Marketplace

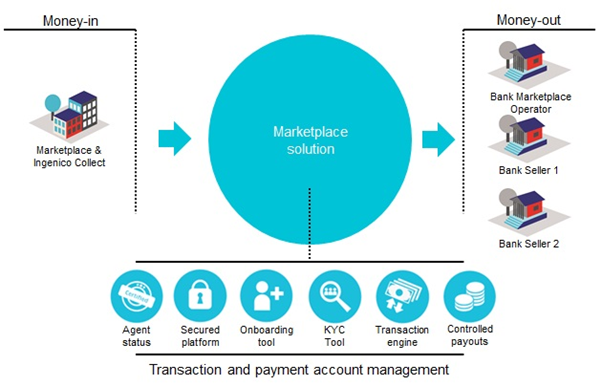

A marketplace is an e-commerce platform where products and services are provided by multiple third party sellers. While the payments on a marketplace are executed by the marketplace operator on behalf of their sellers, Worldline ensures the processing and reconciliation of these transactions to the sellers. Our Payment Solution for Marketplaces can manage split transactions towards multiple sellers at once as well as settling a single transaction to one seller.

Our Payment Solution for Marketplaces is a full service payment solution that enables marketplaces to process transactions and associated payment flows such as refunds and chargebacks, allowing full reconciliation.

Worldline' Marketplace solution is based on the reconciliation of multiple sources of information to ensure a clean and consolidated reconciliation of transactions. This solution can easily be integrated into the environment of the Marketplace Operator. The Payment Solution for Marketplaces is fully in line with EU regulatory and compliance boundaries and is available in any European country with respect of local rules and regulations (including identification of merchants and Anti-Money Laundering) applying for respective countries.

What our solution provides:

- can enable any company to become active in a strongly growing market domain

- assist in compliance of the regulatory obligations in countries where the marketplaces is active

- takes care of technical-financial transactions and accounts platform via our multichannel and multi-product platform

Our platform offers a European-wide solution via an API-based marketplace, accounts and transactions platform. Our product allows marketplace operators to create their own ecosystem fitting their individual needs.

Our solution manages the complete financial flow on behalf of the marketplace operator (reception of funds, complex transaction and commission management, payouts). This is a critical feature for all Marketplaces who are looking for a compliant solution for this important part of their activities.

The use of our own European E-Money license on behalf of our clients is part of the integrated service. It allows marketplace operators to be legally compliant with European regulations.

Legal requirements

Setting-up a market place offers great business opportunities, but it also requires specific legal obligations to be fulfilled for both marketplace operators and payment providers. Worldline is here to assist our clients during the implementation process and make sure they are fully compliant with the regulations.

Know Your Customer (KYC) and Customer Due Diligence (CDD)

Know Your Customer (KYC) is a mandatory process required to verify the identity of sellers. Any entity facilitating payments and holding funds of third parties is obliged to identify their sellers. The purpose of KYC rules is notably to prevent entities from being used for money laundering activities.

The Customer Due Diligence (CDD) is an extension of the KYC obligation. On a marketplace, operators not only need to identify each seller, but also need to verify they have the legitimate rights to operate as a seller. The ultimate goal is to make sure marketplace operators have taken all relevant actions to prevent malpractice and protect end-customers.

In the context of marketplaces, Worldline is requested to identify and validate all sellers at the on-boarding on the marketplace.

Secured environment for KYC process

Worldline provides marketplaces with a seamless identification process and offers a dedicated tool for KYC using a web portal and/or a REST web services. This tool allows marketplace operators to either use the interface of Worldline or leaves them the flexibility of choice to create their own front-end.

Once Worldline received the information related to the KYC file, we will verify its accuracy and inform the marketplace operator about it. Once approved, the marketplace operator can authorize the seller to offer their products or services on the marketplace.

To know more about legal requirements, contact your Worldline representative.

Product description

Our Payment Solution for Marketplaces is designed to simplify the payment process for marketplaces and to ensure a compliant payment solution. The Payment Solution for Marketplaces is a specific setup designed to improve the marketplace's administration efforts and to reduce their implementation effort. This solution allows marketplaces to split a transaction from a buyer to one or multiple sellers and commission accounts.

Payment methods

Worldline offers a unique and easy solution: Collecting Services under an E-money licence

Collecting client funds involves many legal obligations requiring permits and licenses which are difficult and time consuming to obtain. Therefore, we offer our partners the opportunity to outsource the collecting and safekeeping of client funds. All of these activities fall under the responsibility of Worldline, while our clients can focus on their core business and benefit from a complete and flexible solution.

Our collecting solution provides the following benefits:

- Increase conversion by offering more payment methods - buyers choose how they want to pay, they’re more likely to complete their transactions. Buyers across Europe can choose the payment methods they know and trust.

- Expand easily into new markets - for merchants who are trading across Europe or intend to expand, our collecting services (Full Service) is an obvious fit. One single contract gives an instant access to buyers’ preferred payment methods, placing millions of new customers within reach.

- Save time on reconciliation - Instead of juggling different reports, payment cycles and conditions for every activated payment method, merchants will receive funds andreports in one single batch. Managing all payments in this way, from just the one account, will save significant time and resource.

In detail, this means for you:

- Only one contract to manage, instead of a contract for each acquirer and/or payment methods in each country.

- Receive payments in a single funds transfer and in a consolidated reporting file, for example Carte Bancaire from France, iDEAL payments from the Netherlands, Bancontact payments from Belgium and Sofort payments from Germany.

- Issue refunds whenever you want to – even for some payment methods that don’t offer this function originally.

- As soon as a new payment method is available in the Full Service portfolio, existing merchants, marketplaces and sellers can offer it to their end customers.

- Let buyers pay by local bank transfer and get notified as soon as the payment has been received.

- All information on retrieval requests and chargebacks which impact transactions are centralized in a dedicated module in order to simplify the management of such an event.

Our Full Service offering is the one-stop solution for accepting and collecting payment methods on the Ogone payment gateway. Our collecting services are notably offered for:

Available payment methods may vary depending on the situation of the marketplace operator

More payment methods available, please contact Worldline representatives.

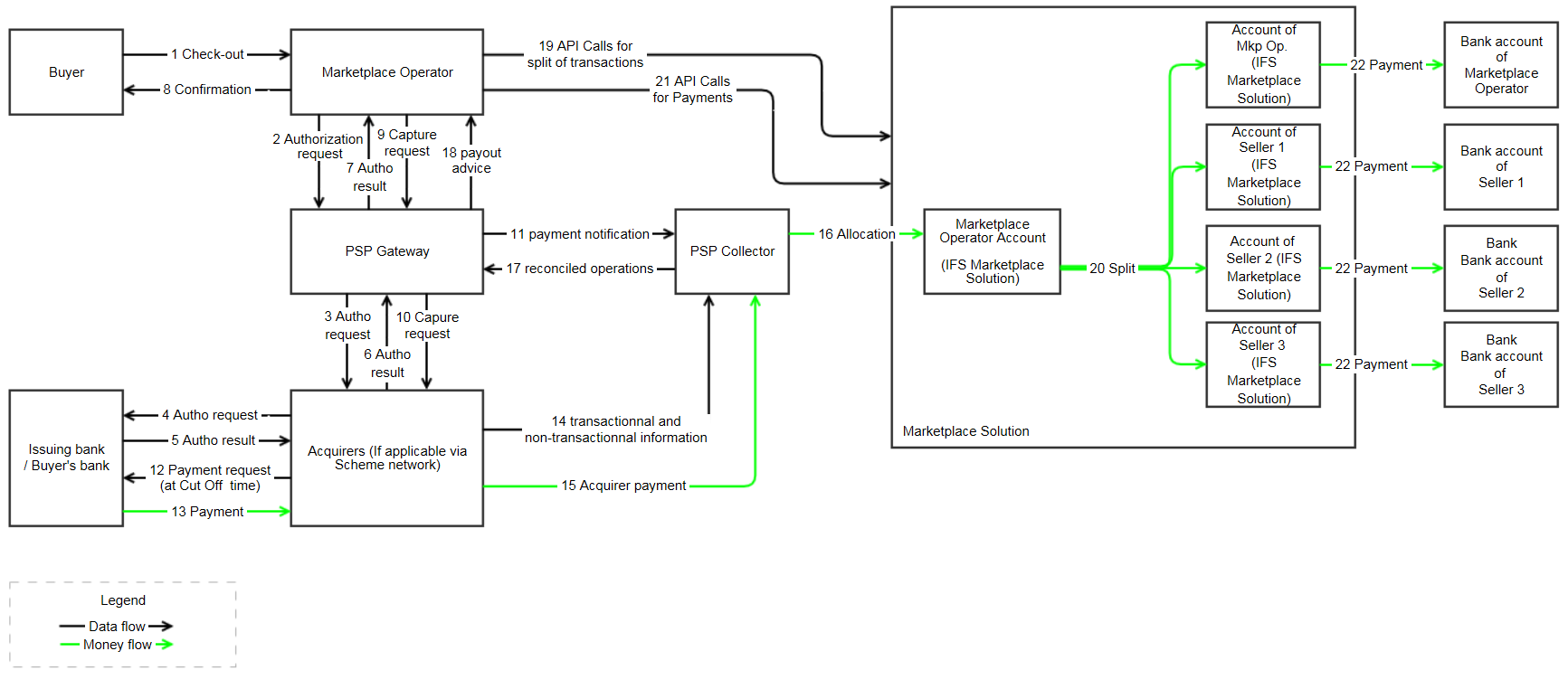

Split-Payment

Worldline's Payment Solution for Marketplaces allows buyers to pay for an order composed of different products and services provided by multiple sellers via one single transaction. Our Payment Solution for Marketplaces will ensure the payouts to all parties and manage commission accounts accurately based on reconciliation of information from the Acquirer, the Payment Service Provider and instructions of the marketplace operator.

1.The consumer goes to the marketplace, selects products and validates his/her basket

2.The consumer pays his/her products via a single payment and one of the available payment methods on the marketplace.

3.The transaction is authorised via the Worldline Gateway

4.Funds are collected by Worldline

5.The money is then transferred by Worldline to the escrow account.

6.On request of the marketplace operator, Worldline splits via API calls the transaction among different accounts.

7.Funds from the marketplace operator and seller accounts are distributed on request of the marketplace and/or sellers.

Refunds and Partial refunds

Refunds are part of the day-to-day eCommerce business and can generate a consuming workload that requests extensive efforts. Many purchases include multiple items bought at multiple sellers, which can make refunding only one item challenging to manage without the appropriate tools. Our Payment Solution for Marketplaces allows you to manage refunds easily and effectively.

Marketplace operators can conveniently refund the total amount or part of it via the merchant back office or DirectLink.

Worldline will then debit the respective amount from the collecting account. This action will impact the amount that will be transferred on the escrow account at the next pay-out. Then, the marketplace operator will have the possibility to trigger a money transfer from the sub-account of the impacted seller(s) to the escrow account.