Paylib

1. Introduction

Paylib is a French e-wallet that contains cards supported by Carte Bancaire in France.

A customer can pay with Paylib in two ways:

- via the Paylib mobile app

- via an SMS code

As no card details are required, the customer does not need to have his card at hand or have to pass sensitive card details.

Paylib is supported by the following acquiring banks in France:

- BNP Paribas

- Société Générale

- La Banque Postale

Paylib via Worldline must be used with our Pagina di pagamento ospitata hosted payment page solution. Only minimal integration is required.

2. Activation and configuration

In order to add Paylib, you need to have at least one credit or debit card (supported by Carte Bancaire in France) activated in your Worldline account. The acquirer of this card needs to be one of the acquirers supported by Paylib at Worldline.

Once you've added the payment method accordingly, you can request the enrollment of the payment method. The enrollment request will be sent to nostro Assistenza clienti team, which will complete the rest of the activation.

In our test environment the activation process is similar, with the exception that a sandbox environment of Paylib is used and there's no acquirer connection.

3. Integration with Pagina di pagamento ospitata

If you let your customers choose their preferred payment method directly on our e-commerce hosted payment page (as opposed to a selection page of your own), no further integration is required; the payment method (once activated) will be visible on the payment page.

In the event you've created a payment method selection page of your own, by which your customers are redirected from your page directly to the payment page with the payment method preselected, you're making use of the PM and BRAND parameters.

To call the Paylib payment page directly, the following PM and BRAND values must be used:

| Parameter | Value |

|---|---|

| PM | Paylib |

| BRAND | Paylib |

The same values are returned in the redirection and post-sale feedback.

4. Testing

Once you've activated Paylib in your test account, you can perform tests between the Worldline and the Paylib platform.

Testing Paylib however is focussed mainly on testing the various possibilities on the Paylib platform. As there's no connection with any acquirer, it's not possible to make any authorisations or captures; A transaction will always be refused.

Below are all the tests that are possible with Paylib, using login en password:

| Login | Password | Description |

|---|---|---|

| sb.visa.ok@paylib.fr | P@ssword1! | Successful authentication and VISA card details available. |

| sb.mc.ok@paylib.fr | P@ssword1! | Successful authentication and MasterCard card details available. |

| sb.multi.ok@paylib.fr | P@ssword1! | Successful authentication and choice of cards: 1 VISA and 1 MasterCard. |

| sb.multi.ok.sms@paylib.fr | P@ssword1! | Successful authentication and choice of cards: 1 VISA and 1 MasterCard. Hard authentication required: OTP SMS (One-Time password). SMS not available in TEST, ‘123456’ to be used. |

| sb.ko@paylib.fr | P@ssword1! | Refused authentication. |

| sb.multi.ok.nocard@paylib.fr | P@ssword1! | Successful authentication and no cards available. |

| sb.multi.ok.te@paylib.fr | P@ssword1! | Successful authentication and choice of cards: 1 VISA and 1 MasterCard, but will result in a technical error. |

| sb.multi.ok.badtoken@paylib.fr | P@ssword1! | Successful authentication, but invalid token when getting card details. |

5. Reporting

5.1 Online

As Paylib only acts as a container for the actual cards, at the beginning of a transaction the payment method will be “Paylib” but later change to "Visa", "Mastercard", etc., once the card data is collected. Nevertheless, a "Wallet" field is also available and will contain the “Paylib” value.

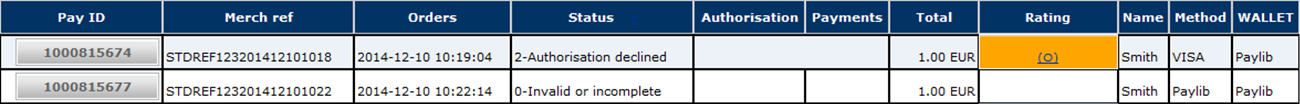

Via "View transactions" in your Worldline account, your Paylib transactions would look like this (click image to enlarge):

Note that the transaction in status 0, in which case no card details have been collected, still shows "Paylib" as the payment method, whereas for the declined transaction a Visa card was used. For both transactions the Wallet column shows "Paylib".

5.2 Download

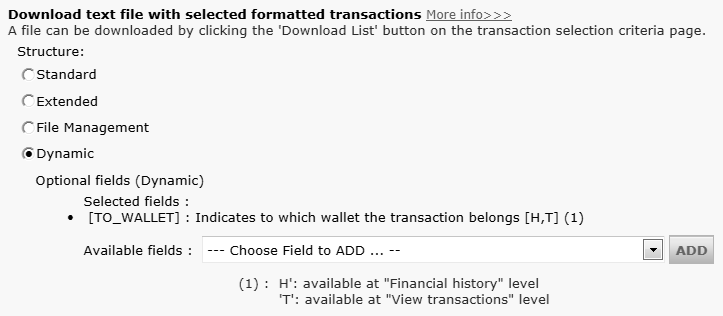

In the files that you download via "View transactions" and/or "Financial history", the "METHOD" and "BRAND" columns show the values of the payment method that the customer used. In case of Paylib, these values will be no different than those of normal credit card transactions.

Therefore, in order to distinguish which credit card transactions were actually initiated with Paylib, you can add an extra field/column to your reports: "TO_WALLET". To have this field added, go to "Operations" > "Electronic reporting" and under the "Dynamic" structure" add the "[TO_WALLET]" field to the "Optional fields":

6. Transaction maintenance

Paylib is only applied as such in the beginning of a transaction. Once the card details have been processed, the payment method changes to the card brand used (e.g. Visa or MasterCard). As from that point, Paylib will only be used as the wallet indicator.

Consequently, all usual maintenance operations for credit cards also apply here.

Domande frequenti

- L’affiliazione richiede all'acquirente o alla banca una settimana circa. Ovviamente, se l'affiliazione è già attiva, l'attivazione richiede solo qualche giorno.

- Alcuni metodi di pagamento richiedono controlli aggiuntivi prima di poter essere attivati, ad esempio in caso di 3-D Secure, richiesto direttamente a VISA o MasterCard (e non all'acquirente)

Un acquirente è un'istituzione finanziaria che elabora i pagamenti effettuati con determinate carte di credito e debito. L'acquirente è responsabile della parte finanziaria dell'elaborazione della transazione, mentre Worldline è responsabile di quella tecnica. In altre parole, senza acquirente il denaro non viene trasferito al conto bancario.

Per ogni metodo di pagamento che si desidera aggiungere, occorre un contratto di accettazione con un acquirente. Per chiedere informazioni sugli acquirenti più adatti per la propria attività e la propria zona, ci contatti per favore. Se si conoscono gli acquirenti con cui si desidera lavorare, basta semplicemente selezionarli dall'elenco a discesa quando si aggiunge un metodo di pagamento all'account.

Possiamo occuparcene noi? Full Service consente di attivare molti metodi di pagamento locali contemporaneamente e in diversi paesi, con un solo contratto. Se si eseguono transazioni internazionali, può essere il modo ideale per accettare pagamenti da tutta Europa. Consente di evitare lunghe pratiche amministrative e di aumentare anche i ricavi, grazie all'offerta di più metodi di pagamento.

Scopri di più su Ingenico Full Service qui e contattandoci.