I have noticed I have more declined transactions (status 2) than usual. What can I do?

With the introduction of the PSD2 guideline, all your customers will have to pass a 3-D Secure authentication check (apart from some clearly defined exclusions and exemptions). To make sure 3-D Secure is correctly rolled out for your transactions whenever necessary, go through this checklist:

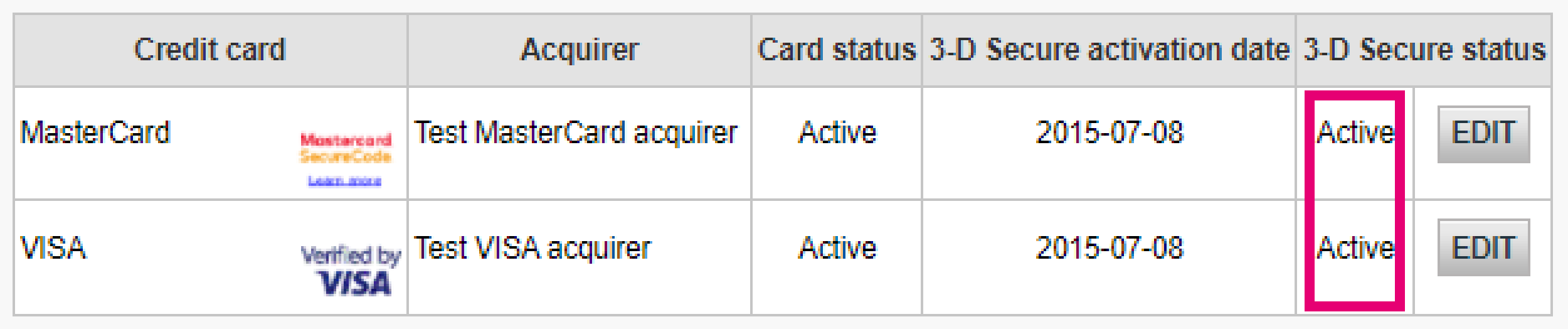

- Confirm that 3-D Secure is active for all credit card payment methods in your Back Office via Advanced > Fraud Detection > 3D-Secure

The image above shows where to find the 3-D Secure activation status for your payment methods in the Back Office

If any of your payment methods is not “Active” as stated in column “3-D Secure status”, contact us - Check that your integration implements the 3-D Secure step correctly. For Hosted Payment Page, we take care of this, but for DirectLink you need to implement it yourself

- Understand when exclusions and exemptions from 3-D Secure apply. Learn how to implement it correctly for Hosted Payment Page and DirectLink

- Know when to skip 3-D Secure using our Soft Decline feature and how to recover them via DirectLink

If a transaction reaches status 2, it is important for you to know whether this is related to a PSD2 violation. Our platform offers you multiple sources of information that will help you. Use them to confirm your integration takes the PSD2 guideline into account:

- Look up the transaction’s error code. The most common PSD2-related errors are:

NCERROR Root cause/Possible solutions 40001137 -

- You advised our platform to perform the authorisation step although there was no 3-D Secure check

- As your customer’s bank rejected the transaction, this is out of your control

40001139 -

- Soft Decline rejection

- Implement a real-time recovery process in your business logic via DirectLink

40001134 -

- Your customer was unable to pass the 3-D Secure check

- Contact your customer to learn why s/he was unable to pass the check

40001135 -

- Your customer’s issuer was not available to roll the 3-D Secure check

- As your customer’s bank failed to roll out 3-D Secure, this is out of your control. Consider offering alternative payment methods for retries

Check our dedicated Transaction error codes guide for detailed information about these decline reasons

-

- Receive parameter CH_AUTHENTICATION_INFO in your transaction feedback for Hosted Payment Page and DirectLink. It contains information about decline reasons from your customers’ issuers

- Consult our dedicated 3-D Secure status guide to get fully familiar with 3-D Secure. Understand all 3-D Secure statuses and learn how to read the authentication log