e-supply advanced

The Advanced e-Supply Integration Guide provides other possible modes for submitting purchasing card transactions (Batch, DirectLink and e-Commerce). This document complements the Basic e-Supply User Guide. Please refer to the individual submission mode technical integration guides for general information.

While as the Basic e-Supply User Guide provides information about the basic e-Supply features on configuring your account and a step-by-step guide on submitting transactions manually in the Back Office.

1. Overview

The purchasing card transaction submission modes described in this documentation are:- Batch: submission of text files containing one or more transactions (manual or automatic).

- DirectLink: a server-to-server request per transaction.

- e-Commerce: submission mode where the card details are entered online by the customer on our secure server.

| New Order |

Maintenance |

|||

|---|---|---|---|---|

| Authorization | Direct Sale | Refund (credit note) | Data Capture | |

| Back Office (manual) | Level I & III | Level III | Level III | Level III |

| Batch (manual & automatic) | Level I & III |

Level III |

Level III |

Level III |

| DirectLink | Level I |

Level III |

Level III |

Level III |

| e-Commerce | Level I |

- | - |

- |

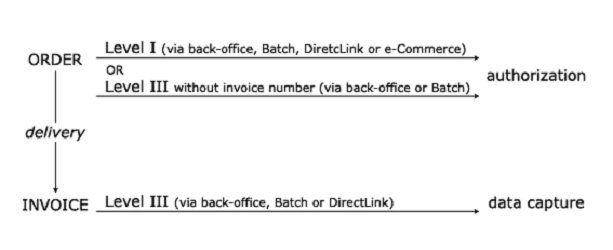

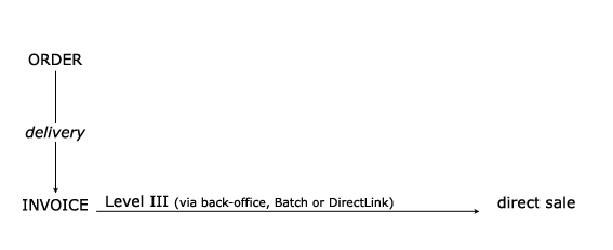

If you decide to work in two steps, your transaction flow will be as follows:

2. Submission Mode Batch

You can also use Batch mode to send maintenance requests. Data captures and refunds (credit notes) need to be sent with level III information.

| New Order | Maintenance | ||

|---|---|---|---|

| Authorisation | Direct Sale |

Refund (credit note) |

Data Capture |

| Level I | Level III |

Level III |

Level III |

Please refer to the Advanced Batch manual for information on headers, footers, etc.

2.1 General rules

The structure and format of e-Supply payment files should comply with a few basic rules:- File: The file should be an ASCII text file.

- Order: There are several lines per invoice/order (except for transactions without Line Item Details). The lines need to be separated by the Carriage Return and Line Feed characters (ASCII : 13 10 – HEX : 0xD 0xA).

- Line: Each line must contain relevant fields (corresponding to the TYPE record) separated by a semicolon (“;”)

- Fields: The fields themselves cannot contain any semicolon (“;”)

- File structure: The file can include several invoices/orders. Each invoice/order contains several records:

- INV: Invoice/Order Header record (1 INV record per invoice/order)

- INV: Invoice/Order Header record (1 INV record per invoice/order)

- CLI: Customer details record (Optional, 0 or 1 CLI record per invoice/order)

- DET: Invoice/Order Line Item details records (1 to x DET records per invoice/order)

Example:

Header

INV ;….. ;

DET;…..;

DET;…..;

DET;…..;

INV ;….. ;

CLI;……;

DET;…..;

INV ;….. ;

DET;…..;

DET;…..;

……

Footer

2.2 File fields

2.2.1 General layout

The following table illustrates all possible fields for a standard purchasing card batch file. Of course, these fields should not be used all together.

Please use this table as a reference for field details. In the following sections we will list the required fields per operation.

INV Record

| Field (# / content) | Source | Format / Max Length / Example |

|---|---|---|

| 1 / Identifier of the INV record type or amount including tax (* 100 to avoid decimals) | - |

INV or N 3 or 12 INV |

| 2 / Currency Unit (alphabetic ISO code) | Supplier |

A 3 EUR |

| 3 / Card type/brand | Client |

AN 25 VISA PC |

| 4 / Card number | Client |

N 20 (Amex: 15) 374291019071995 |

| 5 / Card expiry date |

Client

|

MMYY 4 0915 |

| 6 / Invoice number / credit note number |

Supplier

|

AN 15 (Amex: 12) 2009-0000568 |

| 7 / Client reference 1. Can be client order reference or other data |

Client

|

AN 20 YUJ7885 |

| 8 / Cardholder name |

Client

|

AN 35 (Amex: 20) John Doe |

| 9 / Worldline identifier/ref (PAYID) for the authorisation/settlement, stored by the supplier |

Worldline |

N 12 12759645 |

| 10 / Operation Code Possible values for new orders: RES: request for authorisation SAL: request for direct sale (payment) RFD: refund (credit note) Possible values for maintenance: SAL: partial data capture (payment), leaving the transaction open for a possible further data capture SAS: (last) partial or full data capture (payment), closing the transaction for further data captures |

Supplier |

AN 3 SAL |

| 11 / Authorisation code, not received via our system | Supplier |

AN 15 759642 |

| 12 / Authorisation mode: the way in which the authorisation code in field 11 was received | Supplier |

AN 3 TEL (Telephone) |

| 13 / Authorisation date/time: the date/time when the authorisation code in field 11 was received | Supplier |

MM/DD/YY hh:mm:ss 17 12/26/09 14:02:56 |

| 14 / PSPID of the Worldline Supplier (login name) | Supplier |

AN 30 TESTCPC |

| 15 / Supplier order identifier/ref for the authorisation/settlement, stored by the supplier | Supplier |

AN 15 AB4568TR |

| 16 / Number of DET records in the file for this transaction | Supplier |

N 4 2 |

| 17 / Cardholder Alias (if configured in the Worldline account) | Supplier |

AN 15 BennyB |

| 18 / Client ID: identifier of the client company, as defined in the Worldline> account | Supplier |

AN 20 PEUGEOT |

| 19 / Original invoice number corresponding to the credit note | Supplier |

AN 15 (Amex: 12) 17358948 |

| 20 / Blank field | ... | ... |

| 21 / Client reference 2. Can be cardholder order reference or other data | Client |

AN 16 Order 06/09/11 |

| Blank fields | ... | ... |

| 27 / CVC/CVV2: Card Verification Code. Usually not used or inexistent for purchasing cards. | Client |

N 4 123 |

| 28 / Order/Invoice date to appear in bank files. Current date by default | Supplier |

MM/DD/YY 8 06/23/15 |

| 29 / Order Number corresponding to the invoice | Supplier |

AN 15 4358 |

| 30 / Invoice Level Discount rate Do not use % This discount rate will be stated in the item name in the order details. The invoice level discount rate will be added to the item level discount rate: “Item name (- (INVdiscount + DETdiscount) %)” We do not use this discount rate to calculate order amounts. The amounts you send us must already include the discount. |

Supplier |

N xx.xx 5 05.00 |

| 31 / Client reference 3. Can be customer number or other data. | Client |

AN (Amex: 12) 73TO45 |

| 32 / Total Invoice amount (VAT excl.). Calculated with sent line item details. (* 100 to avoid decimals). |

Supplier |

N 12 100000 |

| 33 / Total Invoice VAT amount. Calculated with sent line item details. (* 100 to avoid decimals). | Supplier |

N 12 21000 |

| 34 / Total Invoice amount (VAT incl.) Calculated with sent line item details. (* 100 to avoid decimals) |

Supplier |

N 12 121000 |

The CLI record is optional, as the client configuration is stored in the <%COMPANY%> Back Office. If you do want to enter address fields in the CLI record, the whole address should be completed for it to be taken into account (name, first name, street, postcode, city, country).

CLI Record

| Field (# / content) | Source | Format / Max. length / Example |

|---|---|---|

| 1 / Identifier of the CLI (Client) record type. | - |

CLI 3 CLI |

| 2 / Cost Centre with which the order is associated | Client |

AN 20 Y567K8 |

| 3 / VAT Number of the Client company (without separators) | Client |

AN 20 123456789 |

| 4 / Delivery name | Client |

AN 35 Doe |

| 5 / Delivery first name | Client |

AN 35 John |

| 6 / Delivery address line1 | Client |

AN 35 1st Avenue 1 |

| 7 / Delivery address line2 | Client |

AN 35 Building 123 |

| 8 / Delivery postcode | Client |

AN 10 1000 |

| 9 / Delivery town | Client |

AN 25 Brussels |

| 10 / Delivery country code (alphabetic ISO code) | Client |

A 2 BE |

| 11 / Billing name | Client |

AN 35 John |

| 12 / Billing first name | Client |

AN 35 Smith |

| 13 / Billing address line 1 | Client |

AN 35 1st Avenue 1 |

| 14 / Billing address line2 | Client |

AN 35 Building 123 |

| 15 / Billing postcode | Client |

AN 10 1000 |

| 16 / Billing town | Client |

AN 25 Brussels |

| 17 / Billing country code (alphabetic ISO code) | Client |

A 2 BE |

| 18 / Cardholder e-mail address | Client |

AN 50 name@youremail.com |

| 19 / Phone Number | Client |

AN 20 +32 1 23 45 56 89 |

| 20 / Fax Number | Client |

AN 20 +32 1 23 45 56 89 |

DET Record

| Field (# / content) | Source | Format / Max. length / Example |

|---|---|---|

| 1 / Identifier of the DET (details) record type | - |

DET 3 DET |

| 2 / Quantity Max. 2 decimals supported |

Order |

N 12 52 |

| 3 / Item ID/Code | Order |

AN 15 U419-52 |

| 4 / Item description/name Sent to the bank and available on the client’s statements |

Order |

AN 40 HP710C Cartridge |

| 5 / Item unit price 4 decimals supported, but * 100 to use cents, which gives max. 2 decimals |

Order |

N 12 5355 |

| 6 / VAT flag: 0 (VAT not included in Unit Price) or 1 (VAT included) |

Order |

N 1 0 |

| 7 / VAT rate or internal VAT code (0, 1, 2, etc. see VAT configuration in <%COMPANY%> account) | Order |

N 6 19.6% |

| 8 / Line item reference 1 Can be a unit of measure or other data (Although American Express accepts a field length of 12, <%COMPANY%> only allows 10) |

Client |

AN 10 Piece |

| 9 / Line item reference 2 Can be commodity code or other data |

Client |

AN 12 (Amex: 8) TY1627 |

| 10 / Item internal description Not sent to bank or client, just available in the back-office. |

Supplier |

AN 255 Black HP catridge |

| Blank fields | ... | ... |

| 13 / Item Discount Rate Do not use % This discount rate will be stated in the item name in the order details. The item level discount rate will be added to the invoice level discount rate: “Item name (- (DETdiscount + INVdiscount) %)” We do not use this discount rate to calculate order amounts. The amounts you send us must already include the discount. |

Supplier |

N 5 02.00 |

| 14 / Total Line amount (excl. VAT) (* 100 to avoid decimals). |

Supplier |

N 12 15000 |

2.3 Required fields for new transactions_orders

The following section lists the minimum fields we recommend you to use. Your client and/or acquirer may also possibly request you to provide other specific fields of the layout in addition to the ones listed here, e.g. Client references, line item references.2.3.1 Authorisation

Level I Authorisation

| Authorisation (Level I, RES) |

|---|

| INV |

| (1) Amount tax included |

| (2) Currency |

| (4) Card number |

| (5) Card expiry date |

| (10) Operation code |

| (14) PSPID |

| (18) Client ID |

| (29) Order number |

Example:

Level I authorisationLevel III Authorisation (without invoice number)

The minimum fields we recommend you use for a level III authorisation are:| Authorisation (Level I, RES) | |

|---|---|

| INV | DET |

| (1) INV identifier | (1) DET identifier |

| (2) Currency | (2) Quantity |

| (4) Card number | (3) Item ID/code |

| (5) Card expiry date | (4) Item description/name |

| (10) Operation code | (5) Item unit price |

| (14) PSPID | (6) VAT flag |

| (16) number of DET records | (6)(7) VAT rate or internal VAT code |

| (18) Client ID | (14) Total line amount (excl. VAT) |

| (29) Order number | |

| (32) Total invoice amount (excl. VAT) | |

| (34) Total invoice amount (incl. VAT) INV 4-5 are optional if you use field 17 Cardholder Alias |

|

| (29) Order number | |

Example:

Level III authorisation without invoice numberINV;EUR;;374291019071995;0514;;;John Doe;;RES;;;;GFR5oes;;2;;FORD;;;;;;;;;;06/30/08;OH74988;;;21000;4410;25410;

DET;10;5634;Scissors;200;0;21%;;;;;;;2000

DET;10;5635;HP720c printer cartridge;1900;0;21%;;;;;;;19000

2.3.2 Direct sale Level III

The minimum fields we recommend you to use for a level III direct sale are:| Direct sale (Level III, SAL) | |

|---|---|

| INV | DET |

| (1) INV identifier | (1) DET identifier |

| (2) Currency | (2) Quantity |

| (4) Card number | (3) Item ID/code |

| (5) Card expiry date | (4) Item description/name |

| (6) Invoice number | (5) Item unit price |

| (10) Operation code | (6) VAT flag |

| (14) PSPID | (7) VAT rate or internal VAT code |

| (16) number of DET records | (14) Total line amount (excl. VAT) |

| (18) Client ID | |

| (29) Order number | |

| (32) Total invoice amount (excl. VAT) | |

| (33) Total invoice VAT amount | |

| (34) Total invoice amount (incl. VAT) INV 4-5 are optional if you use field 17 Cardholder Alias |

|

Example:

Level III direct saleINV;EUR;;374291019071995;0514;7845968574;;John Doe;;SAL;;;;GFR5oes;;2;;FORD;;;;;;;;;;06/30/08;OH74988;;;21000;4410;25410;

DET;10;5634;Scissors;200;0;21%;;;;;;;2000

DET;10;5635;HP720c printer cartridge;1900;0;21%;;;;;;;19000

- (11) Authorisation code

- (12) Authorisation mode

- (13) Authorisation date / date

Example:

Level III direct sale (authorisation received outside Worldline)INV;EUR;;374291019071995;0514;7845968574;;John Doe;;SAL;52485;TEL;06/29/08 14:12:30;GFR5oes;;2;;FORD;;;;;;;;;;06/30/08;OH74988;;;21000;4410;25410;

DET;10;5634;Scissors;200;0;21%;;;;;;;2000

DET;10;5635;HP720c printer cartridge;1900;0;21%;;;;;;;19000

2.3.3 Refund_credit note Level III

The minimum fields we recommend you to use for a credit note are:| Refund (credit note): Level III, RFD |

|

|---|---|

| INV | DET |

| (1) INV identifier | (1) DET identifier |

| (2) Currency | (2) Quantity |

| (4) Card number | (3) Item ID/code |

| (5) Card expiry date | (4) Item description/name |

| (6) Credit note number | (5) Item unit price |

| (10) Operation code | (6) VAT flag |

| (14) PSPID | (7) VAT rate or internal VAT code |

| (16) number of DET records | (14) Total line amount (excl. VAT) |

| (18) Client ID | |

| (19) Original invoice number corresponding to the credit note (mandatory for the de-materialization of invoices) | |

| (29) Order number | |

| (32) Total invoice amount (excl. VAT) | |

| (33) Total invoice VAT amount | |

| (34) Total invoice amount (incl. VAT) INV 4-5 are optional if you use field 17 Cardholder Alias |

|

Example:

Refund (credit note)INV;EUR;;374291019071995;0514;C58945743;;John Doe;;RFD;;;;GFR5oes;;2;;FORD;;;;;;;;;;06/30/08;OH74988;;;21000;4410;25410;

DET;10;5634;Scissors;200;0;21%;;;;;;;2000

DET;10;5635;HP720c printer cartridge;1900;0;21%;;;;;;;19000

2.4 Required fields for maintenance operations

Maintenance operations are based on transactions (orders) that have been entered in our system. As the details of the original transaction are logged in our system, you do not have to repeat specific details such as the card number and expiry date. Instead, you should refer to the original transaction using its PAYID. Information you send us in maintenance transactions will overwrite any contrary corresponding information in the original transaction, except for the card number and the currency. The following section lists the minimum fields we recommend you to use. Your client and/or acquirer may also possibly request you to provide other specific fields in the layout, in addition to the ones listed here, e.g. Client references, line item references, etc.2.4.1 Data capture Level III

The minimum fields we recommend you to use for a data capture are:| Data capture: Level III, SAL/SAS |

|

|---|---|

| INV | DET |

| (1) INV identifier | (1) DET identifier |

| (2) Currency | (2) Quantity |

| (6) Invoice number | (3) Item ID/code |

| (9) Initial authorisation PAYID | (4) Item description/name |

| (10) Operation code | (5) Item unit price |

| (14) PSPID | (6) VAT flag |

| (16) number of DET records | (7) VAT rate or internal VAT code |

| (18) Client ID | (14) Total line amount (excl. VAT) |

| (33) Total invoice VAT amount | (34) Total invoice amount (incl. VAT) |

Example:

Data captureOHF;;MTR;SAS;1;

INV;EUR;;;;7845968574;;;82759845;SAS;;;;GFR5oes;;2;;FORD;;;;;;;;;;;;;;21000;4410;25410;

DET;10;5634;Scissors;200;0;21%;;;;;;;2000

DET;10;5635;HP720c printer cartridge;1900;0;21%;;;;;;;19000

OTF

2.5 Field usage overview

M = mandatory, A = advised, O = optional, / = not applicable

INV record ATR (new transactions): Authorisation (RES) Level I // III

| Field | RES (I) | RES (III) |

|---|---|---|

| 1 INV Identifier/Amount | M (amount) | M (INV) |

| 2 Currency unit | M | M |

| 3 Card type/brand | O | O |

| 4 Card number | M | M |

| 5 Card expiry date | M | M |

| 6 Invoice number / credit note number | / | / |

| 7 Client reference 1 | O | O |

| 8 Cardholder name | O | O |

| 9 PAYID of original transaction | / | / |

| 10 Operation Code | A | A |

| 11 Authorisation code | / | / |

| 12 Authorisation mode | / | / |

| 13 Authorisation date/time | / | / |

| 14 PSPID | A | A |

| 15 Supplier order identifier | / | / |

| 16 Number of DET records | / | M |

| 17 Cardholder Alias | O | O |

| 18 Client ID | M | M |

| 19 Original invoice number | / | / |

| 21 Client reference 2 | O | O |

| 27 CVC/CVV2 | O | O |

| 28 Order/Invoice date | O | O |

| 29 Order Number | M | M |

| 30 Invoice Level Discount rate | / | O |

| 31 Client reference 3 | O | O |

| 32 Total Invoice amount (excl. VAT ) | / | A |

| 33 Total VAT amount | / | A |

| 34 Total Invoice amount (incl. VAT) | / | A |

INV record ATR (new transactions): Direct Sale (SAL) / Refund (RFD) Level III

| Field | SAL (III) | RFD (III) |

|---|---|---|

| 1 INV Identifier/Amount | M (INV) | M (INV) |

| 2 Currency unit | M | M |

| 3 Card type/brand | O | O |

| 4 Card number | M | M |

| 5 Card expiry date | M | M |

| 6 Invoice number / credit note number | M | M |

| 7 Client reference 1 | O | O |

| 8 Cardholder name | O | O |

| 9 PAYID of original transaction | / | / |

| 10 Operation Code | A | A |

| 11 Authorisation code | / | O |

| 12 Authorisation mode | / | O |

| 13 Authorisation date/time | / | O |

| 14 PSPID | A | A |

| 15 Supplier order identifier | / | / |

| 16 Number of DET records | M | M |

| 17 Cardholder Alias | O | O |

| 18 Client ID | M | M |

| 19 Original invoice number | / | / |

| 21 Client reference 2 | O | O |

| 27 CVC/CVV2 | O | O |

| 28 Order/Invoice date | O | O |

| 29 Order Number | M | M |

| 30 Invoice Level Discount rate | O | O |

| 31 Client reference 3 | O | O |

| 32 Total Invoice amount (excl. VAT ) | A | A |

| 33 Total VAT amount | A | A |

| 34 Total Invoice amount (incl. VAT) | A | A |

INV record MTR (maintenance transactions): (Last) data capture (SAL / SAS) Level III

| Field | SAL/SAS (III) |

|---|---|

| 1 INV Identifier/Amount | M |

| 2 Currency unit | M |

| 3 Card type/brand | O |

| 4 Card number | M |

| 5 Card expiry date | M |

| 6 Invoice number / credit note number | M |

| 7 Client reference 1 | O |

| 8 Cardholder name | O |

| 9 PAYID of original transaction | M |

| 10 Operation Code | A |

| 11 Authorisation code | / |

| 12 Authorisation mode | / |

| 13 Authorisation date/time | / |

| 14 PSPID | A |

| 15 Supplier order identifier | O |

| 16 Number of DET records | M |

| 17 Cardholder Alias | O |

| 18 Client ID | M |

| 19 Original invoice number | / |

| 21 Client reference 2 | O |

| 27 CVC/CVV2 | O |

| 28 Order/Invoice date | O |

| 29 Order Number | O |

| 30 Invoice Level Discount rate | O |

| 31 Client reference 3 | O |

| 32 Total Invoice amount (excl. VAT ) | A |

| 33 Total VAT amount | A |

| 34 Total Invoice amount (incl. VAT) | A |

CLI record: all fields are optional, as the customer addresses should be completed in the <%COMPANY%> back office.

CLI record ATR (new transactions): Authorisation (RES) Level I // III

| Field | RES (I) | RES (III) |

|---|---|---|

| 1 INV Identifier/Amount | M (amount) | M (INV) |

| 2 Currency unit | M | M |

| 3 Card type/brand | O | O |

| 4 Card number | M | M |

| 5 Card expiry date | M | M |

| 6 Invoice number / credit note number | / | / |

| 7 Client reference 1 | O | O |

| 8 Cardholder name | O | O |

| 9 PAYID of original transaction | / | / |

| 10 Operation Code | A | A |

| 11 Authorisation code | / | / |

| 12 Authorisation mode | / | / |

| 13 Authorisation date/time | / | / |

| 14 PSPID | A | A |

| 15 Supplier order identifier | / | / |

| 16 Number of DET records | / | M |

| 17 Cardholder Alias | O | O |

| 18 Client ID | M | M |

| 19 Original invoice number | / | / |

| 21 Client reference 2 | O | O |

| 27 CVC/CVV2 | O | O |

| 28 Order/Invoice date | O | O |

| 29 Order Number | M | M |

| 30 Invoice Level Discount rate | / | O |

| 31 Client reference 3 | O | O |

| 32 Total Invoice amount (excl. VAT ) | / | A |

| 33 Total VAT amount | / | A |

| 34 Total Invoice amount (incl. VAT) | / | A |

CLI record ATR (new transactions): Direct Sale (SAL) / Refund (RFD) Level III

| Field | SAL (III) | RFD (III) |

|---|---|---|

| 1 INV Identifier/Amount | M (INV) | M (INV) |

| 2 Currency unit | M | M |

| 3 Card type/brand | O | O |

| 4 Card number | M | M |

| 5 Card expiry date | M | M |

| 6 Invoice number / credit note number | M | M |

| 7 Client reference 1 | O | O |

| 8 Cardholder name | O | O |

| 9 PAYID of original transaction | / | / |

| 10 Operation Code | A | A |

| 11 Authorisation code | / | O |

| 12 Authorisation mode | / | O |

| 13 Authorisation date/time | / | O |

| 14 PSPID | A | A |

| 15 Supplier order identifier | / | / |

| 16 Number of DET records | M | M |

| 17 Cardholder Alias | O | O |

| 18 Client ID | M | M |

| 19 Original invoice number | / | / |

| 21 Client reference 2 | O | O |

| 27 CVC/CVV2 | O | O |

| 28 Order/Invoice date | O | O |

| 29 Order Number | M | M |

| 30 Invoice Level Discount rate | O | O |

| 31 Client reference 3 | O | O |

| 32 Total Invoice amount (excl. VAT ) | A | A |

| 33 Total VAT amount | A | A |

| 34 Total Invoice amount (incl. VAT) | A | A |

CLI record MTR (maintenance transactions): (Last) data capture (SAL / SAS) Level III

| Field | SAL/SAS (III) |

|---|---|

| 1 INV Identifier/Amount | M |

| 2 Currency unit | M |

| 3 Card type/brand | O |

| 4 Card number | M |

| 5 Card expiry date | M |

| 6 Invoice number / credit note number | M |

| 7 Client reference 1 | O |

| 8 Cardholder name | O |

| 9 PAYID of original transaction | M |

| 10 Operation Code | A |

| 11 Authorisation code | / |

| 12 Authorisation mode | / |

| 13 Authorisation date/time | / |

| 14 PSPID | A |

| 15 Supplier order identifier | O |

| 16 Number of DET records | M |

| 17 Cardholder Alias | O |

| 18 Client ID | M |

| 19 Original invoice number | / |

| 21 Client reference 2 | O |

| 27 CVC/CVV2 | O |

| 28 Order/Invoice date | O |

| 29 Order Number | O |

| 30 Invoice Level Discount rate | O |

| 31 Client reference 3 | O |

| 32 Total Invoice amount (excl. VAT ) | A |

| 33 Total VAT amount | A |

| 34 Total Invoice amount (incl. VAT) | A |

DET record M = mandatory, A = advised, O = optional, / = not applicable

INV record ATR (new transactions): Authorisation (RES) Level I // III

| Field | RES (I) | RES (III) |

|---|---|---|

| 1 DET Identifier | / | M |

| 2 Quantity | / | M |

| 3 Item Id/Code | / | M |

| 4 Item description/name | / | A |

| 5 Item unit price | / | A |

| 6 VAT flag | / | A |

| 7 VAT rate/code | / | A |

| 8 LIne item reference 1 | / | O |

| 9 Line item reference 2 | / | O |

| 10 Item internal description | / | O |

| 13 Item Discount Rate | / | O |

| 14 Total Line amount (excl. VAT) | / | A |

INV record ATR (new transactions): Direct Sale (SAL) / Refund (RFD) Level III

| Field | SAL (III) | RFD (III) |

|---|---|---|

| 1 DET Identifier | M | M |

| 2 Quantity | M | M |

| 3 Item Id/Code | M | M |

| 4 Item description/name | A | A |

| 5 Item unit price | A | A |

| 6 VAT flag | A | A |

| 7 VAT rate/code | A | A |

| 8 LIne item reference 1 | O | O |

| 9 Line item reference 2 | O | O |

| 10 Item internal description | O | O |

| 13 Item Discount Rate | O | O |

| 14 Total Line amount (excl. VAT) | A | A |

INV record MTR (maintenance transactions): (Last) data capture (SAL / SAS) Level III

| Field | SAL/SAS (III) |

|---|---|

| 1 DET Identifier | M |

| 2 Quantity | M |

| 3 Item Id/Code | M |

| 4 Item description/name | A |

| 5 Item unit price | A |

| 6 VAT flag | A |

| 7 VAT rate/code | A |

| 8 LIne item reference 1 | O |

| 9 Line item reference 2 | O |

| 10 Item internal description | O |

| 13 Item Discount Rate | O |

| 14 Total Line amount (excl. VAT) | A |

3. Submission Mode Directlink

You can also use DirectLink to send maintenance requests. Data captures and refunds (credit notes) need to be sent with level III information.

| New Order | Maintenance | ||

|---|---|---|---|

| Authorisation | Direct Sale |

Refund (credit note) |

Data Capture |

| Level I | Level III |

Level III |

Level III |

This chapter complements the DirectLink Integration Guide. Please refer to the DirectLink integration guide for general information on the DirectLink submission mode. This chapter only refers to the parameters needed for submitting a purchasing card transaction.

3.1 General request parameters

| Parameter | Content | Format / Max. length / Example |

|---|---|---|

| ECOM_CONSUMERID | Client ID, as configured in your <%COMPANY%> account |

AN 20 PEUGEOT |

| ECOM_ CONSUMERUSERALIAS | Allows for credit card detail usage in a PCI compliant environment. |

AN 20 Test123! |

| ORDERID | Order reference. If your order reference is unique you can use it for maintenance transactions to refer to the original transaction; otherwise you need to use the PAYID to refer to the original transaction. |

AN 15 AB5456CB896 |

| INVORDERID | Invoice number for invoices (SAL operation code). Credit note number for credit notes (RFD operation code). |

AN 15 (Amex: 12) 2009-0000568 |

| OR_INVORDERID | Original invoice number (for credit notes). |

AN 15 (Amex: 12) 17358948 |

| REF | Cardholder reference. (as requested by the client). |

AN 16 Order 06/09/11 |

| REF_CUSTOMERREF | Customer reference. (as requested by the client). |

AN 20 YUJ7885 |

| COSTCENTER | Cost Centre. (as requested by the client). |

AN 20 Y567K8 |

| REF_CUSTOMERID | Customer number. (as requested by the client). |

AN 17 (Amex: 12) 73TO45 |

| AMOUNT | Invoice amount including VAT. (* 100 to avoid decimals). |

N 12 121000 |

| AMOUNTHTVA | Invoice amount excluding VAT. (* 100 to avoid decimals). |

N 12 100000 |

| AMOUNTTVA | VAT amount. (* 100 to avoid decimals). |

N 12 21000 |

| INVDATE | Invoice/order date Default: current date |

MM/DD/YY 8 09/25/15 |

| DISCOUNTRATE | Discount rate at invoice level. Can have up to 2 decimals. Do not use %. This discount rate will be stated in the item name in the order details. The invoice level discount rate will be added to the item level discount rate: “Item name (- (DiscountRate + ItemDiscount) %)” We do not use this discount rate to calculate order amounts. The amounts you send us must already include the discount. |

N 5 05.00 |

| DATATYPE | “LID” Use if your requests contain Line Item Details. |

LID 3 LID |

The following fields can be repeated n times, changing the digit at the end of the field name (X):

| ITEMIDX | Product code |

AN 15 U419-52 |

| ITEMNAMEX | Product name |

AN 40 HP710C Cartridge |

| ITEMPRICEX | Unit Price Can have up to 4 decimals. Decimal separator: ‘.’ (full stop). |

N 12 (EUR 35,2575 =) |

| LIDEXCLX | Total line amount, excluding VAT. Can have 2 decimals. (* 100 to avoid decimals). |

N 12 (Amex: 12) 15000 |

| ITEMDISCOUNTX | Item Discount Rate at line level. Can have up to 2 decimals. Do not use %. This discount rate will be stated in the item name in the order details. The item level discount rate will be added to the invoice level discount rate: “Item name (- (ItemDiscount + DiscountRate) %)” We do not use this discount rate to calculate order amounts. The amounts you send us must already include the discount. |

N 5 02.00 |

| TAXINCLUDEDX | Possible values: 1 (ItemPriceX includes VAT) 0 (ItemPriceX does not include VAT), default and recommended |

N 1 0 |

| ITEMVATCODEX | VAT rate with 2 decimals and % or Internal VAT code as configured in the VAT rules of your account (0, 1, etc.) |

xx.xx% 6 21.00% |

| ITEMQUANTX | Item quantity 2 decimals allowed Decimal separator: ‘.’ (full stop) |

N 12 52 |

| ITEMCATEGORYX | Category or Commodity Code This field can also be used to send a reference at line level for some customers. (line item reference 2) |

AN 12 (Amex: 8) TY1627 |

| ITEMUNITOFMEASUREX | Unit Of Measure This field can also be used to send a reference at line level for some customers. (line item reference 1) (Although American Express accepts a field length of 12, <%COMPANY%> only allows 10.) |

AN 10 Piece |

3.2 Required parameters for new orders

The following section lists the minimum parameters we recommend you to use. Your client and/or acquirer may also possibly request you to use other specific parameters in addition to the ones listed here, e.g. Client references.3.2.1 Authorisation (Level I)

The minimum fields we recommend you use for a level I authorisation are:| Authorisation (Level I, RES) |

|---|

| PSPID |

| USERID |

| PSWD |

| ORDERID |

| AMOUNT |

| CURRENCY |

| CARDNO |

| ED |

| OPERATION |

| ECOM_CONSUMERID |

Example:

Level I authorisationPOST request on https://secure.ogone.com/ncol/test/orderdirect.asp containing the following parameters:

PSPID=GFR5oes2

USERID=GFR5oes2api

PSWD=UMPCOP24

orderID=Order758845M

amount=25410

currency=EUR

CARDNO=374291019071995

ED=06/21

OPERATION=RES

Ecom_ConsumerID=FORD

3.2.2 Direct sale Level III

The minimum parameters we recommend you use for level III direct sale are:| Direct sale (Level III, SAL) |

|---|

| PSPID |

| PSPID |

| USERID |

| PSWD |

| ORDERID |

| AMOUNT |

| CURRENCY |

| CARDNO |

| ED |

| OPERATION |

| ECOM_CONSUMERID |

| INVORDERID |

| AMOUNTHTVA |

| AMOUNTTVA |

| DATATYPE |

| ITEMIDX |

| ITEMNAMEX |

| ITEMPRICEX |

| TAXINCLUDEDX |

| ITEMVATCODEX |

| ITEMQUANTX |

| LIDEXCLX |

Example:

Level III direct salePOST request on https://secure.ogone.com/ncol/test/orderdirect.asp containing the following parameters:

PSPID=GFR5oes2

USERID=GFR5oes2api

PSWD=UMPCOP24

orderID=Order759864P

amount=25410

currency=EUR

CARDNO=374291019071995

ED=06/21

OPERATION=SAL

Ecom_ConsumerID=FORD

INVorderID=7598645384

amountHTVA=21000

amountTVA=4410

INVDATE=07/06/08

DataType=LID

ItemID1=5634

ItemName1=Scissors

ItemPrice1=200

TaxIncluded1=0

ItemVatCode1=21%

ItemQuant1=10

ItemUnitOfMeasure1=piece

LIDEXCL1=2000

ItemID2=5635

ItemName2=HP720c+printer+cartridge

ItemPrice2=1900

TaxIncluded2=0

ItemVatCode2=21%

ItemQuant2=10

ItemUnitOfMeasure2=piece

LIDEXCL2=19000

SHASIGN=a65d09014de61bc88a11f248f4995907d548dc0f

3.2.3 Refund/credit note (Level III)

The minimum parameters we recommend you use for a credit note are:| Refund (credit note) (Level III, RFD) |

|---|

| PSPID |

| USERID |

| PSWD |

| ORDERID |

| AMOUNT |

| CURRENCY |

| CARDNO |

| ED |

| OPERATION |

| ECOM_CONSUMERID |

| INVORDERID |

| AMOUNTHTVA |

| AMOUNTTVA |

| DATATYPE |

| ITEMIDX |

| ITEMNAMEX |

| ITEMPRICEX |

| TAXINCLUDEDX |

| ITEMVATCODEX |

| ITEMQUANTX |

| LIDEXCLX |

Example:

Refund (credit note)POST request on https://secure.ogone.com/ncol/test/orderdirect.asp containing the following parameters:

PSPID=GFR5oes2

USERID=GFR5oes2api

PSWD=UMPCOP24

orderID=Order759864P

amount=25410

currency=EUR

CARDNO=374291019071995

ED=06/21

OPERATION=RFD

Ecom_ConsumerID=FORD

INVorderID=12458654

OR_INVorderID=7598645384

amountHTVA=21000

amountTVA=4410

DataType=LID

ItemID1=5634

ItemName1=Scissors

ItemPrice1=200

TaxIncluded1=0

ItemVatCode1=21%

ItemQuant1=10

ItemUnitOfMeasure1=piece

LIDEXCL1=2000

ItemID2=5635

ItemName2=HP720c+printer+cartridge

ItemPrice2=1900

TaxIncluded2=0

ItemVatCode2=21%

ItemQuant2=10

ItemUnitOfMeasure2=piece

LIDEXCL2=19000

SHASIGN=ee2c95e0259a5d546a1fcf0afdb6e3be46be1a39

3.3 Required parameters for maintenance operations

Maintenance operations are based on transactions (orders) that have been entered in our system. Since the details of the original transaction are logged in our system, you do not have to repeat specific details such as the card number and expiry date. Instead, you should refer to the original transaction using its PAYID. Information you send us in maintenance transactions will overwrite any corresponding contrary information in the original transaction, except for the card number and the currency. The following section lists the minimum parameters we recommend you to use. Your client and/or acquirer may also possibly request you to provide other specific parameters in addition to the ones listed here, e.g. Client references, line item references.3.3.1 Data capture (Level III)

The minimum parameters we recommend you use for a data capture are:| Data capture (Level III, SAL/SAS) |

|---|

| PSPID |

| USERID |

| PSWD |

| ORDERID |

| AMOUNT |

| CURRENCY |

| OPERATION |

| ECOM_CONSUMERID |

| INVORDERID |

| AMOUNTHTVA |

| AMOUNTTVA |

| DATATYPE |

| ITEMIDX |

| ITEMNAMEX |

| ITEMPRICEX |

| TAXINCLUDEDX |

| ITEMVATCODEX |

| ITEMQUANTX |

| LIDEXCLX |

Example:

Data capturePOST request on https://secure.ogone.com/ncol/test/maintenancedirect.asp containing the following parameters:

PSPID=GFR5oes2

USERID=GFR5oes2api

PSWD=UMPCOP24

ORDERID=Order758845M

PAYID=18759754

AMOUNT=25410

CURRENCY=EUR

OPERATION=SAS

ECOM_CONSUMERID=FORD

INVORDERID=7598612385

AMOUNTHTVA=21000

AMOUNTTVA=4410

INVDATE=07/06/08

DATATYPE=LID

ITEMID1=5634

ITEMNAME1=Scissors

ITEMPRICE1=200

TAXINCLUDED1=0

ITEMVATCODE1=21%

ITEMQUANT1=10

ITEMUNITOFMEASURE1=piece

LIDEXCL1=2000

ITEMID2=5635

ITEMNAME2=HP720c+printer+cartridge

ITEMPRICE2=1900

TAXINCLUDED2=0

ITEMVATCODE2=21%

ITEMQUANT2=10

ITEMUNITOFMEASURE2=piece

LIDEXCL2=19000

SHASIGN=D2AF81D0E11BCA7531A8E59B698D0FDAC189884F

3.4 Overview of parameter usage

M = mandatory, A = advised, O = optional, / = not applicable

ATR (new transactions): Authorisation (RES) Level I // III

| Field | RES (I) | RES (III) |

|---|---|---|

| ECOM_CONSUMERID | M | M |

| ORDERID | M | M |

| OR_INVORDERID | / | / |

| REF | O | O |

| REF_CUSTOMERID | O | O |

| AMOUNT | M | M |

| AMOUTHTVA | M | M |

| AMOUNTTVA | M | M |

| INVDATE | O | O |

| DISCOUNTRATE | O | O |

| DATATYPE LID | / | M |

| ITEMIDX | / | M |

| ITEMNAMEX | / | M |

| ITEMPRICEX | / | M |

| LIDEXCLX | / | O |

| ITEMDISCOUNTX | / | O |

| TAXINCLUDEDX | / | M |

| ITEMVATCODEX | / | M |

| ITEMQUANTX | / | M |

| ITEMCATEGORYX | / | O |

| IMTEUNITOFMEASUREX | / | O |

ATR (new transactions): Direct Sale (SAL) / Refund (RFD) Level III

| Field | SAL (III) | RFD (III) |

|---|---|---|

| ECOM_CONSUMERID | M | M |

| ORDERID | M | M |

| OR_INVORDERID | / | M |

| REF | O | O |

| REF_CUSTOMERID | O | O |

| AMOUNT | M | M |

| AMOUTHTVA | M | M |

| AMOUNTTVA | M | M |

| INVDATE | O | O |

| DISCOUNTRATE | O | O |

| DATATYPE LID | M | M |

| ITEMIDX | M | M |

| ITEMNAMEX | M | M |

| ITEMPRICEX | M | M |

| LIDEXCLX | O | O |

| ITEMDISCOUNTX | O | O |

| TAXINCLUDEDX | M | M |

| ITEMVATCODEX | M | M |

| ITEMQUANTX | M | M |

| ITEMCATEGORYX | O | O |

| IMTEUNITOFMEASUREX | O | O |

MTR (maintenance transactions): (Last) data capture (SAL / SAS) Level III

| Field | SAL/SAS (III) |

|---|---|

| ECOM_CONSUMERID | M |

| ORDERID | O |

| OR_INVORDERID | / |

| REF | O |

| REF_CUSTOMERID | O |

| AMOUNT | M |

| AMOUTHTVA | M |

| AMOUNTTVA | M |

| INVDATE | O |

| DISCOUNTRATE | O |

| DATATYPE LID | M |

| ITEMIDX | M |

| ITEMNAMEX | M |

| ITEMPRICEX | M |

| LIDEXCLX | O |

| ITEMDISCOUNTX | O |

| TAXINCLUDEDX | M |

| ITEMVATCODEX | M |

| ITEMQUANTX | M |

| ITEMCATEGORYX | O |

| IMTEUNITOFMEASUREX | O |

3.5 Security: SHA signature

3.6 Test pages

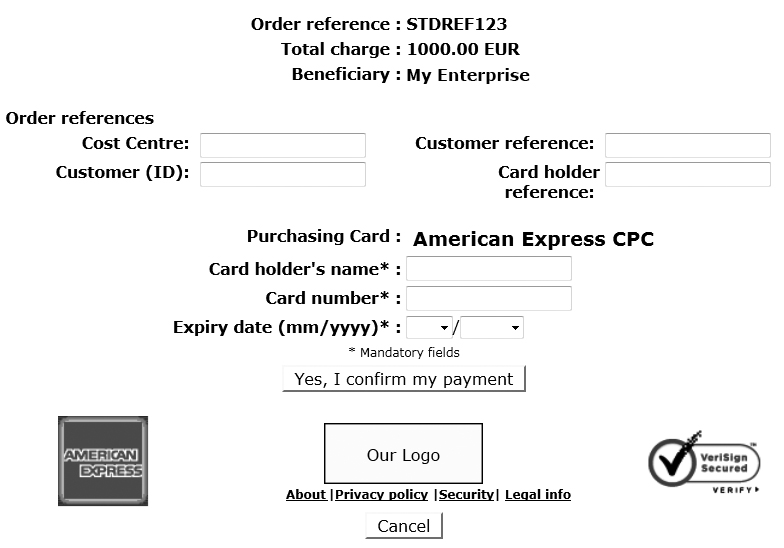

4. e-Commerce Submission Mode

You can send a new purchasing card order via e-Commerce. Authorisation requests are sent with level I information, level III information; direct sale requests or maintenance requests are not possible via e-Commerce.| New Order | Maintenance | ||

|---|---|---|---|

| Authorisation | Direct Sale |

Refund (credit note) |

Data Capture |

| Level I | - |

- |

- |

This chapter complements the e-Commerce integration guide. Please refer to the Advanced e-Commerce integration guide for general information on e-Commerce submission mode. This chapter only refers to the additional items necessary for submitting a purchasing card transaction.

4.1 Additional hidden fields

The following hidden field needs to be transmitted to our system along with the general parameters:

| Field | New Order |

|---|---|

| ECOM_CONSUMERID | The Client ID as you entered/adapted it in our system via the “Customers” link |

4.2 Payment page

4.3 Test page

An example (test page) to submit an authorisation can be found at: https://secure.ogone.com/ncol/test/teststd_pc.htm5. Appendix 1: Troubleshooting

The following section contains a non-exhaustive list of possible errors:Not enough DET records compared to NBDETAILS param for invoice

This error means the number of DET records you indicated in the INV record is too high compared to the number of DET lines according to the INV record. You have an inadequate number of DET lines for the invoice or have entered an incorrect number in the INV record.

DET or CLI record without corresponding payment record

This error means the number of DET records you indicated in the INV record is too low compared to the number of DET lines according to the INV record. You have too many DET lines for the invoice or have entered an incorrect number in the INV record.

Payment detail validation failed

In general, you will receive this error message if there is an error in the amounts you entered in the invoice. If you cannot find the error, please contact our Customer Care Team.

Details not sent for a Purchasing card transaction

You will receive this error message if you were expected to send Level III details in your transaction but you failed to do so. You need to send along Level III details for this order.

ConsumerID not defined for merchant

This error means the Client ID you used in the order is not registered (or registered with another name) in the Customer management section in our back office.

Invoice level amount sounds too big compared to amounts computed from Line Items

You will receive this error when the total invoice amount you sent us is too high compared to the invoice details you sent us. For instance, your invoice amount is 500 EUR and your line item details contain 10 scissors at 2 EUR each and 10 ink cartridges at 20 EUR each: 500 > (20 + 200).

Item Vat Code > 4 and not a Vat Rate for ItemID

This error means you entered a VAT code value higher than 4 as the VAT rate for an ItemID. You can use a VAT percentage (e.g. 21%) or a VAT code. The VAT code will be 0, 1, 2, 3 or 4, as configured in the VAT rules in your account. Invalid combination of amounts (amount - AM)

In general, you will receive this error message if there is an error in the amounts you entered in the invoice. If you cannot find the error, please contact our Customer Care Team.

Not enough customer data for customer

This error means you either forgot to complete some mandatory fields in the Customer profile in your account or you failed to send any Client ID in your order.

This Invoice Number has already been used

This error means you sent us an order with an Invoice number that has already been used for another order.

Card type not active for the merchant

This error means you are trying to send a transaction using a card brand which has not yet been added/activated in your account.

No global orderID

You will receive this error message if you were expected to send an orderID (Order Number, INV 29) in your transaction details but you failed to do so. You need to send along an orderID/Order Number for this order.

6. Appendix 2: Customer References

There are 4 customer references you can send along in transactions:

Cost centre

Customer Reference

Customer ID

Cardholder Reference

| Reference | Batch | DirectLink | Field on bank statement Only for BNP Paribas Customers who are active in the public sector |

|---|---|---|---|

| Cost centre | Cost Center (CLI 2) | COSTCENTER | Référence Client 4/Numéro d’Engagement |

| Customer Reference | Client reference 1 (INV 7) |

REF_CUSTOMERREF | Référence Client 3/Numéro de Marché |

| Customer ID | Client reference 3 (INV 31) |

REF_CUSTOMERID | Référence Client 2 |

| Cardholder Reference | Client reference 2 (INV 21) |

REF | Référence Client 1 |