Thunes

1. Introduction

Thunes is a French payment provider, that enables you to offer various payment methods.

Thunes is only supported in our Gehostete Zahlungsseite environment. The customer is redirected from the Worldline payment page to the Thunes

platform.

This guide should be read in conjunction with the following documentation: Use your Worldline account and Gehostete Zahlungsseite

2. Payment methods

Worldline offers an increasing amount of payment methods through Thunes.

At this time, already the following payment methods can be made available to your customers.

2.1 Alipay

Alipay is a Chinese e-wallet use for online and in-store payment by more than 450 million customers. As a cross-border payment method it supports any currency you offer. You will be paid out in the settlement currency you defined in your acquiring contract, but your customers will pay in CNY.

Our solution includes desktop and mobile versions.

- Authorization and payment: 1-step (debit)

- Integration requirements / specifications

- Mandatory parameter EMAIL (see input parameters)

- Customers need a Chinese ID / Chinese bank account

- Check out https://intl.alipay.com/ for more information

2.2 Floa Pay 3X4X

Floa Pay 3X4X allows paying by instalments for cards issued from this bank. You can offer your customers various instalment payment plans.

Our solution includes desktop and mobile versions.

- Allows both 1-step (debit: You request the payment in one step) and 2-steps payments (You authorize the payment in a first step and capture it at a later point)

- Amount limits are 50€ - 4000€

- Supports multiple, partial or full refund

- Mandatory parameters are

- REF_CUSTOMERID

- Invoicing data

Please check our dedicated chapter on input parameters for detailed instructions.

Depending on which variant you want to offer you customer, populate the following fields accordingly:

| Variant | PM | BRAND |

|---|---|---|

| Floa Pay 3X with fee Your customers pay the amount with three instalments. The bank will add the fees on top what you send in AMOUNT and charge your customers accordingly |

floapay3x | floapay3x |

| Floa Pay 4X with fee Your customers pay the amount with four instalments. The bank will add the fees on top what you send in AMOUNT. Effectively, your customers pay the fee |

floapay4x | floapay4x |

2.3 Cadhoc

Cadhoc is a French prepaid debit card processed by Up, used as a gift card. Customers have to activate the card before using it on more than 15 000 points of sale. Cards can also be branded as “chèque lire” or “chèque culture” but are processed using same integration. If amount left on card does not reach order amount, customer can add another Cadhoc card or complete payment using credit card. Confirmation and refund e-mails are sent by Thunes to customers.

- Authorisation and payment: 1-step payment for payments in addition to payment with Cadhoc.

- Multiple, partial or full refund

- https://www.macarte-cadhoc.com

- In France

2.4 Cado Carte

Cado Carte (by Natixis) is a prepaid payment method

Special features: Customers can add several "Cado Carte" gift cards on the payment page and pay the remaining amount with credit card

- Authorisation and payment: 1-step payment (Debit)

- www.cadocarte.com

- Only in France

- According to the European Anti-Money-Laundering Directive (ALM5), the maximum allowed amount for open loop gift card transactions is 50€.

- No action from your side is required to ensure you comply to this rule.

- The following message is displayed on the payment page after your customers select this payment method: “Because of regulatory reasons, the charge of your giftcard is limited to 50 EUR per purchase, please use your bank card to cover the remaining amount for your purchase”. They will have to choose on the payment page an amount of up to 50€ to pay by gift card.

- As usual, your customers will then pay any remaining amount not covered by the gift card with their credit card as before.

2.5 Cetelem

Cetelem allows paying by instalments for Visa, MasterCard or Carte Bancaire co-badged cards. You can offer your customers various instalment payment plans.

- Support refunds

- You receive the funds within 48 hours

- Amount limits are 90 to 3.000€

- Mandatory parameters are

- Invoicing data

- Delivery data

Please check our dedicated chapter on input parameters for detailed instructions.

Depending on which variant you want to offer you customer, populate the following fields accordingly:

| Variant | PM | BRAND |

|

Cetelem 3XCB Your customers pay the amount with three instalments. The bank will add the fees on top what you send in AMOUNT and charge your customers accordingly |

CETELEM3XCB | CETELEM3XCB |

|

Cetelem 4XCB Your customers pay the amount with four instalments. The bank will add the fees on top what you send in AMOUNT. Effectively, your customers pay the fee |

CETELEM4XCB | CETELEM4XCB |

2.6 Chèque-Vacances

Chèque-Vacances (by ANCV) is a French initiative for travel vouchers.

The customer pays for travel (related) expenses with travel vouchers at accredited merchants. On the payment page the customer declares paper check numbers and pays the remaining amount with his credit card. Authorisation is made on the credit card to guarantee the amount paid with Chèque-Vacances. Then the client must send his paper checks by mail. Additional payments are debited immediately.

- Integration requirement / specificities: The part paid by Chèque-Vacances can't be refunded. The merchant will be notified by email to find another solution to refund his clients.

- Authorisation and payment:

- 1-step payment for payments in addition to payment with Chèque-Vacances.

- 2-step payment in case of doubt about the guarantee on credit card or in case the paper checks don't arrive.

- Only in France

2.7 Chèque Vacance CVConnect

Chèque-Vacances Connect allows customers to validate payments and check their balance via a mobile application using their e-mail address/password as login credentials.

Your customers define how much to pay with this payment method and cover the remaining amount with their credit card.

- Integration requirements / specificities:

- Mandatory parameter EMAIL (see Input parameters)

- No refunds possible for the part paid by this payment method

- Available in France and in member countries of the European Union

- Minimum amount: 20 EUR

- Payments possible with a precision of 0.01 EUR

- Cancellation possible within 4 hours of authorisation

2.8 Cofidis

Cofidis allows paying by instalments for Visa, MasterCard or Carte Bancaire co-badged cards. You can offer your customers various instalment payment plans.

Integration requirements / specificities

- Support refunds

- You profit from protection against fraud and unpaid goods/services

- Amount limits are 100 to 2.300€

- Available in France/Belgium/Spain – Please check the payment method details below to see which payment method is available in which country

- Mandatory parameters are

- Invoicing data

Please check our dedicated chapter on input parameters for detailed instructions.

Depending on which variant you want to offer you customer, populate the following fields accordingly:

| Variant | PM | BRAND |

|

Cofidis 3XCB (available in France and Belgium) Your customers pay the amount with three instalments. The bank will add the fees on top what you send in AMOUNT and charge your customers accordingly |

cofidis3xcb | cofidis3xcb |

|

Cofidis 4XCB (available in France and Spain) Your customers pay the amount with four instalments. The bank will add the fees on top what you send in AMOUNT. Effectively, your customers pay the fee |

cofidis4xcb | cofidis4xcb |

We offer you the possibility to perform test transactions without a financial impact. To do so, you need to

- Request a test account from Thunes

- Send the request to our test environment with parameter AMOUNT between 100€ and 200€

- Enter the following card data on the Thunes payment page to simulate the desired result

| Please note that Thunes might still decline a transaction although you entered the data to simulate a successful payment. You can enforce a successful payment to add “IP” in front of the value you send for parameter ECOM_BILLTO_POSTAL_NAME_LAST |

2.9 Facily Pay

Facily Pay (by Oney) offers 3x and 4x CB e-payment solutions.

- Special features: 4 options

- 3x CB with fees

- 3x CB without fees

- 4x CB with fees

- 4x CB without fees

- Integration requirements / specificities:

- Mandatory information (cf. Input parameters):

- Delivery data

- Invoicing data

- Order data

- Optional information

Parameter Description Example GENERIC_BL Payment modality choice made by your customer CommercialOperationCode=XYZ

- Mandatory information (cf. Input parameters):

- Authorisation and payment: 3-step payment (waiting+authorisation+debit)

- www.oney-ecommerce.com

- Only in France

2.10 Lyf Pay

Fivory (by Crédit Mutuel) offers a mobile wallet payment method.

- Fivory app is available for iOS, Android and Windows Phone

- Mobile payment with QR code scan

- Authorisation and payment: 1-step payment (Debit)

- www.fivory.com

- Only in France

- Integration requirements / specificities:

- Mandatory information: email address, through "EMAIL" parameter

2.11 Illicado

Illicado (by Illicado) offers a prepaid payment method.

- Clients can add several "Illicado" gift cards on the payment page and pay the remaining amount with their credit card

- Authorisation and payment: 1-step payment (Debit)

- www.illicado.com

- According to the European Anti-Money-Laundering Directive (ALM5), the maximum allowed amount for open loop gift card transactions is 50€.

- No action from your side is required to ensure you comply to this rule.

- The following message is displayed on the payment page after your customers select this payment method: “Because of regulatory reasons, the charge of your giftcard is limited to 50 EUR per purchase, please use your bank card to cover the remaining amount for your purchase”. They will have to choose on the payment page an amount of up to 50€ to pay by gift card.

- As usual, your customers will then pay any remaining amount not covered by the gift card with their credit card as before.

2.12 in3

in3 is an online post-payment method, allowing your Dutch customers to pay in 3 instalments. It is a convenient solution for both your customers and you: in3 does not require your customers to pay an extra cost or to register with the Bureau Krediet Registratie (BKR). Once in3 receives the first instalment, they guarantee the settlement of the full amount.

Integration requirements / specificities

- Authorization and payment: 1-step

- Chargeback: No (Guaranteed payment)

- Capture: Allows full and partial

- Refund: Allows full, partial and multiple

- Multiple line items are possible

- Mandatory parameters:

Parameter Description / Possible values EMAIL Your customer’s email address OWNERTELNO Your customer’s phone number CIVILITY Style (form of address) ECOM_BILLTO_POSTAL_NAME_FIRST Billing details: First name ECOM_BILLTO_POSTAL_NAME_LAST Billing details: Postal street address

Optional: add house number at the end of this parameterECOM_BILLTO_POSTAL_STREET_NUMBER Billing details: street number

Required only if you have not included the house number in ECOM_BILLTO_POSTAL_STREET_LINE1 (DO NOT INCLUDE HOUSE NUMBER IN BOTH FIELDS)ECOM_BILLTO_POSTAL_CITY Billing details: City ECOM_BILLTO_POSTAL_COUNTRYCODE Billing details: country code (e.g. NL) ECOM_BILLTO_POSTAL_POSTALCODE Billing details: Postal code ITEMIDX Order details: Define your customer’s order by sending the following ITEM parameters.

Replace “X” with a number to group them to one order (i.e. ITEMID1, ITEMNAME1 etc.)

ITEMNAMEX ITEMPRICEX ITEMQUANTX ITEMCATEGORYX Define the order sending one of these values (see all possible values in our dedicated chapter) - Optional parameters (send only if different from the billing address. If you only send ECOM_BILLTO_XXX parameters, we assume that both billing/shipping address is identical)

Parameter Description / Possible values ECOM_SHIPTO_POSTAL_NAME_FIRST Shipping details: First name ECOM_SHIPTO_POSTAL_NAME_LAST Shipping details: Last name ECOM_SHIPTO_POSTAL_STREET_LINE1 Shipping details: Postal street address

Optional: add house number at the end of this parameterECOM_SHIPTO_POSTAL_STREET_NUMBER Required only if you have not included the house number in ECOM_BILLTO_POSTAL_STREET_LINE1 (DO NOT INCLUDE HOUSE NUMBER IN BOTH FIELDS) ECOM_SHIPTO_POSTAL_CITY Shipping details: City ECOM_SHIPTO_POSTAL_COUNTRYCODE Shipping details: country code (e.g. NL) ECOM_SHIPTO_POSTAL_POSTALCODE Shipping details: Postal code ECOM_SHIPTO_DOB Date of birth

Find detailed information (short description, format, maximum length and so on) for each parameter in our Parameter Cookbook.

Please check our dedicated chapter on input parameters for detailed instructions.

2.13 LMT Giftcard

Thunes Giftcard is a link to Thunes for a customised giftcard provided and supported by Thunes.

- The merchant should ideally present the payment methods on his checkout page before redirecting to the Worldline platform. Otherwise only the generic Thunes logo will be shown. Customers can add several customised gift cards on the payment page and pay the remaining amount with credit card

- Integration requirements / specificities: Multi-currency & multilingual

- Authorisation and payment: 1-step payment (Debit)

- Worldwide

2.14 Monizze

Monizze is an issuer for meal / eco vouchers and prepaid gift cards in Belgium. Belgian employees receive funds on a regular base that can be used to pay for certain services and goods. The Belgian government defines the scope of these services / goods. Your acquiring contract with Monizze defines which of these vouchers / cards you may offer as a payment method.

Your customers need an Monizze account to make online payments. Once they have selected this payment method, they need to login to their Monizze account. For each transaction, they can choose the type of available voucher and how much of their funds they want to use for the payment. If they pay only a part of the full transaction amount, your customers can complete the payment by credit card (Visa, MasterCard) or Bancontact in the Monizze portal.

Integration requirements / specificities

- Chargeback: No (Guaranteed payment)

- Capture: Allows full, partial and multiple

- Cancellation: Allows full, partial and multiple cancellation of requested payments thanks to settlement timing

- Settlement: Takes place two days after transaction completion

- Refunds: Yes

- Only one product type (ITEMCATEGORY) and one line item per order allowed

- Mandatory parameters

Parameter Description / Possible values EMAIL Your customer’s email address ITEMIDX Order details: Define your customer’s order by sending the following ITEM parameters.

Replace “X” with a number to group them to one order (i.e. ITEMID1, ITEMNAME1 etc.)

ITEMNAMEX ITEMPRICEX ITEMQUANTX ITEMCATEGORY Define the order sending one of these values:

- FOODANDDRINK = meal vouchers

- HOMEANDGARDEN = eco vouchers

- GIFTANDFLOWERS = gift cards

Find detailed information (short description, format, maximum length and so on) for each parameter in our Parameter Cookbook.

Please check our dedicated chapter on input parameters for detailed instructions.

2.15 Multibanco

Multibanco is a payment method available in Portugal only for physical payments as a post-pay voucher.

On the payment page the customer is informed of the entity, the reference, the amount and the period (start and end date) during which the client can pay. From this moment on the order stays in pending status 51 until the customer finalises the payment at an ATM of Multibanco network with either credit card or cash. The transaction will then reach either status 2, 5 or 9 (see this chapter for more details).

Integration requirements / specificities

- The exact amount needs to be entered in order to process the payment.

- No refunds are possible

- Multibanco reference is valid for a defined period. Start and end dates of validity are set up by default

- If the validity period for the payment has not started yet or has expired, the payment will be denied. This validity period can only start the day after the order on the website

- Mandatory parameters : EMAIL (see input parameters)

- Available country: Portugal

2.16 OneyBrandedGiftCard

OneyBrandedGiftCard is a gift card offered by the French acquirer Oney.

When your customers choose this payment method, they are redirected to the Thunes payment portal. There they need to enter the card number and the password (cryptogram) that appear on their card.

Oney offers various options to split a single purchase on several Oney or credit cards. Your customers can:

- Choose the amount to be paid with their Oney card

- Pay the remaining amount with their credit card or a different Oney card. They can use up to three different Oney / credit cards for single purchase. After a card has been used and there is still a remaining amount to be paid, we automatically redirect the customer to our Hosted Payment Page. There s/he can select either Oney or a credit card payment method to complete the transaction

Integration requirements / specificities

- Authorisation and payment: 1-step payment (Debit)

- Multiple, partial or full refund

- You profit from protection against fraud and unpaid goods/services

- You can customise Thunes’s payment page with your own logo and colour

- Mandatory parameters are

Please check our dedicated chapter on input parameters for detailed instructions.

2.17 Pacifica

Pacifica (by Pacifica) is a prepaid payment method.

- Clients can add several "Pacifica" gift cards on the payment page and pay the remaining amount with their credit card

- Authorisation and payment: 1-step payment (Debit)

- carte.pacifica-e-reequipement.fr

- In France and Belgium

2.18 Sodexo

Sodexo is an issuer for meal / eco and gift vouchers in Belgium. Belgian employees receive funds on a regular base that can be used to pay for certain services and goods. The Belgian government defines the scope of these services / goods. Your acquiring contract with Sodexo defines which of these vouchers / cards you may offer as a payment method.

Your customers need a Sodexo card and a phone number registered at Sodexo to make online payments. Once they have selected this payment method, they need to login to their Sodexo account using their Sodexo card credentials (card number / expiration date). For each transaction, they can choose the type of available voucher and how much of their funds they want to use for the payment. Your customers confirm the payment by a validation code received on their mobile phone. If they pay only a part of the full transaction amount, your customers can complete the payment by credit card (Visa, MasterCard) or Bancontact in the Sodexo portal.

Integration requirements / specificities

- Chargeback: No (Guaranteed payment)

- Capture: Allows full, partial and multiple

- Refund: No

- Cancellation: Allows full cancellation of requested payments thanks to settlement timing

- Settlement: Takes place on the last day of the month for transactions processed in this period

- Sodexo manages balance and authentication. Wordline manages authorization and capture

- Minimum transaction amount: 1€

- Only one product type (ITEMCATEGORY) and one line item per order allowed

- Mandatory parameters

Parameter Description / Possible values EMAIL Your customer’s email address ITEMIDX Order details: Define your customer’s order by sending the following ITEM parameters.

Replace “X” with a number to group them to one order (i.e. ITEMID1, ITEMNAME1 etc.)

ITEMNAMEX ITEMPRICEX ITEMQUANTX ITEMCATEGORY Define the order sending one of these values:

- FOODANDDRINK = meal vouchers

- HOMEANDGARDEN = eco vouchers

- GIFTANDFLOWERS = gift cards

Find detailed information (short description, format, maximum length and so on) for each parameter in our Parameter Cookbook.

Please check our dedicated chapter on input parameters for detailed instructions.

2.19 Sofinco

3xCB and 4xCB, known as Sofinco (by Crédit Agricole Consumer Finance) is a solution of payment by installment using the client credit card.

- Authorization and payment: 1-step (debit) and 2-steps payments (authorization+debit)

- Multiple, partial or full refund

- https://www.ca-consumerfinance.com

- In France

- Special features: 4 options

- 3x CB with fees

- 3x CB without fees

- 4x CB with fees

- 4x CB without fees

2.20 Spirit of Cadeau

Spirit of Cadeau (by CCDS) offers a prepaid payment method.

- Clients can add several "Spirit of Cadeau" gift cards on the payment page and pay the remaining amount with their credit card

- Authorisation and payment: 1-step payment (Debit)

- www.spiritofcadeau.com

- Only in France and Belgium

- According to the European Anti-Money-Laundering Directive (ALM5), the maximum allowed amount for open loop gift card transactions is 50€.

- No action from your side is required to ensure you comply to this rule.

- The following message is displayed on the payment page after your customers select this payment method: “Because of regulatory reasons, the charge of your giftcard is limited to 50 EUR per purchase, please use your bank card to cover the remaining amount for your purchase”. They will have to choose on the payment page an amount of up to 50€ to pay by gift card.

- As usual, your customers will then pay any remaining amount not covered by the gift card with their credit card as before.

2.21 TWINT

TWINT is a flexible mobile payment solution that allows consumers to load credit on an electronic wallet from any account and to use it with their Smartphone in stores or online.

- TWINT app is available for iOS and Android

- Online mobile payment with QR code scan/numeric code, in store checkout with a beacon

- Prepaid solution. Top up with postal / bank account, register via LSV, use an inpayment slip via e-banking or load credit via a Postomat or a credit code

- Authorisation and payment: 1-step payment (Debit)

- www.twint.ch

- Integration requirements / specificities:

- Mandatory information: email address, through "EMAIL" parameter

2.22 WeChat Pay

WeChat Pay is a Chinese payment feature integrated into the WeChat app used by more than 650 million monthly users. It enables customers to quickly pay with their smartphones.

As a cross-border payment method, it supports any currency you offer. You will be paid out in the settlement currency you defined in your acquiring contract, but your customers will pay in CNY.

- Authorization and payment: 1-step (debit)

- Integration requirements / specifications

- Mandatory parameter EMAIL (see input parameters)

- Customers need to create a wallet on WeChat application

- Check out https://pay.wechat.com/ for more information

3. Integration with Gehostete Zahlungsseite

3.1 Payment method selection

Once you have activated at least one of the Thunes payment methods in your Worldline account, you can offer these payment methods to your customers in a selection on the payment page.

However, if you have chosen to offer the payment methods in a selection screen on your own site, allowing the customer to be redirected directly to the correct payment method, you need to make use of the PM and BRAND parameters.

The following table shows the values you can submit with the PM and/or BRAND parameter:

| Payment method | PM | BRAND |

|---|---|---|

| Alipay | ALIPAY | ALIPAY |

| Floa Pay 3x | floapay3x | floapay3x |

| Floa Pay 4x | floapay4x | floapay4x |

| Cado Carte | CADOCARTE | CADOCARTE |

| Cadhoc | CADHOC | CADHOC |

| Cetelem 3xcb | CETELEM3XCB | CETELEM3XCB |

| Cetelem 4xcb | CETELEM4XCB | CETELEM4XCB |

| Chèque-Vacances | ANCV | ANCV |

| Chèque-Vacances CONNECT | CVCONNECT | CVCONNECT |

| Cofidis 3XCB | COFIDIS3XCB | COFIDIS3XCB |

| Cofidis 4XCB | COFIDIS4XCB | COFIDIS4XCB |

| e-Chèque-Vacances | eANCV | eANCV |

| FacilyPay 3x | FACILYPAY3X | FACILYPAY3X |

| FacilyPay 3x sans frais | FACILYPAY3XNF | FACILYPAY3XNF |

| FacilyPay 4x | FACILYPAY4X | FACILYPAY4X |

| FacilyPay 4x sans frais | FACILYPAY4XNF | FACILYPAY4XNF |

| Fivory | FIVORY | FIVORY |

| Illicado | ILLICADO | ILLICADO |

| in3 | IN3 | IN3 |

| Le Pot Commun | LEPOTCOMMUN | LEPOTCOMMUN |

| LMT Giftcard | GIFTCARD | GIFTCARD |

| Monizze | MONIZZE | MONIZZE |

| Multibanco | Multibanco | Multibanco |

| OneyBrandedGiftCard | ONEYBRANDEDGIFTCARD | ONEYBRANDEDGIFTCARD |

| Pacifica | PACIFICA | PACIFICA |

| SEQR | SEQR | SEQR |

| SlimPay | SLIMPAY | SLIMPAY |

| Sodexo | SodexoBelgique | SodexoBelgique |

| Sofinco 3XCB | SOFINCO3XCB | SOFINCO3XCB |

| Sofinco 3XCB sans frais | SOFINCO3XCBSANSFRAIS | SOFINCO3XCBSANSFRAIS |

| Sofinco 4XCB | SOFINCO4XCB | SOFINCO4XCB |

| Sofinco 4XCB sans frais | SOFINCO4XCBSANSFRAIS | SOFINCO4XCBSANSFRAIS |

| Spirit of Cadeau | SPIRITOFCADEAU | SPIRITOFCADEAU |

| TWINT | TWINT | TWINT |

| YesByCash | YESBYCASH | YESBYCASH |

| WeChat Pay |

3.2 Input parameters

In addition to the default Gehostete Zahlungsseite parameters (cf. Gehostete Zahlungsseite), for each order you can or must send the parameters in the table below, depending on the selected payment method.

| Parameter | Description | Format (max ch.) | Example |

|---|---|---|---|

NOTE: Mandatory for all Thunes payment methods |

|||

| Customer's email address | AN (50) - Email address format | test@company.com | |

Invoicing data (mandatory for Floa Pay, Cetelem, Cofidis, FacilyPay/Oney, Slimpay and Sofinco and YesByCash)

| Parameter | Description | Format (max ch.) | Example |

|---|---|---|---|

| ECOM_BILLTO_POSTAL_ NAME_PREFIX |

Invoiced customer's prefix | AN (10) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, full stops | M |

| ECOM_BILLTO_COMPANY * | Invoiced customer's company | AN (50) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | My Company |

| ECOM_BILLTO_POSTAL_ NAME_LAST |

Invoiced customer's last name | AN (35) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | Jean |

| ECOM_BILLTO_POSTAL_ NAME_FIRST |

Invoiced customer's first name | AN (35) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | Dupont |

| ECOM_BILLTO_POSTAL_ STREET_NUMBER |

Invoiced customer's street number | AN (10) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes, full stops, commas | 14 |

| ECOM_BILLTO_POSTAL_ STREET_LINE1 |

Invoiced customer's street (line 1) | AN (35) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes, full stops, commas | Boulevard de Rochechouart |

| ECOM_BILLTO_POSTAL_ STREET_LINE2 |

Invoiced customer's street (line 2) | AN (35) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes, full stops, commas | Gate DEL |

|

ECOM_BILLTO_POSTAL_ |

Invoiced customer's postcode | AN (10) - [a-z A-Z 0-9] space, dash | 75008 |

| ECOM_BILLTO_POSTAL_ CITY |

Invoiced customer's town/city | AN (25) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | Paris |

| ECOM_BILLTO_POSTAL_ COUNTRYCODE |

Invoiced customer's country code | AN (2) - Codified according to ISO 3166-1 alpha-2 | FR |

| ECOM_BILLTO_TELECOM_ PHONE_NUMBER |

Invoiced customer's phone number | AN (20) - "+" followed by the international dialing code, then the required digits with no spaces | +33175757574 |

| ECOM_BILLTO_TELECOM_ MOBILE_NUMBER |

Invoiced customer's mobile phone number | AN (20) - "+" followed by the international dialing code, then the required digits with no spaces | +33696213222 |

Delivery data (mandatory only for Cetelem and FacilyPay/Oney)

| Parameter | Description | Format (max ch.) | Example |

|---|---|---|---|

| ECOM_SHIPTO_COMPANY | Customer's delivery company | AN (50) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | My Company |

| ECOM_SHIPTO_POSTAL_ NAME_PREFIX |

Customer's delivery delivery | AN (10) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, full stops | M |

| ECOM_SHIPTO_POSTAL_ NAME_FIRST |

Customer's delivery first name | AN (35) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | Ernest |

| ECOM_SHIPTO_POSTAL_ NAME_LAST |

Customer's delivery last name | AN (35) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | Hemingway |

| ECOM_SHIPTO_POSTAL_ STREET_NUMBER |

Customer's delivery street number | AN (10) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes, full stops, commas | 13 |

| ECOM_SHIPTO_POSTAL_ STREET_LINE1 |

Customer's delivery street (line 1) | AN (35) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes, full stops, commas | Boulevard de Rochechouart |

| ECOM_SHIPTO_POSTAL_ STREET_LINE2 |

Customer's delivery street (line 2) | AN (35) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes, full stops, commas | Gate Ship |

| ECOM_SHIPTO_POSTAL_ POSTALCODE |

Customer's delivery postcode | AN (10) - [a-z A-Z 0-9] space, dash | 75009 |

| ECOM_SHIPTO_POSTAL_ CITY |

Customer's delivery town/city | AN (25) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | Paris |

| ECOM_SHIPTO_POSTAL_ COUNTRYCODE |

Customer's delivery country code | AN (2) - Codified according to ISO 3166-1 alpha-2 | FR |

| ECOM_SHIPTO_TELECOM_ PHONE_NUMBER |

Customer's delivery phone number | AN (20ch, no spaces) - "+" followed by the international dialing code, then the required digits with no spaces | +33175757575 |

| ECOM_SHIPTO_TELECOM_ MOBILE_NUMBER |

Customer's delivery mobile phone number | AN (20ch, no spaces) - "+" followed by the international dialing code, then the required digits with no spaces | +33696213221 |

| ECOM_SHIPMETHOD |

Customer's delivery method:

|

AN | Carrier |

| ECOM_ SHIPMETHODDETAILS |

Identification of collection point | Free text (50) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes | COLISSIMO |

| ECOM_ ESTIMATEDDELIVERYDATE |

The estimated date of the delivery | yyy-MM-dd - UTC format, as defined in ISO 8601. The short format, without the T suffix, is an acceptable Request format. In this case, the Thunes server will assume midnight. However, the Response will always include the T suffix. | 2013-06-11T16:32:11Z |

| ECOM_SHIPMETHODSPEED | The number of hours required for the delivery | Integer value [0-9] | 15 |

Order data (mandatory for FacilyPay/Oney and SEQR)

| Parameter | Description | Format (max ch.) | Example |

|---|---|---|---|

| ITEMIDX | Item Identifier | AN (15) - [a-z A-Z 0-9] dash, underscore, slash | HGY78765 |

| ITEMNAMEX | Item Name | AN (40) - Upper and lower case ISO-8859-1 chars, incl. accented letters, spaces, slashes, dashes, apostrophes, full stops, commas | TinyBit |

| ITEMPRICEX | Item Price | N - Maximum of 8 digits before the decimal point, 2 after | 0.25 |

| ITEMVATCODEX | Item VAT Code | percentage | 25% |

| ITEMQUANTX | Item Quantity | N (4) [0-9] whole positive number** | 1 |

| ITEMCATEGORYX |

Item Category:

|

AN (50) | Appliances |

| TAXINCLUDEDX |

> This feature is strongly recommended as it avoids any issues when rounding off the order line totals. |

0 / 1 | 1 |

Optional Data

| Parameter | Description | Format (max ch.) | Example |

|---|---|---|---|

| AMOUNTTVA | VAT Amount | N (15) - Amount x100; No decimals | 5 |

| REF_CUSTOMERID | Customer number | AN (20) - [a-z A-Z 0-9] dash, underscore, slash | 111222333 |

** Sending the line item details with a “0” will lead to refused orders.

4. Transaction processing

4.1 Authorisation and payment

Note for FacilyPay, Multibanco and YesByCash: The authorisation may take a few days. Until the final status is known, the transaction remains in the uncertain status 51. After that, depending on the outcome, the status will automatically be updated to 5 (Authorised) or 2 (Refused). If, however, you've chosen Direct sale as default operation code, a capture will follow after the status has changed from 51 to 5.

4.2 Transaction maintenance

You can perform partial and full refunds on Thunes transactions.

Maintenance operations, such as refunds, can be performed directly in your Worldline account, via a DirectLink request and through a Batch file upload.

| Thunes asks that merchants proactively use cancellation instead of expiration of authorisation, because for some payment methods the authorised amount is in fact taken from the card and then refunded at cancellation/expiration. |

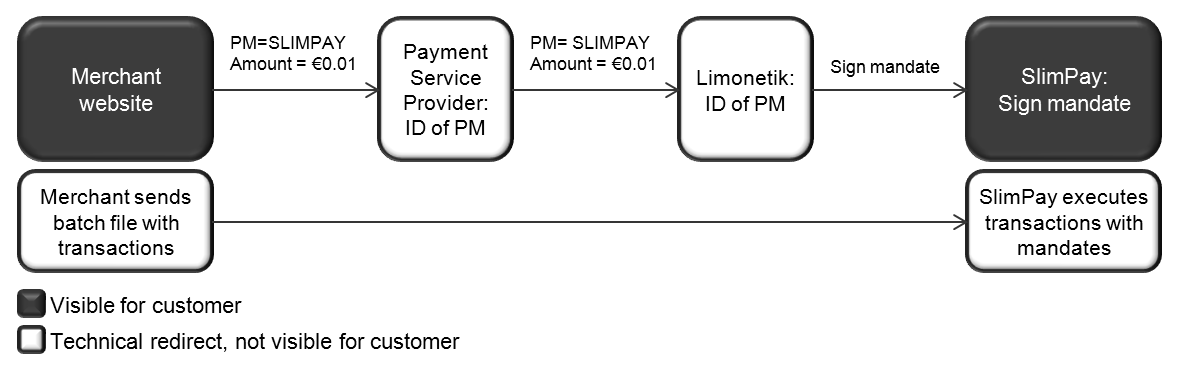

4.3 Slimpay processing

4.3.1 Sign mandate

In order to let a customer sign a mandate and to process the signature, a dummy transaction has to be executed with an amount of €0.01. This amount will not be debited from the customer’s account nor will it be credited to your merchant account. This amount has to be transferred from your merchant account to Worldline and will also be used as placeholder to Thunes.

In order to hide this amount for the customer on the payment selection page of Worldline, you need to perform a direct call to the payment method.

In practical terms, this means that the PM and BRAND values for SlimPay need to be sent along with the other data to the Worldline platform (see Payment method selection). This allows the platform to redirect the customer directly to SlimPay without showing the amount of €0.01 amount.

PM = Payment Method

Payment Service Provider = Worldline

4.3.2 Recurring transactions

Currently it is not yet possible to sign the mandate via our Worldline platform. The mandate has to be signed directly via the SlimPay back office.

Recurring transactions with the mandate have to be processed directly via SlimPay:

- by sending a batch file to SlimPay

- manually in the SlimPay back office

For more information on this procedure, please contact SlimPay directly (www.slimpay.net).

Häufig gestellte Fragen

Wie lange die Aktivierung einer Zahlungsmethode dauert, hängt von den folgenden Faktoren ab:

- In der Regel dauert es etwa eine Woche, bis der Acquirer bzw. die Bank Ihren Vertrag bearbeitet hat. Wenn Sie bereits einen Vertrag haben, dauert die Aktivierung ein paar Tage.

- Bei bestimmten Zahlungsmethoden sind zusätzliche Kontrollen erforderlich, bevor sie aktiviert werden können, z. B. im Fall von 3-D Secure, das direkt bei VISA oder MasterCard (und nicht beim Acquirer) beantragt wird.

Mit Worldline Collect können Sie mehrere Zahlungsmethoden in einem Schritt aktivieren.

Ein Akzeptanzpartner ist ein Finanzinstitut, das Zahlungen mit bestimmten Kredit- und Debitkarten verarbeitet. Der Akzeptanzpartner ist für den finanziellen Teil der Transaktionsabwicklung verantwortlich, Worldline ePayments für den technischen Teil. Mit anderen Worten: Ohne einen Akzeptanzpartner wird das Geld nicht auf Ihr Bankkonto überwiesen.

Für jede Online-Zahlungsmethode, die Sie hinzufügen möchten, brauchen Sie einen Akzeptanzvertrag mit einem Akzeptanzpartner. Falls Sie sich darüber beraten lassen möchten, welcher Akzeptanzpartner für Sie und Ihre Region am besten geeignet ist, wenden Sie sich an uns. Wenn Sie wissen, mit welchem Akzeptanzpartner Sie arbeiten möchten, können Sie ihn einfach aus der Dropdown-Liste auswählen, wenn Sie eine Zahlungsmethode in Ihrem Konto hinzufügen.

Aber warum lassen Sie uns das nicht für Sie erledigen? Mit Full Service können Sie zahlreiche inländische Zahlungsmethoden auf einmal und in mehreren Ländern mit einem einzigen Vertrag aktivieren. Wenn Sie international handeln, ist dies eine ideale Möglichkeit, um Zahlungen aus ganz Europa anzunehmen. Dies erspart Ihnen zeitraubende Verwaltungsarbeit, und da Sie mehr Zahlungsmethoden anbieten können, können Sie auch Ihren Umsatz steigern.

Hier erfahren Sie mehr über Full Service. Für Informationen über Verträge wenden Sie sich bitte an uns.