remain empty on the payment page.

- If you don't provide a MANDATEID, we will use the ORDERID. However, if the ORDERID is not compliant with the specifications of the MANDATEID, the PAYID will be used instead.

- If SIGNDATE is not provided, the transaction date will be used.

The following fields will be presented to the buyer:

- IBAN

3. Direct Debits NL (Equens)

3.1 Introduction

As of 1 February 2014, the processing of Direct Debits changes significantly because of the implementation of SEPA rules and regulations. Worldline has prepared these changes to ensure you, as a merchant, can continue accepting payments via Direct Debits.

At Worldline, we’ve anticipated these changes for the following payment methods and their refund functionality:

- Direct Debits NL – SEPA Direct Debits regulations

- Refunds of Direct Debits NL – SEPA Credit Transfers regulations

- Refunds of iDEAL transactions – SEPA Credit Transfers regulations

Worldline works with the Corporate Payment Services (CPS) service of Equens to ensure all merchants can continue using their current bank. However, still some administrative and technical changes have to be anticipated.

The technical changes in the different modes are described in the dedicated integration guides.

On the administrative part you should do the following:

- Apply for a CreditorID with your bank when you want to process SEPA Direct Debits

- Let your bank know that you will use the CPS service of Equens with Worldline as a service agency. Specify whether you want to use this for SEPA Direct Debits or for SEPA Credit Transfers. The latter is for processing refunds on Direct Debits or for iDEAL refunds via the option ‘IDERFD’.

In order to use the SEPA Direct Debits via Equens; you must sign a contract with your bank to process SDD via the CPS service of Equens with Worldline as Service provider.

If you want to process refunds of Direct Debits and/or iDEAL refund with the ‘IDERFD’ option (i.e. outside of Full Service), you must sign a contract with your bank to process SCT transactions via the CPS service of Equens with Worldline as Service provider.

If the activation of SCT and/or SDD for CPS is done correctly with your bank, you will no longer have to send a confirmation fax to Equens to have your transactions processed (as banks used to request with ClieOp).

On a technical level, we've upgraded the Direct Debits NL payment method. As a merchant, you can decide by yourself when to switch to the SEPA mode, using a parameter on the configuration page.

The option to download the transaction file as it was previously possible with the ClieOp payment file is no longer available.

3.2 Configuration

You need to insert your CreditorID on the Direct Debits NL configuration page. The CreditorID is a identification number that you obtain from your bank. In general a CreditorID can contain up to 35 alphanumeric characters, however the Dutch CreditorID usually contains 17 alphanumeric characters.

Instead of the current (regular) account number of 9 digits, you need to enter your IBAN and BIC.

A flag is implemented to allow you to switch to the new SEPA version:

- Flag switched on: new SEPA version will be used as described below

- Flag switched off: current ClieOp version will be used. So below described changes won’t be applied.

3.3 Additional fields for SEPA

The following parameters are created or adapted to process SEPA Direct Debit transactions:

Existing field:

- CARDNO: used for the buyer's IBAN

Fields for SEPA Direct Debit:

- BIC: new field for BIC code of the bank of the buyer (optional)

- MANDATEID: all transactions should be done under the mandate agreed between merchant and his customer. This Unique Mandate Reference should be a unique reference for the merchant. The UMR is maximum 35 characters and character set is: “A-Z a-z 0-9 space /-?:().,'+”

- SIGNDATE: the date the mandate between merchant and his customer was signed

- SEQUENCETYPE: indicates whether the mandate is the first one of a collection, a recurrent one, a final one or a One-off. Possible values: FRST, RCUR, FNAL and OOFF.

These parameters will be applied for the different modes to process SDD transactions on the Worldline platform: Gehoste betaalpagina, DirectLink, Batch and e-Terminal. Further in this document we highlight what changes you need to anticipate for Gehoste betaalpagina, DirectLink and Batch. For e-Terminal you’ll need to input these parameters in the back office.

See schedule below:

| Field | Content | Format/ Value |

If empty |

|---|---|---|---|

| CARDNO | Buyer's IBAN account number | Buyer's IBAN account number | Transaction blocked |

| BIC | Buyer's BIC (Bank Identifier Code) | Buyer's BIC (Bank Identifier Code) | (optional) |

| MANDATEID | Unique Mandate Reference | Unique Mandate Reference | ORDERID will be used |

| SIGNDATE | Signature Date of Mandate | Signature Date of Mandate | Transaction date will be used |

| SEQUENCETYPE | Indicate state of mandate | Indicate state of mandate | OOFF will be used |

| Possible values: | First collection of a series of Direct Debit instructions | FRST | |

| Direct Debit instruction where the debtor's authorization is used for regular Direct Debit Transactions initiated by the creditor. | RCUR | ||

| Last collection of a series of Direct Debit instructions (afterwards same MandateID can’t be used anymore) | FNAL | ||

| Direct Debit instruction where the debtor’s authorization is used to initiate one single Direct Debit transaction. | OOFF | ||

In case your buyer, the debtor, changes his IBAN/BIC we recommend you to change the Unique Mandate Reference as well. This will avoid problems with the processing of your Direct Debit transactions under SEPA.

In case you don’t provide the MANDATEID, SIGNDATE and SEQUENCETYPE, we will use default values:

- MANDATEID: ORDERID (if ORDERID is not compliant, the PAYID will be used)

- SIGNDATE: date of transaction

- SEQUENCETYPE: OOFF (One Off)

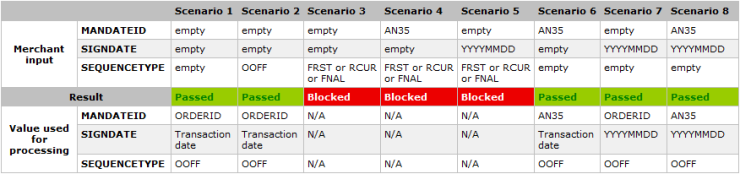

However, not all combinations are possible, as displayed in the following diagram:

3.4 Integration with Gehoste betaalpagina

The following fields should be sent along for Direct Debits NL transactions (only via Equens):

| Field | Description |

|---|---|

| MANDATEID |

Unique Mandate Reference (for SEPA) Max. 35 AN characters, charset: “A-Z a-z 0-9 /-?:().,'+”) No spaces allowed; cannot start or end with a forward slash "/" or contain two consecutive slashes. Only applicable for SEPA (Single Euro Payments Area) transactions. If not provided, the ORDERID will be taken |

| SIGNDATE |

Date mandate was signed by the buyer. Format: YYYYMMDD Only applicable for SEPA (Single Euro Payments Area) transactions. If not provided, the transaction date will be taken. |

| SEQUENCETYPE |

Possible values to indicate the Direct Debit transaction type (max. 4 alphanumeric characters):

Only applicable for SEPA (Single Euro Payments Area) transactions. If not provided, the transaction will be considered as a "one-off" (OOFF is applied). If "FRST", "RCUR" or "FNAL" is sent, you must submit values with the MANDATEID and SIGNDATE |

Note: These fields can be returned in the post-payment feedback (Dynamic e-commerce parameters) and need to be included in the SHA-IN (and optionally SHA-OUT) calculation.

The following fields will be presented to the buyer on the payment page:

- IBAN

Veelgestelde vragen

Hoelang het duurt om een betaalmethode te activeren, is afhankelijk van de volgende factoren:

- Gewoonlijk heeft de acquirer of de bank ongeveer een week nodig om uw aanmelding te voltooien. Als u al bent aangemeld, duurt de activering slechts een paar dagen.

- Voor sommige betaalmethoden zijn extra controles vereist voordat ze kunnen worden geactiveerd, bijv. in geval van 3-D Secure, dat rechtstreeks wordt aangevraagd bij VISA of MasterCard (en niet bij de acquirer).

Met Worldline Collect kan u verschillende betaalmethoden in één keer activeren.

Een acquirer is een financiële instelling die betalingen van bepaalde creditcards en debitcards verwerkt. De acquirer is verantwoordelijk voor het financiële gedeelte van de transactieverwerking en Worldline is verantwoordelijk voor het technische gedeelte. Met andere woorden, zonder een acquirer wordt het geld niet overgemaakt op uw bankrekening.

Een acquirer is een financiële instelling die betalingen van bepaalde creditcards en debitcards verwerkt. De acquirer is verantwoordelijk voor het financiële gedeelte van de transactieverwerking en Worldline ePayments is verantwoordelijk voor het technische gedeelte. Met andere woorden, zonder een acquirer wordt het geld niet overgemaakt op uw bankrekening.

Voor elke online betaalmethode die u wilt toevoegen, hebt u een aanvaardingscontract met een acquirer nodig. Als u advies wilt bij de keuze van de acquirer die het meest geschikt is voor u en uw regio, gelieve ons te contacteren. Als u weet met welke acquirer u wilt samenwerken, kunt deze eenvoudig in de vervolgkeuzelijst selecteren wanneer u in uw account een betaalmethode toevoegt.

Maar wij kunnen dat ook voor u regelen. Met Full Service kunt u met één contract een groot aantal lokale betaalmethoden tegelijk activeren, in meerdere landen. Als u internationaal handel drijft, kan dit de ideale manier zijn om betalingen uit heel Europa te accepteren. Het bespaart u veel tijdrovende administratie en omdat u meer betaalmethoden kunt aanbieden, kunt u hiermee bovendien uw omzet verhogen.

Meer informatie over Full Service vindt u hier, maar u kunt ook ons contacteren.